MGT 1- Intro to Business Cypress College Ms. Patricia Kishel Learn with flashcards, games, and more — for free. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Also, banks and suppliers may be more willing to extend credit or grant larger loans to a partnership over a sole proprietor personal interest ( partnerships ) general partners are very concerend with the operation of the firm, perhaps even more so than sole proprietors, since they are responsible for the actions of all other general partners, as.

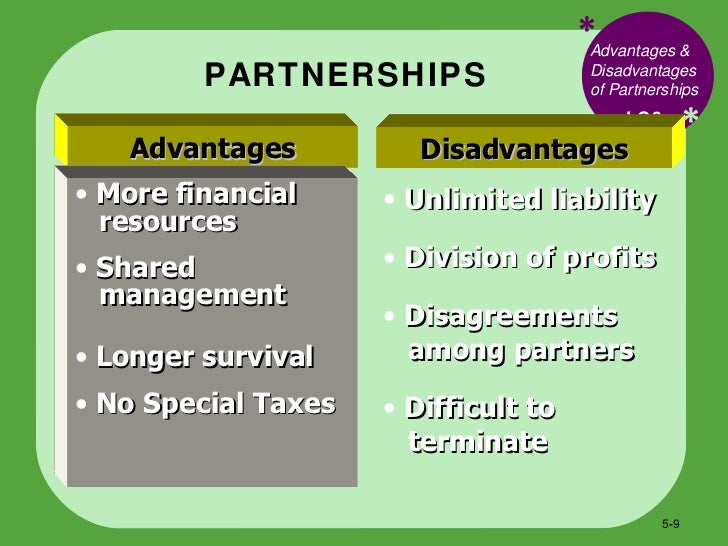

A partnership is a unincorporated business with two or more owners. This is the most common type of business. The disadvantages include different interests, one partner dies the partnership is over.

Potential Tax Benefits. A possible advantage of a general partnership may be a tax benefit. A general partnership may not pay income taxes. What benefits come with a general partnership? What are the disadvantages of a general partnership?

What is partnership and its advantages? Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Partnership with kinds of owners, general partners and limited partners. Starting a business can offer you several benefits , including the ability to set your own work hours, hire employees, and select products and services your company will sell to consumers.

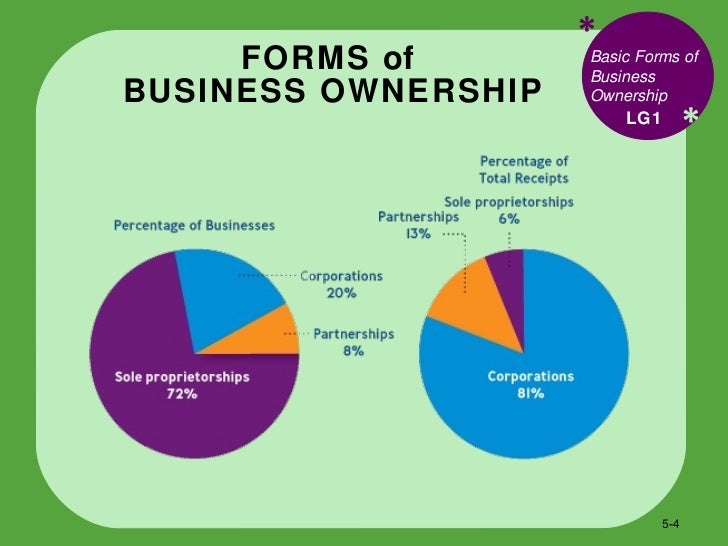

It can also leave you with choices, such as the type of legal structure under. When two or more parties work together to carry on a business for profit, you form a general partnership. Although you often operate under a partnership. Disadvantages of Partnership. Sole Proprietorship When it comes to types of businesses , sole proprietorships are the easiest ones to start, especially since the business is the person who starts the organization.

The paperwork is limited and is only slightly more complicated than the paperwork required for a Sole Proprietorship. The main advantage of a partnership is that it can be easily organized. There are no legal formalities required in this type of business. The partners enter into a partnership and start a business. Favorable Credit Standing.

The second merit is partnership enjoys a better. When you create a general partnership , all partners are taking an equal share of duties as well as liability. The cost of creating a general partnership is less expensive than setting up a corporation or a limited liability partnership like an LLC.

A tax-reporting entity that allows certain corporations with 1or fewer stockholders to choose to be taxed as partnerships. Its stockholders receive the organizational benefits of a corporation and the tax advantages of a partnership. General partnerships. Formation of a general partnership requires no fee if it operates under the legal names of the owners. No partnership may operate in Virginia under a fake, or “fictitious,” name until it registers that name with the Clerk of the Circuit Court for the county in which the business is located.

Registration requires a fee, which is typically. Creating a business is difficult to do alone. Bringing on someone as a partner can seem like a great way to take some of the burden off of you while increasing the connections you have and therefore your chances of success. If a company operates as a partnership , there are two distinct ways of doing this - as a general partnership and as a limited partnership.

A business with more than one proprietor has the benefits of a wider pool of knowledge, aptitudes, and contacts when compared to a business that is operated by a sole proprietor. ADVERTISEMENTS: After reading this article you will learn about the advantages and disadvantages of partnership form of organisation. The general partner assumes the responsibility for the management of the business and the limited partner contributes only assets to the business, while having no role in the company’s management.

The limited partners can only participate marginally as compared to the general partner.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.