Estate documents ( probate or death certificate and will) and payment of the $90. Computershare then contact a broker for their requirements. What is deceased estate sales service?

The death of a loved one can bring about many unforeseen challenges, especially when it comes to the settlement of their financial affairs. It can be a complex and emotional process, and in the situation that the estate includes shares or other securities that need to be transferred from the name of the deceased into the name of the executor(s) or beneficiary(ies), there are specific items. We want to make the process of managing a deceased estate as easy as possible for you.

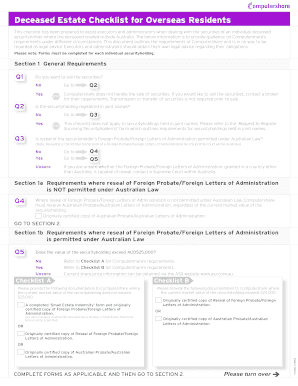

The below checklists outline the steps involved to manage shares that are held individually or jointly. If the shareholding is broker sponsored (the holder number begins with the letter X or L), please contact the managing broker directly. Please return the original form by post to the address above.

Before registering, please ensure you have read the DESS the Terms and Conditions and Tariff. IMPORTANT: In order to sell or purchase additional shares, you will require your Shareholder Reference Number. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Unsure Please refer to the holders recent holding or interest statement(s), for face value.

CHECKLIST FOR REPORTING A DECEASED ESTATE. Documents to be completed and furnished to the Master: Death Notice. Acceptance of trust (duplicate) Declaration of Subsisting marriages (civil union, customary marriage etc) Affidavit of non-reporting. Special Power of Attorney. Next-of-kin affidavit.

If transferred into an existing holding you must write the name (and address details) of the existing holding exactly as they currently appear on the register. Joint Holding – Checklist 1. A certified copy of the Death Certificate. Deceased Estate Supporting Documentation. UK Financial Conduct Authority.

Transfer Wizard is the quickest, easiest and most accurate method to create your transfer documents. The wizard validates the information as you go through the process to ensure all key elements are entered. Real Estate , Family Law, Estate Planning, Business Forms and Power of Attorney Forms. In the course of providing services to you and our corporate clients, we receive non-public personal information about you from transactions we perform for you, forms you send us, other communications we have with you or your representatives, etc.

Once you collect the Decedent’s liquid assets, you are going to need a place to put them. You cannot put them into your own bank account as some may consider this stealing or commingling. Estate – Include Executor Name, Provide Estate EIN on Form W-Qualified Pension Plan (Non-custodial) