There Is Now An Additional Requirement To Categorize Clients As Part Of The Kyc Process. Here is a list of documents that can be submitted as proof of identity and address. Aadhaar Card issued by UIDAI. Letter from the National Population Register containing details of name and address. What does KYC mean in banking?

See full list on sbi. If minor is less than years of age, ID proof of the person who will operate the account to be submitted. Passport and Residence Visa Copies, duly attested by 1. Submission of self-attested photograph and affixation of signature or thump impression before the officer of the Bank who is authorized to approve opening of accounts who will certify under his signature that the person opening the account has affixed his signature or thumb impression, as the case may be, in his presence. Bank of having applied for any of the officially valid documents within twelve months of the opening of the said account, with the entire relaxation.

Resolution authorizing opening of investment accounts , authority to operate the investment accounts. Registered office address and principal place of business. KYC of persons assigned to operate the investment accounts. A recent utility bill (UB) bill or a recent bank or credit card statement or a recent.

The premise is that knowing your customers — performing identity verification , reviewing their financial activities, and assessing their risk factors — can keep money laundering , terrorism financing and other types. One of those safeguards being to ensure the identity of the person completing the financial transactions. This is described as: know your customer. A KYC check refers to verifying that the information provided about a person is legitimate and evaluating the risks of doing business with them. The know your customer or know your client ( KYC ) guidelines in financial services requires that professionals make an effort to verify the identity, suitability, and risks involved with maintaining a business relationship.

Capital Raising Process This article is intended to provide readers with a deeper understanding of how the capital raising process works and happens in the industry today. Savings Plans Can Be Overwhelming. Learn About Our Financial Advisor Services.

Onboarding times and reduce. Dublin, London, Boston , New. The KYC documents include types of documents which are, proof of identity and proof of address. There are KYC registration agencies (KRA) such as CAMSKRA, CVLKRA which maintain the records filled in the KYC form by the investor centrally. This collaborative approach has yielded significant benefits – we have identified the need for timestamps on documents , for example.

Corporate and investment bank sales teams are under tremendous pressure to win more business and maximise customer profitability. However, a recent survey found that of bank sales professionals spend more than 1. Pls tick Pls tick Pls tick. Know Your Customer ( KYC ) requirements.

The Bank of Thailand (” BOT “) has introduced a new regulation to facilitate the Know-Your-Customer ( KYC ) process by using an electronic means (” e- KYC “) for account opening for deposit acceptance or fund acceptance from public. EDGAR is an enormous database. There’s a massive number of possible forms that companies and investment bankers may have to submit. Some of the regulatory forms are pretty obscure, so they’re rarely filed.

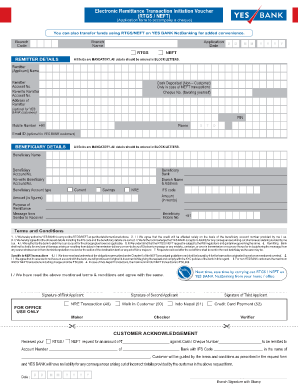

Here you can download or print out forms and documents related to the banking services we have to offer. You must document the customer identification procedures you use for different types of customers. Searching for Financial Security? A form containing detailed information on the risk tolerance and investment goals of the client of a brokerage. KYC norms are mandated by the Prevention of Money Laundering Act (PMLA), to track the legality of funds used for investments.

Money laundering refers to converting money that is earned through. The KYC Form is an application form that used to verify the identity of the customers. This application form template can be divided into two main parts.

Andy Mantzios, our expert on Data talks us through simple steps to achieve KYC Data Remediation. This subject never being more valid than it is today considering the regulatory landscape that we are facing. Andy guides us through this landscape dispelling the hype and highlighting key points such as KYC , big data and regulatory compliance.

The term is also used to refer to the bank and anti-money laundering regulations which governs these activities.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.