Changes announced to the low and middle income tax offsets were only in respect of the amount of that offset. Complete the PAYG withholding application (e-variation) to vary or reduce the amount of pay as you go ( PAYG ) tax withheld from income paid to you in the application year. The last date for lodgment is April of the application year.

Pay as you go ( PAYG ) instalments is a system for making regular payments towards your expected income tax liability. Find out about the essentials on this page. What is a Pay as you go SIM? A 30-day SIM deal is just another way of referring to a pay as you go SIM. The term refers to a one-month contract which includes a monthly allowance of calls, texts and data.

SIMs are often a far preferable option over pay-as-you-go plans. When you pay your employees, you must withhold a certain amount of tax from their pay. You then send this tax to ATO. The ATO calls this pay as you go ( PAYG ) withholding. You withhold this tax on behalf of your employees.

See full list on softwaredevelopers. Keep control over your bill with no credit check or commitment with a cheap pay-as-you-go ( PAYG ) deal. As an employer, you have a role to play in helping your payees meet their end-of-year tax liabilities.

Proposals on extending the pay-as-you-go ( PAYG ) on rail. Consultation description. Seeks views proposals on extending. Single Touch Payroll The Single Touch Payroll is a new ATO initiative whereby employers send all of their employee payroll information to the ATO at the same time they pay their employees.

Plus, you’ll be able to find the best value deal for you. It’s all about what fits you best. Differences will always be in favour of the ATO, however these will be refunded when the annual year tax return is processed. The financial year for tax purposes for individuals starts on 1st July and ends on June of the following year. Cheap Pay As You Go Plans.

If you buy a £sim credit it needs to last until you have used it, otherwise its not really pay as you go is it. Owned and operated by O giffgaff gives its members the exact same coverage as the primary network. The SIM works best for light to medium users who can make use of the goody bag bundles. The index provides businesses, policymakers and practitioners with a tool to assess these markets along a 71-point indicator matrix under three main pillars: deman supply and enabling factors.

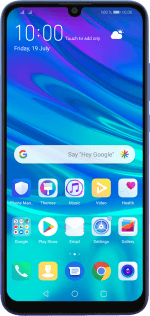

A further increase in the basic medicare percentage rate, moving to 2. Official tax instalment ( PAYG ) rates are slightly more than the actual tax rate. So all things being equal, an employee with nothing other than wages to put in their tax return, could normally expect a small refund on the final tax assessment. Discover our best pay as you go deals on top brands such as Apple, Samsung, Huawei, Sony and more.

Rather than re-issue new tax tables, the ATO adopted the EOY refund approach instead. So when calculating PAYG , you must use the published tax tables and cannot take the offsets into account. The Income Statement is only available from your myGov account for both Department and School Local Payroll (SLP) employment. A copy of the Income Statement cannot be generated by the Department or the school. These payments accumulate towards your expected end of year income tax liability.

Before you lodge your income tax return, it is important to finalise your PAYG instalments. If there is any difference between the pricing shown in these price guides and the pricing shown elsewhere (for example on our website, in advertising or in our stores) the pricing in these guides will take precedence. This will ensure that your.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.