Australia Income Tax Treaty exempts superannuation from U. Use the form to offer eligible employees their choice of superannuation (super) fund. You must fill in the details of your nominated super fun also known as your default fun before giving the form to an employee. See full list on ato. Employees can access and complete pre-filled forms through either: 1. ATO online services via myGov 1. Enter data electronically and then print the form out – you cannot save an electronic copy after you have typed data into this form.

More information can be found on Extranet frequently asked questions. Note: online superannuation forms can only be submitted using an AUSkey that has been issued in respect of a Trustee ABN. A superannuation is an organizational pension program created by a company for the benefit of its employees. How do you find your superannuation?

How to choose a superannuation fund? The online form should take around minutes to complete. Your super is invested in a range of assets to help grow your balance so you can have the best possible retirement outcome.

You don’t automatically get it once you turn 65. These are general thresholds: Category 1: U. SFCs) subject to the provisions of section 965. It is funded through employment, along with other voluntary contributions.

The SG mandatory contributions for employees is similar to social security, but based on the all the voluntary contribution exceptions (non-concessional) it more resembles a 401K than it does social security. These persons are known as the eligible persons. If we say ‘your partner’ this only applies if you have one. Tell us about yourself If you’ve received a benefit or extra financial help from us before, write your client number here if you know it. Single touch payroll (STP) is a new way of reporting tax and superannuation information to the ATO.

How is my superannuation valued? There are different types of superannuation. The superannuation splitting legislation sets out methods for valuing most types of superannuation , but there are.

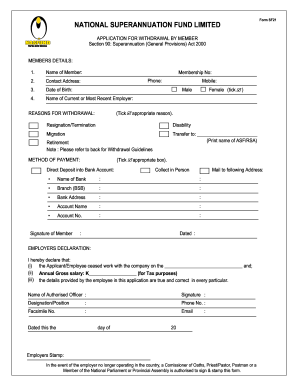

Tax file number declaration form. Whole balance transfer to a Kiwisaver Scheme. SASS Form 4- Application for payment of a previously deferred SASS benefit. The data is defined in the set of reporting forms and instructions. Superannuation rollover form.

The Code was produced by a cross-industry working group and sets out the superannuation industry’s commitment to high standards when providing insurance to members of superannuation funds. You provide this information to your employees by completing section B of the Standard choice form listed below. Contact your super fund. Your super fund can decide to release your super early if one of the following apply. Under severe financial hardship.

The rules cover general areas relating to the trustee, investments, management, fund accounts and administration, enquiries and. Coalition promised at the last election to stick with that. View our useful forms and documents for superannuation products to update your details, beneficiaries, consolidate your super plus more.

Your superannuation agreement must form part of a Part VIII A financial Agreement , (sect 90MH and 90MHA). Most of our forms are interactive PDFs and are labelled. Here you’ll find the official SIS Act definitions for each fee type.

Often your superannuation is the biggest asset you have when you die. Many people do not know this, but your superannuation does not automatically form part of the assets under your Will in most cases. Read more about COVID-early release of super on the ATO website.

Our members breathe life into their communities, and we’re aware of the potential for their super to do the same. Our new name celebrates this spirit and demonstrates our commitment to action and impact.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.