TFN application for a deceased estate. You can apply for a tax file number ( TFN ) for a deceased estate either: online at abr. Apply for a TFN for business Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number (TFN) online. Most businesses or organisations can apply for a TFN while completing their ABN application.

How to apply for TFN for a deceased estate? After the date of death, a deceased person’s estate is treated separately from the deceased person for tax purposes. Can traders apply for TFN? We record a TFN for the estate as ‘The trustee for the (deceased person’s full name) estate’.

Note: The LPR may only need to apply for an TFN if they are not carrying on an enterprise but required to manage post date of death income. You do not need to register them for a TFN in a separate process. When you apply for a TFN at the same time you apply for an ABN, your client will be automatically registered with a business TFN when their ABN application is processed. The decedent and their estate are separate taxable entities.

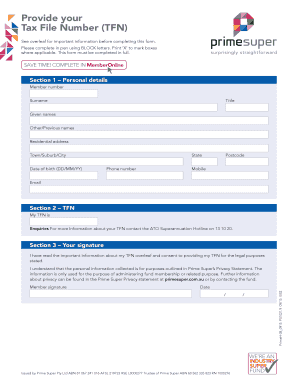

A tax file number ( TFN ) is free and identifies you for tax and superannuation purposes. You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. If your details change, you need to let us know. How you apply for a TFN depends on your circumstances.

Use the TFN registration form to provide the information required. Apply for Estate Tax ID Online The most convenient method for obtaining a federal tax ID number for an estate is via the internet. This is the most common reason to apply for an EIN for an estate. All Australian residents can apply for a TFN online.

Please note: This application applies to Australian residents only. If you live outside Australia, or are a permanent migrant or temporary visitor, visit the Australian Taxation Office (ATO) website for more information. This must be done prior to the distribution of any funds to beneficiaries. In some instances, there may be several years where a tax return will need to be lodged for the trust.

The precise fee will vary on the size of the estate. The good news is that the application fee for estates less than $500is only $62. There can be no doubt that to burden larger estates with a significantly larger fee is simply unfair. DHS can assist applicants in obtaining a TFN.

Use this application if: Ł you have never had a TFN, or Ł you are not sure if you have a TFN, or Ł you know you have a TFN but cannot find it on any tax papers you have. In these circumstances full proof of identity may not be required. Do not use this application if you are a non-resident and applying for purposes other than employment.

The period from the date of death to the end of the income year is covered by the first return of the deceased estate. Physical and legal persons who reside abroad are required to possess a Taχ File Number if they own property located in Greece, engage in any real estate or commercial transaction in Greece or earn. Refer to Trust return for a deceased estate for details of when you need to lodge. Tax file number ( TFN ) declarations.

Tax File Number Australia - The trusted Tax File Number ( TFN ) service for travellers who plan to work in Australia. If you’re a Centrelink customer you can apply for a TFN by: Ordering an application form online and completing it. Visiting a Centrelink centre, remember to bring the completed application form and original identity documents.

If you do not want to apply for a PTIN online, use Form W-1 IRS Paid Preparer Tax Identification Number Application. The paper application will take 4-weeks to process.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.