Make Your Searches 10x Faster and Better. Powerful and Easy to Use. Get a Business Loan From The Top Online Lenders. Grow Your Business Now! Browse our content today!

TheAnswerHub is a top destination for finding online. Can you get a start up loan to buy a business? Should I take a loan to start a business? What is the average loan to start a business? Where to get free grants for small businesses?

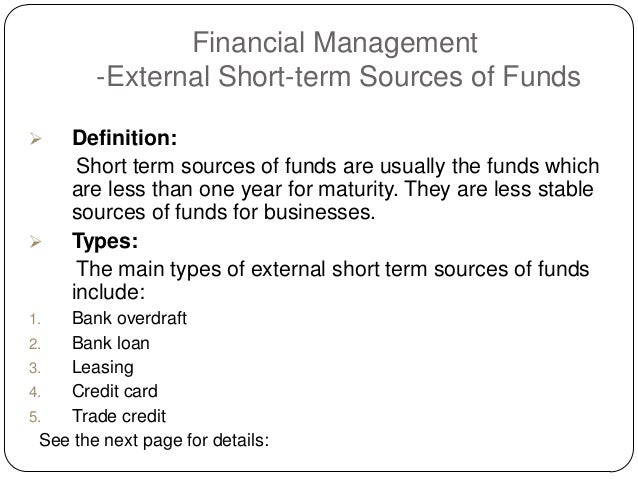

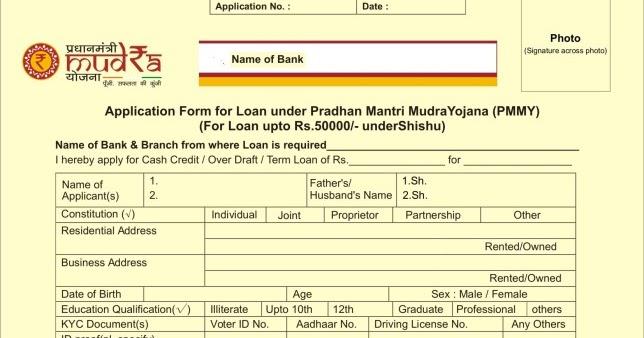

The loan program is designed to assist for-profit businesses that are not able to get…. This helps those who may have trouble qualifying for a traditional bank loan. In these programs, you’ll apply by creating a loan package with a participating lender. Websites or other publications claiming to offer free money from the government are often scams. First there’s the quest for a decent location, then comes building a customer base, followed by all the initial hiccups of generating a cash flow before your business grows roots and gains momentum.

Government small business loans help put your own business within reach. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their business. The programs and requirements are normally listed in the business or commerce sections of the government website.

Learning how to get a loan to start a business can help you understand what commercial lenders are looking for, what you can qualify for and some alternative approaches you can take. This may be the start of a second career for you. If you own a business and have had to shut it due to the economic downturn, you can avail of government loans to restart it. This is the spirit of true enterprise in the American way, and the government wants to help women who want to help themselves.

Save time Searching at MyDeal. SBA provides loans to businesses - not individuals - so the requirements of eligibility are based on aspects of the business , not the owners. The beginning of a business is crucial because it’s when you gain or lose market credibility. Use Lender Match to find lenders who offer SBA-guaranteed loans.

If you have trouble getting a traditional business loan, you should look into SBA-guaranteed loans. When a bank thinks your business is too risky to lend money to , the SBA can agree to guarantee your loan. Probably the best-known government lending agency is the U. The SBA doesn’t actually make direct loans to businesses. Small Business Administration (SBA).

Rather, it works with lending institutions, and guarantees that loans will be repaid. The MicroLoan Program provides very small loans to start -up, newly establishe or growing small business concerns and certain not-for-profit childcare centers. A branch of the SBA Microloan program, the Community Advantage Loan program is designed to provide loans to businesses in an underserved community. It has a higher loan limit of $5000-$2500 and a lower interest rate of 7-.

That way, the bank has less risk and is more willing to give your business a loan. The SBA’s flagship 7(a) loan program also offers financing that borrowers can use to start businesses. But 7(a) SBA loans are tough to get.

They typically go to established businesses that can. Find Goverment Business Loans and Informative Content. Tax Requirements to Start a Business. It’s important for your business to comply with federal, state, and local tax laws.

Make sure to meet all federal tax requirements for starting a business. The minimum age criterion to apply for a government business loan is years. The government doesn’t offer business loans directly, but you may be able to qualify for an SBA microloan, which is insured by the SBA, from an approved lender. You can find a list of lenders to compare on the SBA website.

How to get a loan to start a business with bad credit?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.