Identity of your responsible party. If you change your address beforefiling your return, enter your new address on your return when you file. Be sure to also notify your return preparer.

See full list on irs. Because not all post offices forward government checks, you should also directly notify the IRS as described below. You may also write to inform us that your address is changing.

Joint Filers - If you filed a joint return, you should provide the information and signatures for bothspouses. Send your written address change information to the IRS addresses listed in the instructions to the tax forms you filed. Separated -If you filed a joint return and you now have separate residences, each joint taxpayer should notify us of your new, separate addresses. If the change of address relates to an employment tax return, the IRS issues confirmation notices (Notices 148A and 148B) for the change to both the new and former address. Can you change address online with IRS?

How do you notify IRS of change of address? How to update an address with the IRS? Provide your full name, old address , new address , social security number or other tax ID number, and date of birth. Send your statement to the address where you would send a paper tax return.

If your address has change you need to notify the IRS to ensure you receive any IRS refunds or correspondence. A name change can have an impact on taxes. There is a box on the top of income tax forms that allow you to write in your new business address. The medium through which a business informs the IRS of its name change is determined by the kind of company it runs.

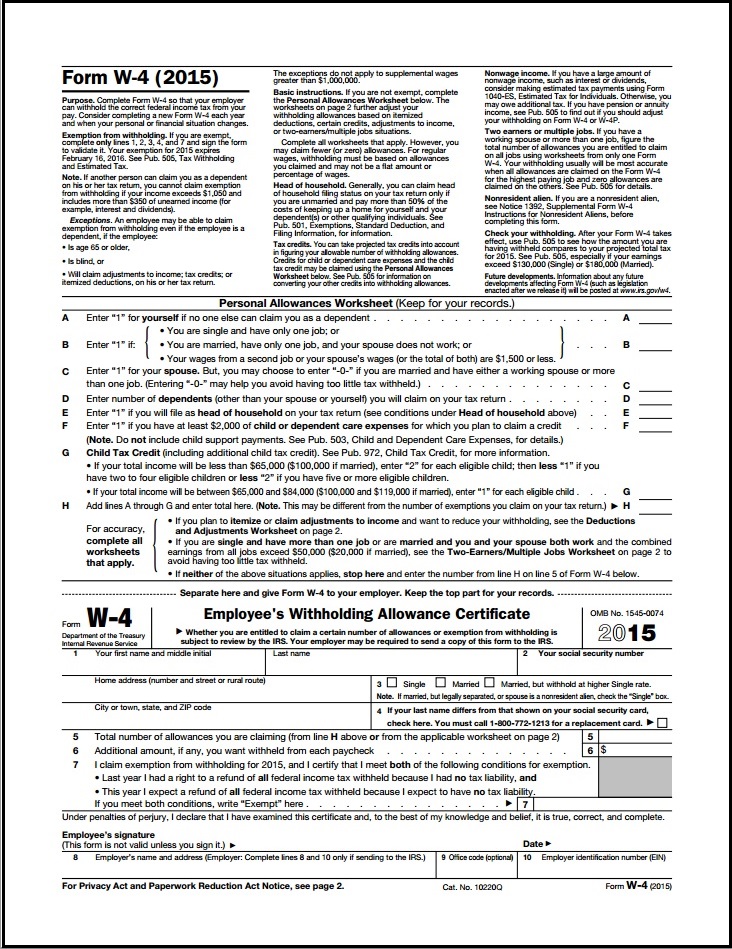

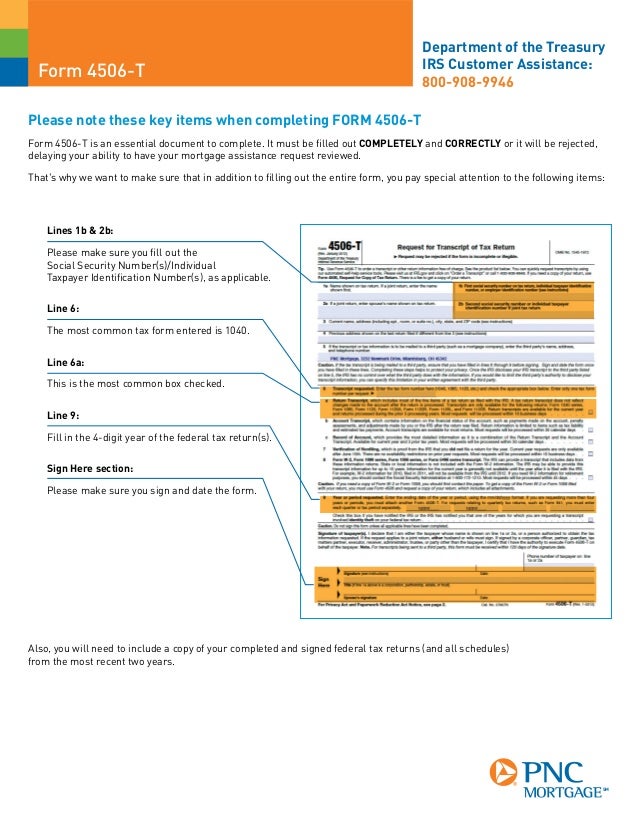

The two-page form can easily be completed and sent to the proper IRS office. You will need to mail the completed form to the IRS. You can also use helpful registry resources to assist you in updating your address. The form may be filed by either the business or the worker.

Not ready to use this online service? Make sure to provide the proper address when you are updating your information. Having the address updated with the IRS takes four to six weeks, and a mistake will extend the process. Points to Consider for Updating Your Address. The IRS change of address corporation form must be sent to let important agencies, people, and other contacts know that your business address has changed.

To change the name of your business with the IRS , follow these steps: Use the U. Notify DOR of your business change of address Update your business address with the Department of Revenue (DOR). A current address will ensure that you receive important mailings pertaining to your business account(s). If you are a third-party taxpayer representative, a completed TBOR-must be on file or your request will not be processed. Individuals: Addresses are automatically updated when Income Tax returns or Property Tax Relief applications are filed by paper.

Only the changes to your mailing address will be used for future correspondence. The IRS makes it easy to do this by providing a form you can print, fill out and send them. It is important to let the IRS know of any address changes as soon as possible so that you receive mail or refunds from them timely.

In most cases, a new tax ID for change of business location is not required. Next, you’ll need to notify the Secretary of State. File your return using your new address.

You should mail the completed form to an IRS office near your state. You’ll need to update your business information with the Indiana Department of Revenue (DOR) to ensure you are getting all important correspondence about your business. Logon to the Georgia Tax Center. Click on Names and Addresses tab.

Select the address to change. Click on Edit (top right corner) Make your changes and click Save. Click Yes to submit your request. Change Address in GTC. Check Account Balance in GTC.

The business registration number, original and new business name, business address and the date of change should be clearly stated. For local companies or registered non-Hong Kong companies registered under of the Companies Ordinance, please refer to One-stop Company and.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.