Statements Online And Customize. Download And Print- 1 Free! Create an income statement that shows revenue and expense over a period of one year with this accessible template.

Search for small business for matching templates. It includes all things your small business needs from categorized tables to numeric calculations. It is downloadable, editable, and printable so you can work on it wherever and wherever. It is also available in all document formats and sizes.

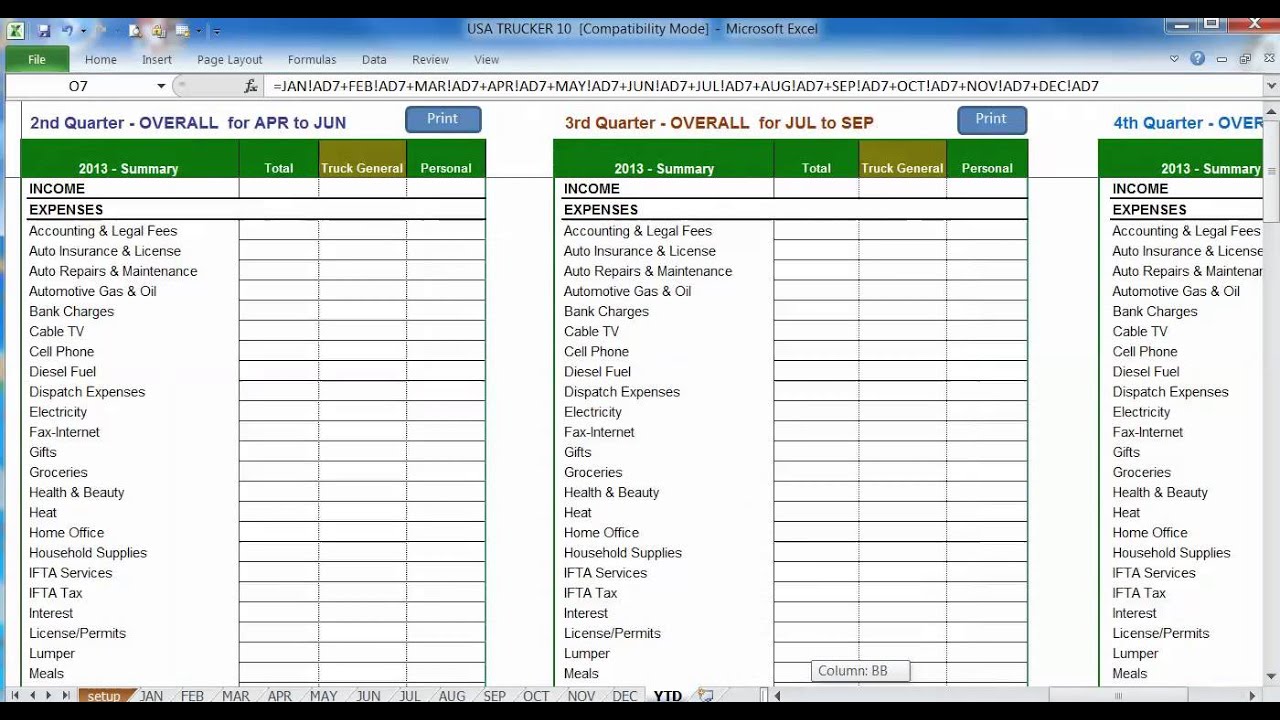

Experience convenience in account management. You’ve probably heard by now that you need to keep track of your business income and expenses , but you may be wondering HOW to do that. You can use a spreadsheet for basic income and expense tracking. It’s very easy to set up.

What Is an Expenses Spreadsheet ? One of the many wonderful uses of a spreadsheet is being used to keep track of one’s expenses. Step 3: Create a budget income statement. Sally produces a budget income statement using the assumptions she made in step 2. This income statement template calculates the operating income so businesses know exactly where their finances stand.

How do I create an expense spreadsheet? Using the Expense Tracking Spreadsheet Template. Step 1: The first step when using this template is to clear the sample data. The data is simply meant to give you a guide on how you can enter balances and basic expense transactions as well as the transfer of money between accounts.

Over 1M Forms Created - Try Free! Keep Your Financial Records Up To Date. The small business budget template is ideal for small businesses or for the self-employed in tracking and managing their finances. With this, you can easily track your income and expenses every month.

Maintaining proper accounting records is imperative to a small business owner. You need to be able to tell at a glance where you stand financially in order to make sound business decisions. By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports.

Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction. Gain an accurate picture of your weekly, monthly, and annual costs, and determine actual spend to compare against your predicted budget. Business Budget Template. Once you have this data stored within a spreadsheet , you can use. Register and Subscribe now to work with legal documents online.

In this one simple Excel workbook, you can create your monthly budget , your annual budget , and then compare your actual numbers to your budgeted numbers. A small business budget template is something you’ll be referring to quite often. Manage the income and expenses of your small business. Make it easier by creating a spreadsheet.

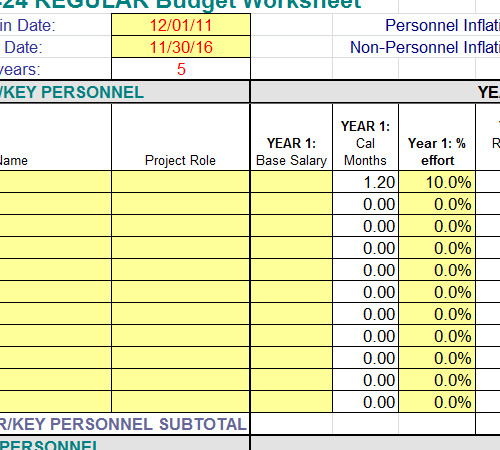

In the body section, make a primary column to enlist all the activities and sub-activities for which expenses been incurred on a particular day. In fact, this basic budget is ideal for small businesses that want an easy, blank template to customize. To create a business budget, include both fixed and variable expenses along with revenue and funding sources.

The idea behind this Excel sheet budget template is to allocate every dollar of your income to a part or aspect of your budget, so the difference between both equals zero. The Zero-based budget Spreadsheet has two sections – one side for your monthly income and another for your expenses. Enter your operating expenses from marketing to payroll and office supplies, and weigh these against your income. They are simple and easy to use with full instructions available.

We have designed Excel business templates. If you can not find what you are looking for, drop us a message. We may be able to design one for you. Include column headers for income , expense, and account balance. This is very similar to entering your transactions in a checkbook register.

List income sources and business expenses , track operating costs, and balance your budget accordingly with this comprehensive budget template.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.