PAYG payment summaries : forms and guidelines. Under pay as you go (PAYG) withholding, you must give each of your employees, workers and other payees a payment summary showing the payments you have made to them and the amounts you withheld from those payments during a financial year. I deleted them in case there was a glitch in MYOB. Small businesses are able to adopt the new reporting framework earlier if they choose to do so.

Your payment summary information should now be pre-filled in the ATOs myTax system. Does Social Security max out? How much will I get in SSI disability benefits? STP they will continue to provide you with a payment summary by July (as they do now).

Your employer should let you know if you will receive an income statement or payment summary. You should talk to them if you are unsure. If your original report was lodged online and your payroll product is able to generate amended files you can lodge an amended payment summary annual report online. This video shows how to do your payment summaries for your employees in xero.

We sincerely apologise for this regrettable situation and are working hard to resolve th e issue. With the recent introduction of Single Touch Payroll, access to Income Statements is now via your myGov account, linked to the Australian Taxation Office (ATO) Online Services. What do you need to do? Your Centrelink payment summary is now pre-filled in the ATOs myTax system and also available through a registered tax agent. Prior to publishing a payment summary , you should finalise all payments, post any draft pay runs for the relevant financial year, review the payroll year, and check everything reconciles accordingly.

As of this financial year, Single Touch Payroll is mandatory for all employers with or more employees and will become mandatory for employers with or less employees next financial year. Your formula should look somehow like in the picture below. Press Enter to confirm the selection.

This webinar is designed for businesses who have not yet started or are not required to start reporting to the ATO via STP. This includes WPN holders and bus. The tax office has issued a PSA explaining why workers’ annual pay summaries may be missing this year, in a bid to stem confusion about changes arising from the Single Touch. At tax time, the ATO will send a notification to each employee’s myGov inbox as soon as their income statement has been marked as ‘tax ready’. The send process validates the Supplier ABN (for the practice) against the ABN registered with the digital certificate.

The following list contains vendor information for vendors who have received payments from PGCPS totaling $20or more. Type in the box below to search for a vendor. They made six in payments with debit, credit, or prepaid cards, or payments. Debit cards were used the most, for payments, followed by credit cards (payments), and cash (payments).

Latest Summary (5) There are summaries for S. The option to lodge through the old method is deactivated. As such, you can only preview your payment summaries, but not publish them. This course will provide … Benefits of Using the MSPRP – CMS. Worldwide Tax Summaries Online.

