Most businesses or organisations can apply for a TFN while completing their ABN application. Use your individual TFN when you deal with the ATO. If you don’t have one, you can apply for an individual TFN on the ATO website. Should I apply for an ABN or TFN?

Who can apply for TFN? How to apply for a business TFN? Can I apply for TFN with a registered agent number?

If you are experiencing an issue accessing the ABN application please use this alternative link. Apply or reapply for an ABN using the application below: Apply or reapply for an ABN. Watch this video to find out more about ABNs. You can apply for a TFN for most businesses or organisations while completing their ABN application.

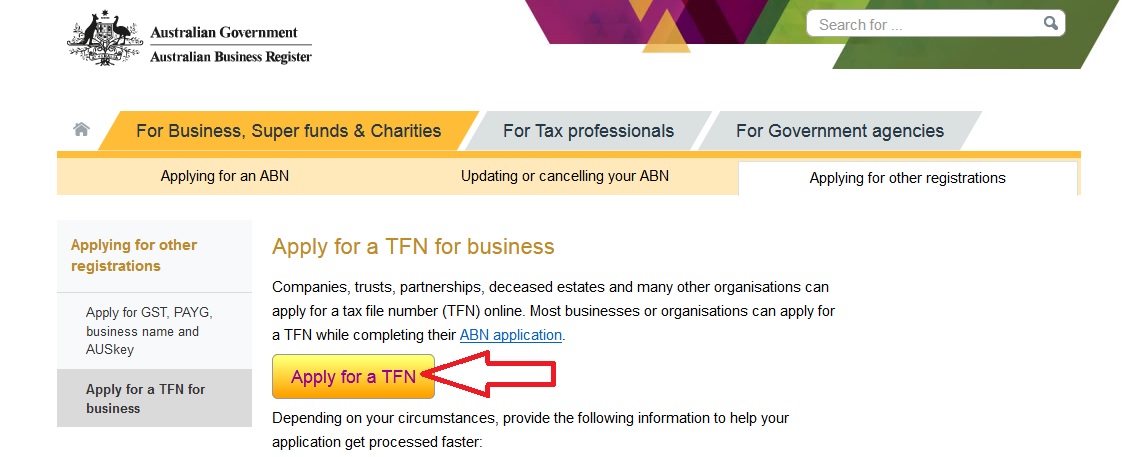

You do not need to register them for a TFN in a separate process. When you apply for a TFN at the same time you apply for an ABN , your client will be automatically registered with a business TFN when their ABN application is processed. There is a range of documents you require and it is easier to have a TFN before you apply for an ABN. Business or company registrations. TFN , select the Applying for other registrations tab,and then click Apply for a TFN for businesslink.

TFN and an ABN , apply for both by selecting the Apply for an ABNlink. A Tax File number ( TFN ) is an important requirement for Australian workers. Without a Tax File Number , certain forms of business will not be eligible for an ABN. This means that regardless of being on an ABN or a TFN you can still earn up to $12tax free in the financial year. Example: Mike is working on both an ABN and TFN and has been in Australia for the full tax year (meaning he is entitled to full TFA).

Mike earned the following: ABN : 1000. Australian company number (ACN), Australian Registered Body Number (ARBN) or Australian business number ( ABN ) either their TFN or address and date of formation. Resident associate details provided must match ATO records. Non-resident associates without TFNs need to supply proof of identity documents. If information is incomplete or inaccurate, your application may be refused or delayed.

If your company is solely a corporate trustee for your superfun there is no requirement for an ABN or a TFN as it does not lodge tax returns nor does it run a business. Other uses If your corporate trustee will engage in other activities, such as investments and trade, you will need an ABN and TFN to manage those logistics. There are other issues pertaining to ABN and TFN also that will be discussed in this article.

ABN is a unique digit number with first two numbers being a check sum. It helps in all tax dealings with the ATO. Your application will be processed faster if we can identify your client with the information you provide, such as a tax file number.

If you provide your registered agent number during the application , it will be recorded against the ABN. A successful application. A tax file number ( TFN ) is free and identifies you for tax and superannuation purposes. You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. An ABN comes in the form of a unique, 11-digit number that identifies your business to the government, and is also used to inform the general public about your business by way of search on the ABN Lookup website.

An ABN is used in conjunction with your TFN , or tax file number , when dealing with the ATO and should be listed on any invoices or. You need a Tax File Number ( TFN ) to apply. Keep in min if you’re starting a company , you need an Australian Company Number (ACN) and not an ABN. In order to apply for an ABN , you will need certain information. Below is a list of requirements you’ll need.

The ATO will generate your company TFN and post it to your registered office address within business days. If you plan on running your business as a sole trader, you can keep your individual TFN. Learn how to register for a TFN. Your Australian business number ( ABN ) is used for identification purposes with both the government and the people. This number is digits and is used to claim various grant credits, collect tax credits, file invoices, and more.

An ABN is necessary for most business activity and can be obtained through the Australian Government.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.