Onboarding times and reduce. Dublin, London, Boston , New. How to run an AML check? What KYC and AML are? Automate the ID verification process and simplify document collection and validation through your own custom client portal.

Speed up the AML compliance process with electronic identity checks. Apply automated PEP and Sanction checks on all new clients. Online identity verification is the starting point for AML compliance in the digital world. While KYC is straightforward identity verification , AML can consist of multiple components. Accura Scan is an AML KYC service provider that supports total security over customer integrity by supporting a range of document types.

Now, with our AML screening solutions, you can scan identity documents, driver’s licenses, passports, visas, and a range of ID cards simply and efficiently using the document reader. No Support Charges, join us today! The terms under which a customer may use an account while the bank attempts to verify the identity of the beneficial owner(s) of a legal entity customer.

When the bank should close an account, after attempts to verify the identity of the beneficial owner(s) of a legal entity customer have failed. Contact us to receive all the information you need. Get in touch with us to Request a Demo of the First AML Software based on Artificial Intelligence and Machine Learning Algorithms. Learn more about the CAMS certification. Firms must comply with the Bank Secrecy Act and its implementing regulations ( AML rules).

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation. Though anti-money laundering. Electronic identity verification (EV) and AML services for businesses in New Zealand and Australia. Know your customer made easy.

Cloudcheck is a flexible electronic identification verification (EV) tool that allows you to verify the identity of your customer in seconds using biometric checks , MRZ checks, Australian and New Zealand government data sources and global watchlists. At Veriphy, we can enhance your AML methodology and procedures through our online AML checking service. Cost-effective and fully compliant, our online Anti Money Laundering ( AML ) checks allows regulatory professionals to carry out necessary due diligence with ease.

AML is a blanket term for the constantly evolving laws and regulations that are in place to prevent money laundering and other related financial crimes. Our AML checks are fast. AML compliance is a lot more comprehensive and actually includes KYC compliance as one of its requirements.

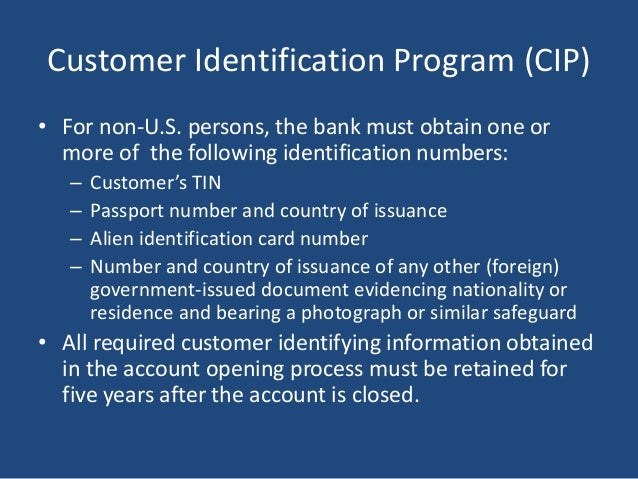

Since Fintech companies provide financial services, they are mandated by AML regulations to verify their customer’s identity before offering their services. These are necessary measures to ensure that the institutions are doing business with legitimate entities. The term “KYC” also references the regulated bank customer identity verification practices to assess and monitor customer risk. The KYC process is also a legal requirement intended as an anti-money laundering (AML) measure. You must use reliable and independent documentation or electronic data (or both) to verify information about the customer and beneficial owner.

The Bank Secrecy Act, among other things, requires financial institutions, including broker-dealers, to develop and implement AML compliance programs. Anti-money laundering refers to a set of laws, regulations, and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Any document that was relied on to verify identity, noting the type of document, the identification number, the place of issuance, an if any, the date of issuance and expiration date.

The method and the of any measures undertaken to verify identity. The of any substantive discrepancy discovered when verifying identity. The Solicitors Regulation Authority (SRA) insisted that its 0regulated firms re-assess their processes in order to comply with regulatory change. Data extraction from structured and unstructured documents. Verification is done against many sanction lists.

Show face in front of the camera while holding the printed or any handwritten note. Verify the face of your customers in real-time. As financial institutes need a solid proof for each of the components of AML so these have to be easily accessible to everyone including relationship managers, branch managers and other financial salespersons.

If anyone else accesses your account, you will lose all credit for previous courses, since we cannot verify who completed the coursework. Browser Check For optimal use of the CFM Network, we recommend that you use Internet Explorer 6.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.