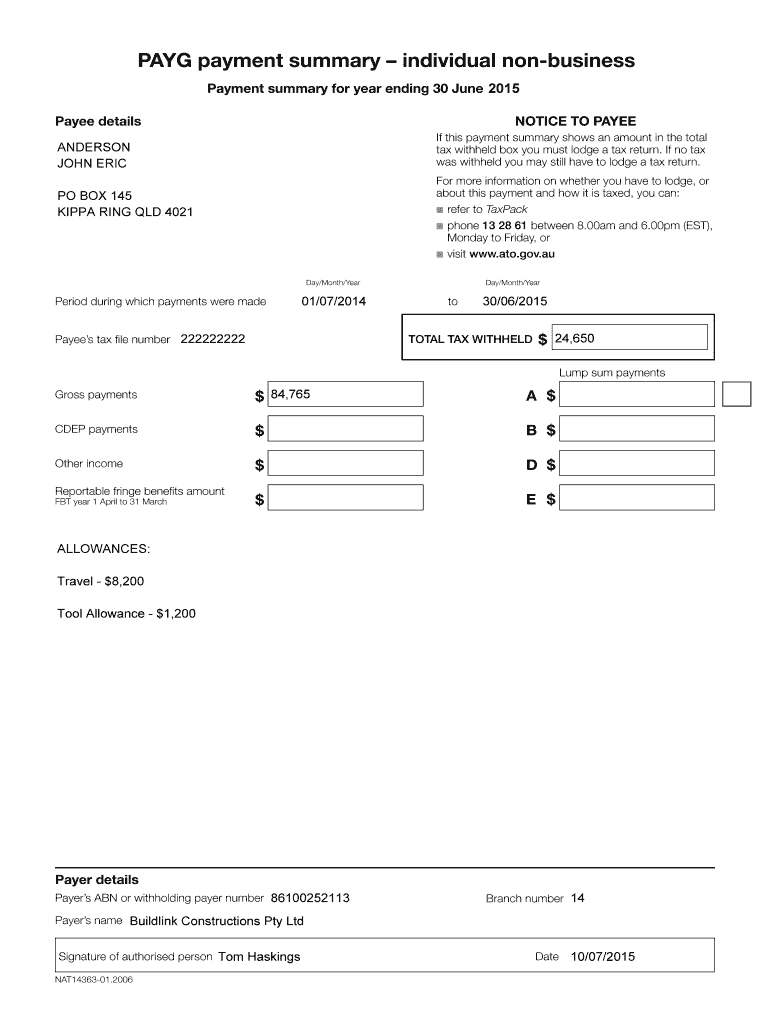

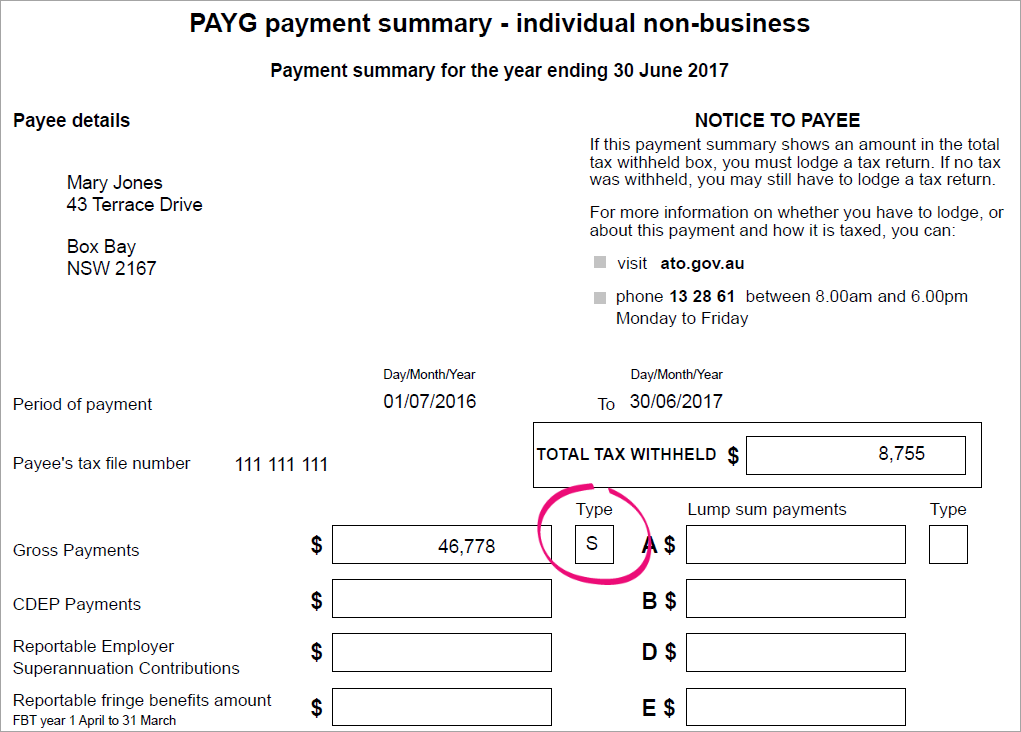

Payment Summary Setup – Step 12b. With the Single Touch Payroll system, the ATO has immediate access to your payment details, without the need for your employer to submit them. To view the payment summary details, click the zoom arrow next to an employee’s name.

MyTax If you are using MyTax, the ATO should have automatically filled in some information on your tax return using the information provided by your super fund(s). B Program when they are furnished by non-excepted off-campus provider-based departments (PBDs) of a hospital. Through your employer.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.