The last date for lodgment is April of the application year. The e-variation is a transmittable form you need to lodge online over the internet. As an employer, you have a role to play in helping your payees meet their end-of-year tax liabilities.

Labels W W W W Wand 4. Pay as you go withholding. These payments accumulate towards your expected end of year income tax liability. They can use their from the estimator to help fill out the form and adjust their income tax withholding. This will ensure that your. But before you do that, experts recommend doing a little legwork to determine which tweaks are necessary.

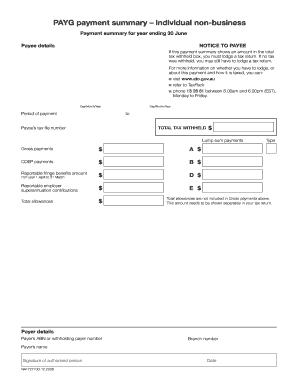

Payment summary for year ending June. Today I solved the problem myself. Nothing happens and it looks like the Page is hanging. Contact your tax agent or BAS agent. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn.

A withholding requirement relates to an amount required to be deducted and withheld from the payment of income paid to a foreign person. For additional information, refer to. The main purpose of varying the rate or amount of withholding is to make sure that the amount withheld during the income year bests meets your end of year tax liability. The payer doesn’t have to use this form, but any voluntary agreement must be a written agreement including all the information specified above. When you pay your employees, you must withhold a certain amount of tax from their pay.

You then send this tax to ATO. You withhold this tax on behalf of your employees. By making partial payments during the year, there is less likelihood of the payees being lumped with a huge tax bill at the end of the year. For state withholding , use the worksheets on this form.

EXEMPTION FROM WITHHOLDING : If you wish to claim. You may claim exempt from withholding California income tax if you meet both of the following conditions for exemption: 1. All Major Categories Covered. Form W-and the state DE 4. It comprises the total number of payment summaries issued during the financial year, which must equate to the total amount of gross and tax withheld reported on the form.

Tax Declaration Form. The Court held journal entries alone are not conclusive evidence of the withholding process and that maintaining a relevant bank account, complemented by accounting entries, is required to support the. The employee claims an exemption from withholding under the Military Spous - es Residency Relief Act. Does that qualify as a tax debt?

In most jurisdictions, withholding tax applies to employment income. Display the balance sheet at the end of the period. Many jurisdictions also require withholding tax on payments of interest or dividends. Add the tax amount withheld by your customer.

Add other important info including your customer’s name, and then Save and close. Withholding Taxes General Information. You can file your VA-using your regular filing method ( Web Upload , your Business Account , or eForms ). You are required to send both by Jan.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.