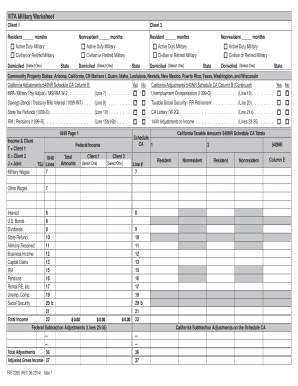

A nonresident is a person who is not a resident of. California is a community property state. If you changed your residency during. Head of household (with qualifying person).

Qualifying widow(er). What Is Earned Income? New Jersey Division of Taxation.

Basically, brief vacations or transactions, such as signing a contract or giving a speech, constitute temporary or transitory purposes that do not confer residency. If a non resident , your retirement income is likely not taxable by CA. That tax is imposed in addition to whatever income tax the governments of the United States and your state or country of residence may impose on such income.

Resident Income Tax Return. The sale of real estate is another common point of confusion. Add this amount to the payments you made. New residents would have the wealth tax phased in for them over ten years. Part-year residents must file a state tax return if total income exceeds the filing requirement amount for full-time residents.

I was part year resident in NY and CA. For Oregon, the part-year return is Form 40P. Part-year returns are filed when you’ve lived in more than one state during a year. As stated previously, nonresident individuals must file income tax returns in both Arizona and their home state.

Less than of nonresident and part-year resident taxpayers file using the short form. The input will vary by state, but typically includes residency dates or move dates for part-year returns, as well as a permanent resident or domicile state. You can file resident , nonresident, and part-year resident returns for any state.

Requirements to File State Return(s) You may need to file a tax return for your resident state if your resident state collects income taxes. Note: This screen appears only for part-year residents and nonresidents. The term “non- resident ” includes every individual other.

A part-year resident is also subject to Special Accrual Rules. This information will be included in the calculation of the percentage to prorate the tax figured on Line 10. You are required to determine a percentage of income from other states, so it is best to have your federal and other state returns prepared prior to starting the Arizona return. The ratio used to calculate the tax liability for nonresident and part-year resident taxpayers is: a. The deduction is multiplied by a fraction, the numerator of which is the number of days in the taxable year the person resided in the Commonwealth and the denominator of which is the total number of days in the taxable year.

Most states with an income tax follow. Part-year tax residents – Applies if you were a resident of one state for part of the tax year and moved to another state with the intention of making it your home. In general, you’ll need to file taxes for both states. Justices debated and listened to oral arguments for over six months before they ultimately and narrowly voted 5-that states must exempt from taxation earnings that were taxed elsewhere if the way taxes are structured would penalize interstate commerce.

State and local governments require that people file tax returns, just like the federal government. Announcements and Updates. It’s important you report CA source income and report on the correct form. The classification of who falls under non- residency status is determined in each region by set circumstances such as the amount of time spent within the region during the.

Name(s) as shown on tax return. CA (540NR) TAXABLE YEAR. Part-year resident and nonresident return processing - Enter the part-year or nonresident state postal code in the state field in the screen or statement to designate the associated income, expense, withholding, payment, or deduction to the state indicated.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.