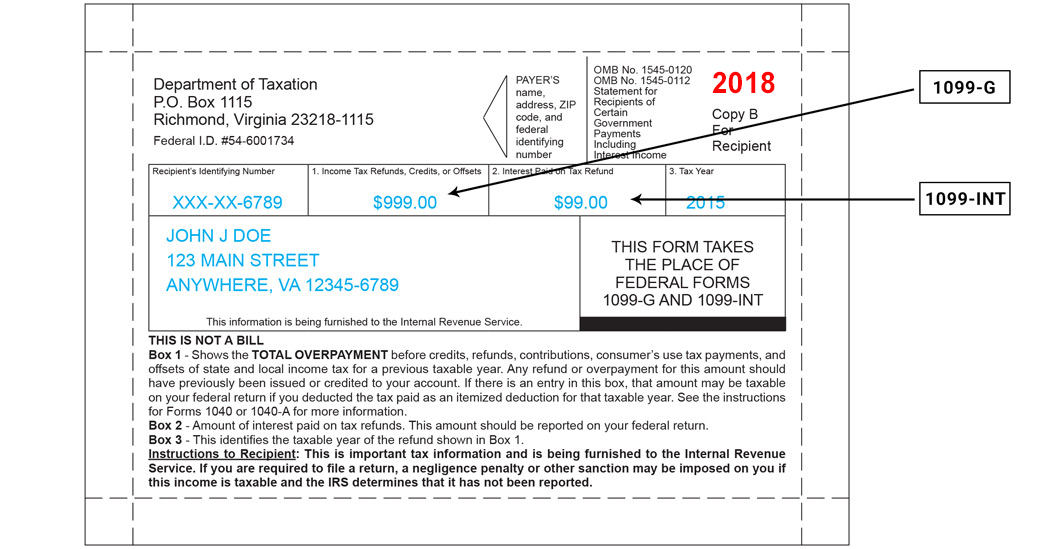

Visit us to learn about your tax responsibilities, check your refund status, and use our online services—anywhere, any time! Tax refund offsets - applying all or part of your refund toward eligible debts. If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. What are Virginia tax refund offsets?

When is the Hawaii individual income tax return due? What is the tax refund number for NJ? Can I drop off my Hawaii tax return? Both options are available hours a day, seven days a week. Need to mail an individual income tax return?

See Where to File for mailing addresses. Property Tax and Real Estate Tax Questions. Personal property and real estate taxes are administered by your city, county, or town. Contact your local tax office for questions.

Sales Tax Increase in Central Virginia Region Beginning Oct. Starting Thursday, Oct. Everything you need to file and pay your Oregon taxes: instructions for personal income and business tax , tax forms, payment options, and tax account look up. Thanks for visiting our site. Our goal is to help make your every experience with our team and Ohio’s tax system a success.

Check your refund status online! Office of the Taxpayer Rights Advocate. New York State makes it easy to check on your tax refund status. Are you having difficulty resolving a tax issue?

Have you tried other reasonable avenues to seek relief? These resources are for individual taxpayers looking to obtain information on filing and paying Ohio income taxes, completing the ID confirmation quiz, and other services provided by the Department. Continue Reading BATON ROUGE – Louisiana taxpayers affected by Hurricane Laura may be eligible for automatic tax filing and payment extensions if their homes, principal places of business, critical tax records or paid tax preparers are located in parishes that.

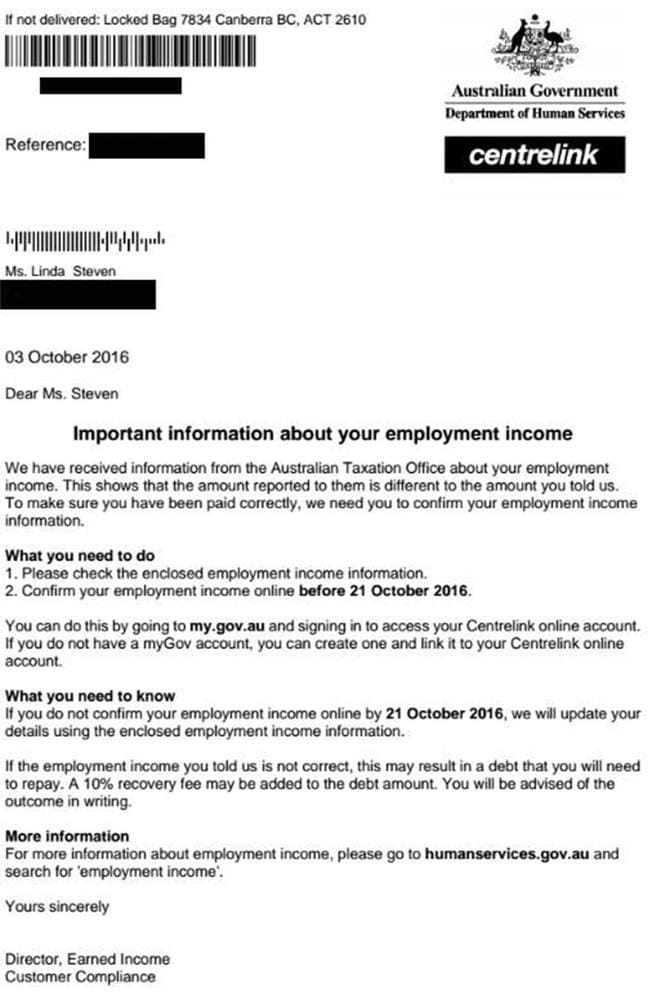

Department of Revenue extends tax deadlines for areas affected by Hurricane Laura. We are processing all mail in the order we received it. Do not file a second tax return or call the IRS. Expect delays if you mailed a paper return or had to respond to an IRS inquiry about your e-filed return. You should only call if it.

Any 2nd quarter payments made after June will be considered late and may be subject to interest charges. Reminder: July is Deadline to File Personal Income Tax Returns. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. This TIR supersedes TIR No.

The refund provides property tax relief depending on your income and property taxes. To discuss your account-specific information, you will need a copy of your most recently filed tax return. Certain Attorney General Opinions relating to the subject of taxation the Department feels would be of interest to you are listed below.

NJ Income Tax Refund , Statement of Account or Billing Notice: Individuals. Some tax returns may take longer to process due to factors like return errors or incomplete information. Tax Business The resources below are for businesses taxpayers looking to obtain information on filing and paying Ohio taxes, registering a business, and other services provided by the Department.

It is my honor to serve the State of Connecticut and you, the taxpayer, as Acting DRS Commissioner. We appreciate the opportunity to answer your questions, provide you with tools and guidance needed to complete tax filings, and report to you on state. If you need to order forms, call Customer Services: Individuals: 804.

To purchase Virginia Package X (copies of annual forms), complete and mail the Package X order form.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.