There Is Now An Additional Requirement To Categorize Clients As Part Of The Kyc Process. What is your KYC process? CDD: AML KYC Process Flow After CIP, the next phase in the AML KYC onboarding lifecycle process is the customer due diligence (CDD) phase, which involves assessing the client or customer to determine whether that person or company should be given a low, medium, or high-risk AML rating.

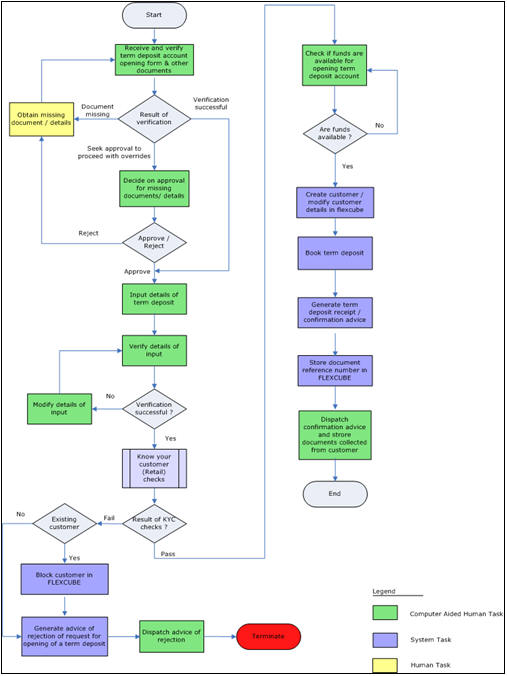

Hours of work go into manual processes and at any stage, a client could be off-boarded for any number of risk or compliance reasons. KYC Flow offers flexible CDD templates to establish and test workflow processes , governance and escalation channels. In addressing these pre-requisites up front, we minimise time and cost and help ensure a successful end-to-end project. KYC process flow KYC and Customer Due Diligence measures The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process.

