If there are no funds available under this credit facility, ANZ may process the debit using the Informal Overdraft facility for your linked account (refer to the terms and conditions of your linked account for more details about the Informal Overdraft facility ). ANZ everyday account, with regular credits being made into the account the overdraft will be loaded on. New Zealand Citizen or Permanent Resident , or be in New Zealand and have the right to work in New Zealand for at least years. ANZ Assured overdraft Extra cash for the unexpected.

How much is ANZ refund? Can ANZ debit be honoured? The Overdrawn Fee is $ , payable for each ANZ business day when the balance of your Informal Overdraft facility is more than $(up to a total of ten ANZ business days and a maximum amount of $per statement month). Recipients of Government benefits who hold an ANZ Access Basic account will not incur the Overdrawn Fee.

ANZ FastPay refunds Yes , you can perform refunds on the spot for the full or partial amount (subject to the daily refund limit of $0). Your customer and the card they used to make the original payment. Processing refunds Refunds for an Apple Pay purchase are processed in a similar way to a traditional contactless refund.

Even if you don’t do it multiple times a day, one overdraft hit is bad enough. ANZ Banking Group has flagged a $ 6million hit to its full-year profit before taxes after it set aside more capital for customer refunds following previous misconduct. We can set up an overdraft on your existing ANZ account. Please call us or visit a branch to complete an application.

Alternatively, if you’re only eligible for a credit, we suggest waiting until Air New Zealand launches its online credit redemption system in late July. RBS Group has now agreed to pay out a total of £2. ANZ Business Overdraft The Credit Facility Fee on the ANZ Business Overdraft is calculated daily on the facility limit and is as detailed below. An unarranged overdraft occurs when you spend more money than you have in your account and any agreed overdraft limit with your bank. The level of unarranged overdraft fees banks and building societies charge has been a contentious issue for some time.

Many banks or credit unions have programs where they can assist consumers during times of hardship, he says. Sometimes the charges can slip by. We offer a wide range of financial services in NZ, with global reach as a subsidiary of the ANZ Group. Talk to the Bank with more experts in more places.

We’ve included your credit limit, interest rate and fees, and terms and conditions that will apply. Chase Bank Overdraft Fees. Approval fees range from $1to $500. Credit facility fee of (payable quarterly) $2p. ANZ allowed customers on Centrelink benefits to go into negative balance and then charged them up to $a month in overdraft fees as well as per cent.

As a former employee, possibly. There are algorithms that look at you account history - how long has your account been open, what are your average balances, have you gotten a fee waiver before, etc. When you don’t have enough money in your CommBank transaction account our Overdraw feature may make extra funds available temporarily so that any direct debits or cheques you may have written can go through. We have a £5overdraft limit which, to be honest, we would struggle without at the moment. We are processing all mail in the order we received it.

Do not file a second tax return or call the IRS. Expect delays if you mailed a paper return or had to respond to an IRS inquiry about your e-filed return. You should only call if it.

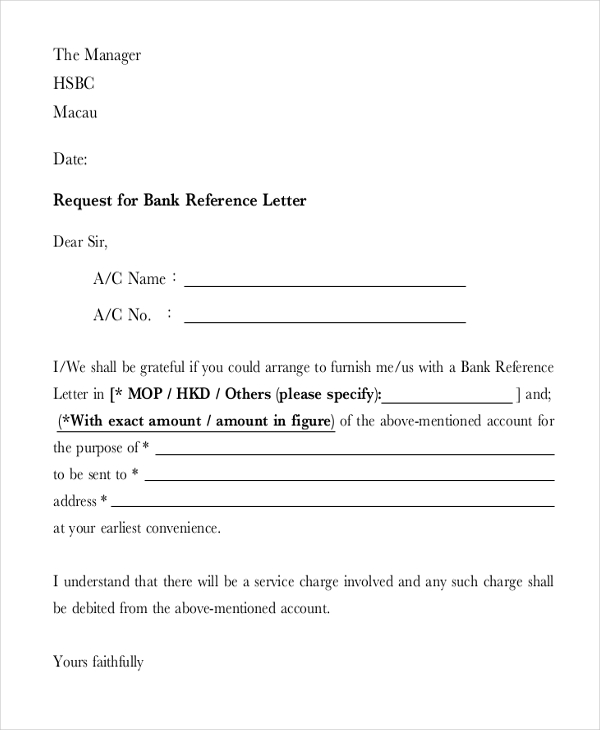

Why not just, one month, restrict your spending severely, and save $10 and leave that in your account as a buffer, instead of hitting $ you hit $100. Wells Fargo Overdraft Policies General Overdraft Fee: $35. Letter to Bank Requesting for Overdraft Facility From(Company Name)(Address)(Date) To The Manager (Bank Name)(Address) ADVERTISEMENTS: Dear Sir, We are having a current account with you bearing no. Our monthly turnover is above ____________ (Amount) and our amount has never been overdrawn against our current account.

This letter is to request a full refund for my tuition fee of $225. According to the refund policies of the university written the Student Manual, a full refund will be granted if the student withdraws from the course within six weeks from the beginning of the course. As you can see from the enclosed withdrawal slip, I am within that limit.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.