The user fees must be paid through Pay. Customer Account Services for the latest information. Internal Revenue Service as it pertains to requests for letter rulings, determination letters, Voluntary Correction Program (VCP) compliance statements, etc. Commissioner, Tax Exempt and.

Applicants must pay the fee through Pay. Payment can be made directly from a bank account or by credit or debit card. Get relevant Here!

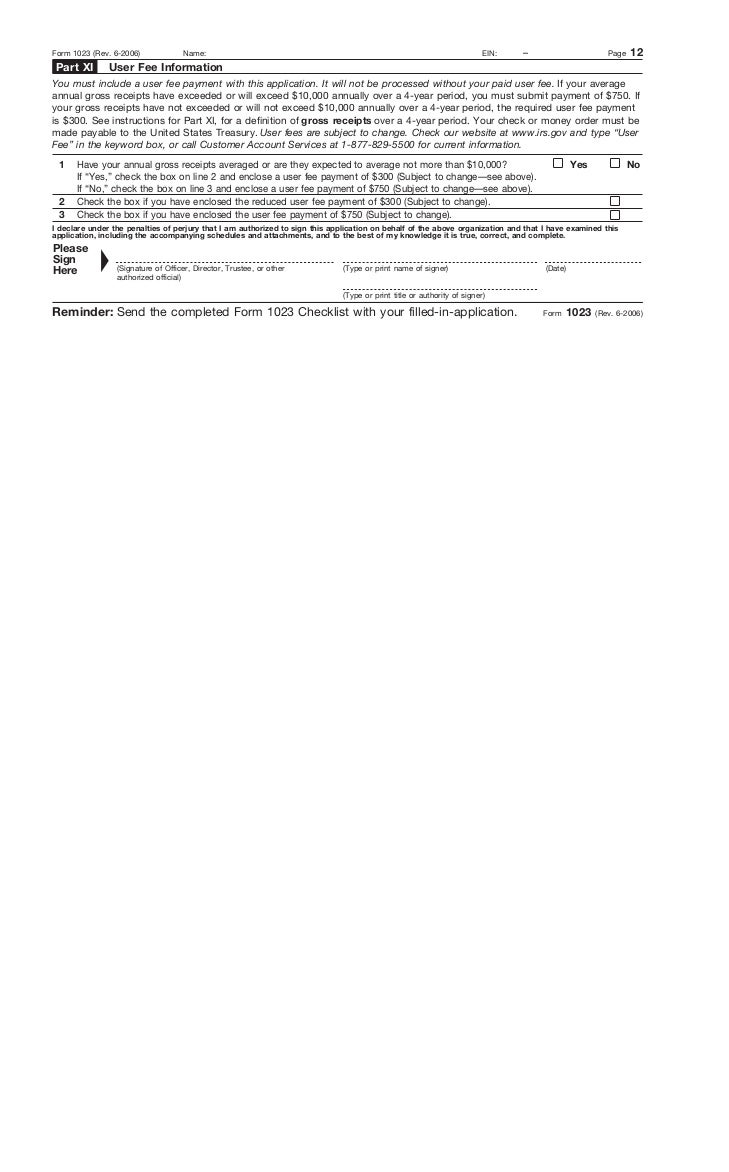

A check for the user fee must accompany the application and is generally non-refundable. Attachments and mailing All attachments must have a heading that includes your PTA’s corporation name and EIN, as in the following example. Once you have registered with Pay. This application fee is made online as part of your application to the United States Treasury and submitted as part of your 501capplication packet. The IRS has a two-tiered filing fee structure.

The EZ is only filed electronically and is designed for small organizations. True, but you are doing more: you are telling a story. Attn: Extracting Stop 3Covington, KY. Download And Print Instantly - 1 Free! The instructions indicate that organizations should refer to Rev.

Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. From there, you will be able to complete the filing, or save your work if you need to return. You will pay using a credit or debit card. All applicants must pay a $2user fee using a credit or debit card.

What Do I Need To Prepare? Under the newest form changes, the $2fee remains in effect. No Installation Needed. Convert PDF to Editable Online. If you have any tax compliance questions for your exempt organization, please contact Matthew Rak or another member of our Nonprofit Organizations team.

It includes prerequisite questions, auto-calculated fields, help buttons and links to relevant information. The list of NTEE codes is provided in Appendix D to the newly revised Instructions. Most small organizations are eligible to use the form and it also has a reduced filing fee of $400. When filing, you will also include copies of your signed formation documents, Bylaws, EIN, and a user fee of $6regardless of your organization’s projected annual revenue.

Together, all of this makes up your 501capplication packet to be filed with the IRS. This form must be filed electronically. Nonprofits seeking tax-exempt status under a section of the Internal Revenue Code other than 501(c)(3) file different forms. Pay the necessary filing fees. Here we have everything you need.

The law requires the payment of a user fee for determination letter requests such as your application for recognition of tax-exempt status. Your payment must accompany your request. User fees are listed in Rev.

The short answer, as with most things IRS-relate is “it depends.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.