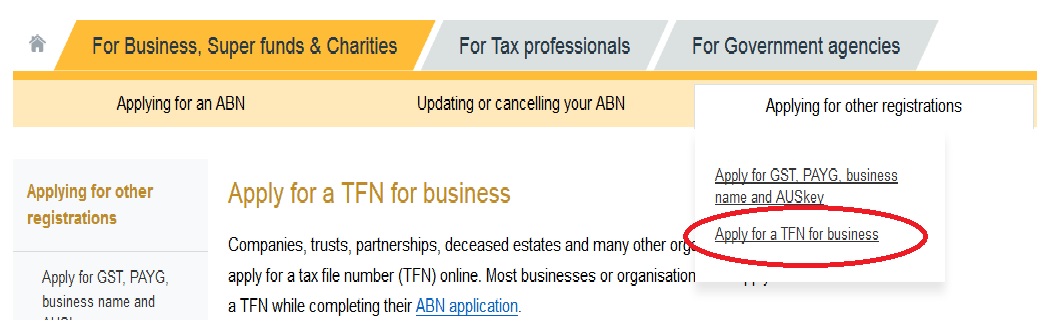

Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number ( TFN ) online. Most businesses or organisations can apply for a TFN while completing their ABN application. You do not need to register them for a TFN in a separate process. When you apply for a TFN at the same time you apply for an ABN, your client will be automatically registered with a business TFN when their ABN application is processed.

You can apply for a TFN for most businesses or organisations while completing their ABN application. How to apply for TFN for your business? Who can apply for TFN? What is a TFN number? Can traders apply for TFN?

Resident associate details provided must match ATO records. Your business information on the ABR. Update your ABN details. Opens a modal dialog. Australian Business Register.

Registering for a TFN is an important step when starting your business. You can then give it to: investment bodies responsible for paying interest, dividends and unit trust distributions. Thinking of changing your business structure.

TFN application for companies and other organisations. Companies and other organisations can apply for a tax file number ( TFN ) online at abr. If you: only need a tax file number ( TFN ), select. You can order this form using our online publication ordering service for business External Link.

ABR does not facilitate saving of applications requesting only a TFN. If you only require a TFN , please update the selections made in the Business Activitysection of the saved application prior to submitting with the ABR. This is the first step to legally creating your business and must be done before you begin trading. An ABN comes in the form of a unique, 11-digit number that identifies your business to the government, and is also used to inform the general public about your business by way of search on the ABN Lookup website.

Even if your business isn’t going to register for GST, you still need an ABN. It is also used for some tax purposes. If you are exempt, but have a TFN , it is safer to provide your TFN in case your circumstances change. For securities held jointly, details of only two holders are required. You can do this using myGovID and Relationship Authorisation Manager (RAM).

Before registering for a service, check your system is compatible. The notes at the end of this compilation (the endnotes) include information about amending laws and the amendment history of provisions of the compiled law. Before applying for an ABN the entity must have a tax file number ( TFN ). The ABN is an 11-digit number where the first two digits are a checksum. It helps ensure we pay the correct amount of tax and supports us in various other government dealings. Without a Tax File Number , certain forms of business will not be eligible for an ABN.

Qualified new business customers only. Internet offer is for mos. JavaScript is not currently enabled in this browser.

Your ABN is allocated by the ATO and is usually included on all official documents. An ABN is a unique digit number that identifies your business to the government and community.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.