Register and Subscribe now to work with legal documents online. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax -exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. How do you calculate a tax exemption?

What income is tax exempt? The most common Tax-Exemptions are – 1. The exemption is based on dependent, i. The interest on those bonds is tax exempt, so John does not have to pay federal income taxes on that income. Income generated by investments in Roth IRAs is often tax exempt.

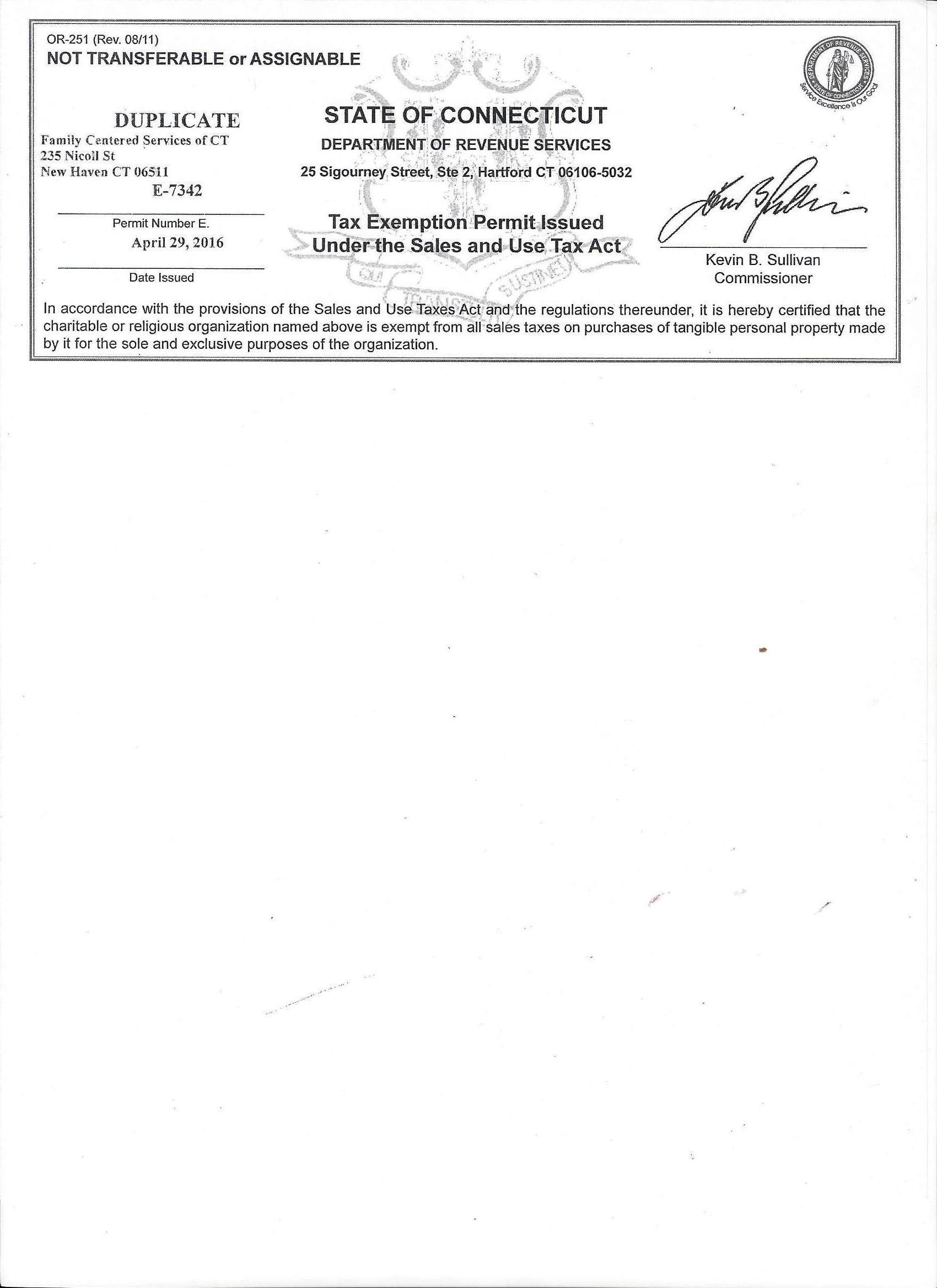

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. It depends on the jurisdictions or country. But it is determined by the need for such items and where there is a lack of skill for the production of such items. Sales Tax Exemption Form sample enable a buyer to make tax-free purchases that would normally be subject to sales tax. The buyer needs to fill this form and hand it over to the seller.

For instance, charities and churches. Download this sample and use it for your purpose. W-Sample - Claiming Exempt. End Your IRS Tax Problems.

Money Back Guarantee - Free Consultation. Stop Wage Garnishments. Here are some examples of above-the-line standard deductions: Alimony Educator expenses Job-related moving expenses Penalties for early withdrawal of CDs and savings accounts Qualified tuition and fees Self-employed deductions for health insurance premiums Half the Self-Employment Tax Traditional. For example , a business may be exempt from paying local property taxes if it moves its operations to a particular geographic area.

Monoprice Inc is now billing sales tax on the following states. Please reference your account number or order number for prompt processing. Once the company or the individual sends a letter for tax exemption to the tax department, the concerned authority reviews the application, and all the documents are thoroughly scrutinized. Homestead exemptions keep you from paying tax on a portion of your home value.

Some states tie the homestead exemption to income level or other criteria. Each area has its own rules and deadlines for applying. The Internal Revenue Service (IRS) Form W-is used to calculate and claim. Please contact your local taxing authority if you have questions about state and local tax exemption.

If you purchase goods to be resold in the same form that they are purchase they qualify for a resale exemption if the reseller is licensed and can provide a resale certificate. The reseller is required to collect sales tax when they later resell the goods. All Government Forms.

State Tax Exempt Forms. Find federal forms and applications, by agency name on USA. The partial exemption rate is 3. San Francisco County and 5. Assessment of the Sales and Use Tax on Purchases. The sales and use tax rate is determined by the point of delivery or the “ship to” address. Home Improvement Exemption.

Honorably discharged veterans in Connecticut may qualify for a property tax exemption of $5“from the total assessed value” of the home, which must be a primary residence. This exemption is for any veteran who has served at least days of active duty during wartime.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.