Register and Subscribe now to work with legal documents online. No Installation Needed. Convert PDF to Editable Online. We Have More Than 2Legally-Binding Docs.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! The Electronic Contract for Sale (ECOS) provides access to the Contract for Sale and Purchase of Land and the Contract for Sale of Business. Customers wishing to purchase the Contract for Sale and Purchase of Land should select the panel on the first panel below. Usually, a Standard Contract for the Sale of Business is used when businesses are sold or purchased.

This contract contains extensive clauses that cover all legal requirements under Australian law. However, since all businesses are different, you may need to include extra clauses or special conditions into your contract. Special conditions can be added to the end of the contract and it is important that these conditions are drafted properly to avoid any uncertainty or confusion in the future. During this time the purchaser will also conduct preliminary searches of the business documents and premises to make sure that they are aware of all the matters involved with their purchase of your business.

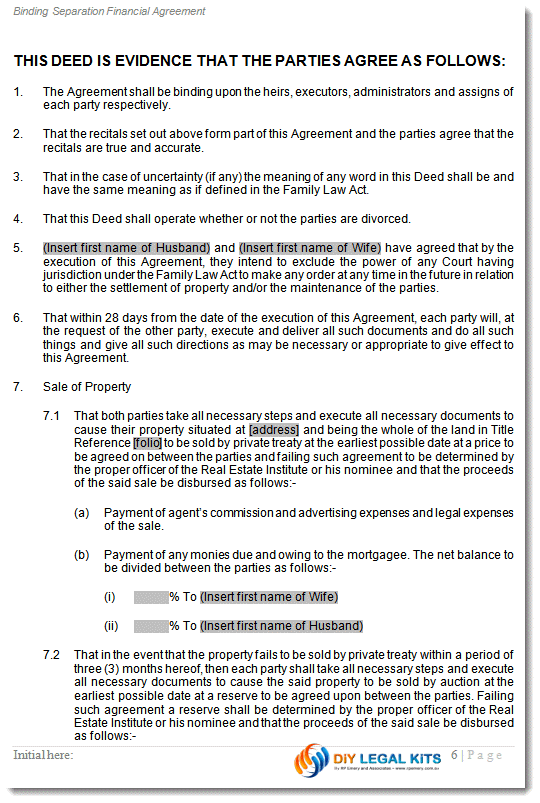

See full list on legalvision. After all the negotiations have been made and the contracts have been signed by you and the purchaser, the contracts can be exchanged. It will be your responsibility to arrange for a time and place to exchange these contracts. After the exchange, the contracts will be legally binding.

During this stage, you will be required to fulfil a range of obligations outlined in your contract for sale. There are standard obligations that you must perform and then there may be obligations in the special conditions that you may also have to consider. Some standard obligations are as follows: 1. Transferring all documents so ownership can be transferred to the purchaser 2. Maintaining the goodwill of the company 3. Discharging securities, mortgages or any other encumbrances that may be held over your business 4. At the settlement stage, there are certain documents that may need to be exchanged.

For example, you may give the purchasers: 1. Share certificates 3. Appointment of directors 4. Approvals for share transfers 5. Items listed in the second schedule 6. A Director Resignationdocument In exchange the purchasers may give you: 1. A bank cheque for the value of your business 2. A deed of guarantee if there is a lessor involved 3. Your lawyer will also have to undertake certain tasks to make sure that you do not continue to hold responsibility over assets that have been transferred to the purchaser. These tasks may include: 1. Cancel any licenses or insurance that are held in your name in relation to the business 2. Send an order on the agent so that the deposit paid by the purchaser will be transferred to you 3. A major concern when selling a business is the tax implications that this transaction may attract. Since business owners usually sell their business to generate revenue, it is useful to consider any taxes that may apply which may impact on the money you may end up with after selling your business. If you are registered for the Goods and Services Tax and you sell your business you may be liable to pay GST. However, if you sell your business as a going concern then this sale may not attract GST.

If your business is being sold as a going concern: 1. You are supplying everything to the purchaser so they can continue operating the business 4. The purchaser is registered for GST 3. You intend to carry on the business until you sell it to the purchaser If you sell your business and receive a profit, the profit you gain may be subject to Capital Gains Tax. You will sell the business in return for payment 5. While selling a business can be very exciting, the process can also be rather tricky. It is a good idea to get legal assistance during this time so that you are aware of all the risks, obligations and duties that you may undertake as a vendor. However, you must keep in mind that a sale of business lawyercan only provide you with legal advice and not financial advice.

If you require financial advice about how much you should value your business for, whether it is the right time to sell your business or any other financial matters you should speak with a financial advisor. When you buy a business in NSW, you must pay transfer duty if the sale includes land or an interest in land , such as a lease. If it does, you may also need to pay transfer duty on the assets used to operate the business, including warehouse equipment and computers. Transfer duty is due three months after you sign the business sale agreement.

How do you buy a business in NSW? What is a contract for sale of business? A term sheet is a document outlining the terms and conditions of a business agreement and differs from a business sale agreement as it does not aid in transferring assets, rather it aids in preparing for the final transaction of a deal.

This comprehensive Contract for Sale of Business includes provisions that specifically deal with the goodwill of the business , stock in trade, leases, business assets , GST (goods and services tax),the business name , restraints of trade, employees,stamp duty, dispute resolution and much more. The parties in a business sale agreement are the business owner (seller) and the individual or business entity that the assets or shares are being transferred to (buyer ). Along with deciding how much your business is worth and the best time to sell, there are a range of other considerations that you will need to make during this process. Business Sale Agreement This Business Sale Agreement is for use when the owner of a business sells the business to a new owner. This BUSINESS SALE CONTRACT is compliant in all states of Australia, has been drafted in Plain English and will provide strong legal protection in the event of a misunderstanding. In NSW most sales of small and medium businesses are effected in accord with the NSW Law Society “Contract for the Sale of Business”.

That Contract provides a purchaser with a right to rescin without penalty, “… if the Contract expressly gives a party a right to rescind”. Thrilled With Your Service.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.