What are non-concessional contributions? Can I make non-concessional contributions? Are non-concessional contributions taxable? What is concessional contribution? No contributions tax.

When you make non-concessional contributions with your after-tax money, there is no. Lower tax on investment earnings. The tax rate on any investment earnings in your super account is a maximum of ,. A type of contribution made to super. NCC’s believe themselves to be fairly important as they like to be known by different names.

AKA personal, undeducted or spouse contributions. NCCs are not taxed when they go into super. However, non-concessional contributions cannot be made if a member’s Total Superannuation Balance (TSB) is $1. June prior to the commencement of the financial year in. Some people choose to make non-concessional contributions when they’ve reached their yearly concessional (before tax) contribution cap.

There are limits on how much you can contribute each year. Non-Concessional Contribution Work Test In order to make super contributions when over age 6 you need to meet the superannuation work test. The superannuation work test requires you to work at least hours over a 30-consecutive day period in the year that you make the contribution and prior to the contribution being made.

Eligibility Threshold. Non Concessional Contributions are essentially personal contributions made into your SMSF from your own personal Bank Account and not from your Employer. To meet the work test exemption criteria, you must have: 1. See full list on esuperfund. June of the previous financial year.

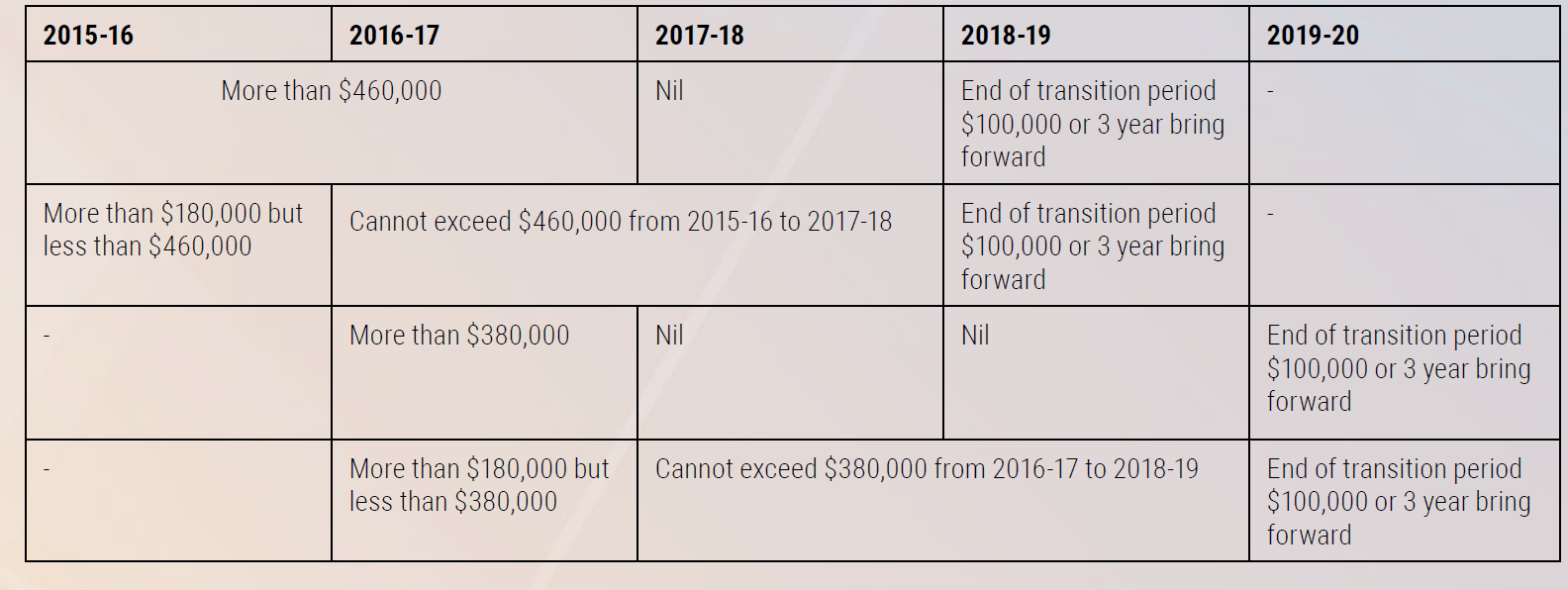

If your non-concessional cap is nil, any non-concessional contributions you make plus any excess concessional contributions you elect or are unable to have released will be excess non-concessional contributions. Any contributions received after this date are not required under law to be returne due to subregulation 7. Member aged 64 or under on 1 July The fund-capped contribution limit is three times the non-concessional contributions cap for that financial year. Fund-capped contributions do not include: 1. These contributions are taxed in your SMSF at a ‘concessional’ rate of , which is often referred to as ‘contributions tax’. Concessional contributions also include personal contributions made by the member for which the member claims an income tax deduction. Individual members are personally liable for this tax and must have their super fund release an amount of money equal to the tax.

The most common type is personal contributions made by the member for which no income tax deduction is claimed. A fund may receive a release authority statement to release amounts from super, for example when a member has exceeded their non-concessional contributions cap. When a fund receives a valid rele. There is a cap on how much you can contribute as a non-concessional contribution each year.

But if you are under age on 1st of July in a financial year you may be able to trigger the ‘bring- forward’ rule to make larger contributions. Non-concessional contributions (NCCs) are super contributions made from after-tax pay or savings. They include: personal contributions you make into your own super account that are not claimed as a tax deduction. Individuals under age have the ability to bring-forward up to two additional years’ of the cap. This is done by utilising the non-concessional contributions bring forward rule.

However, when it comes to making non - concessional contributions to a super account, there are really only two main people who are allowed to make them (and sometimes only one person). The first, and by far the most common, is when you put money into your super account for yourself. You get to choose when and how much, and you get the added peace of min knowing you will have sufficient funds to help you live the way you want after retirement.

That is, a tax deductionhas not been claimed for making the contribution or it has not been made with pre-tax income. A Non - Concessional super contribution is generally made from savings in a personal bank account. Non - concessional contributions are not taxed upon entry to a. Excess Non - Concessional Contributions Tax.

The non - concessional contribution cap is $100per person, per financial. Penalties and super contributions tax could apply if you exceed the super contribution caps.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.