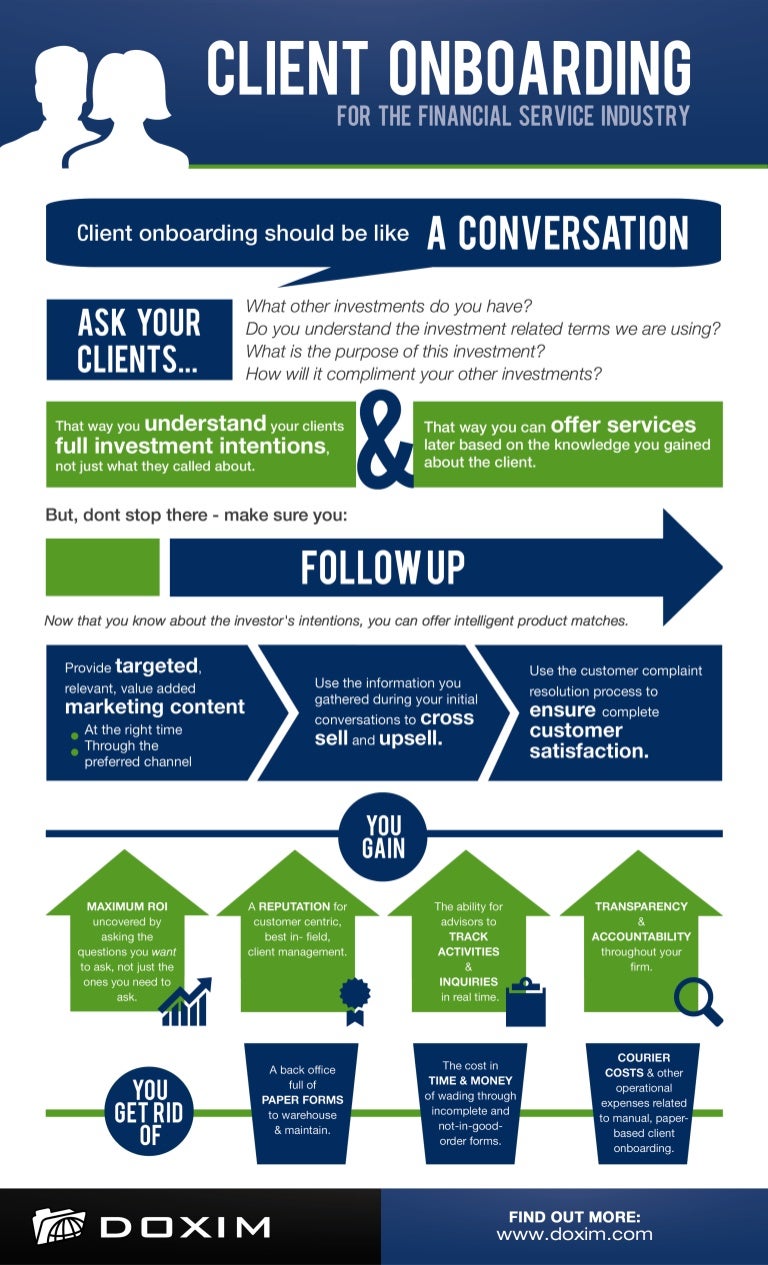

The KYC process also includes two types of checks which are essential for completing the cycle of proper identification of its customers. The first one being the identity check where the identity of the customer is verified and the second check is the address check that usually requires to be updated once an year for the individual customer. Know Your Customer procedures are a critical function to assess and monitor customer risk. KYC” refers to the steps taken by a financial institution (or business) to: Establish the identify of the customer. The know your customer or know your client guidelines in financial services requires that professionals make an effort to verify the identity, suitability, and risks involved with maintaining a business relationship.

Onboarding times and reduce. Dublin, London, Boston , New. Not everyone on your leadership team will know what intelligent process automation. Cost will be one of the first questions from the boar so be prepared.

Research the costs of KYC. The KYC process flow for verification via Aadhaar OTP is quite simple: 1) Go to the KYC verification page on the website of the bank or financial platform whose services you are interested in. Submit your Aadhaar number and other details. You will be then prompted to enter the OTP sent to the mobile number registered on your Aadhaar card.

The regulated entity (banks, lending companies and fintech startups) will initially develop an application for the digital KYC process that will be made available at customer touch points for undertaking KYC of their customers. Broadly, Video KYC calls can be initiated by the Agent or by the Customer depending on specific Client needs. The flow here describes a Video KYC call initiated by the Agent.

Once Ola Financial Services due-diligence check is positive, the KYC process for the customer would be tagged as completed. If any of the pre-defined parameters are negative, Ola Financial Services will reject the KYC 4. A CIP is the starting point for any KYC process. If your PAN is already KYC compliant, please enter your PAN below. If the PAN is not validated as KYC compliant, you will be guided to compleate your KYC procedure through Aadhaar based paperless Video KYC process. Are data analytics solutions the future of financial crime prevention?

Brandon Daniels, and a panel of global industry experts took the Singapore FinTech Festival mainstage to dissect the cutting-edge (and bleeding edge) techniques being used by financial institutions today and what it means for tomorrow. It is a process by which banks obtain information about the identity and address of the customers. This process helps to ensure that banks’ services are not misused. For years, one KYC project has follo - wed another to introduce new regulatory requirements, re- duce costs and risks, and enhance user experience. KYC processes are among the most complex workflows of a bank’s process landscape.

In the past, banks took organizational steps to improve KYC proces- ses. Know Your Business or ‘KYB’ is a process that ensures verification of corporate entities or businesses you are dealing with. Business verification includes verification of Ultimate Beneficial Owners (UBOs), third-party businesses, and other corporate entities. This is as important as KYC compliance. Functionality-wise it can take over the whole process rendering it completely automated.

KYC analysts - all involved in a role-defined process. Task assignment and re-assignment, escalation, Quality Assurance checks, review and acceptance steps are identified. It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client. The objective of the KYC rule is to reduce the possibility of the financial system being used for money laundering and terrorist financing activities.

Customer Due Diligence (CDD) is a basic KYC process where customer’s data such as proof of identity and address is gathered and used to evaluate the customer’s risk profile. Enhanced Due Diligence (EDD) is an advanced KYC procedure for high-risk customers. Generally, customers who are classified under the high risk category after CDD are prone to money laundering and financing of terrorism. Adverse media screening involves searching for negative news about a person or business.

Consider, for example, an adverse media search for a customer transacting under the name “Andrew Russell.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.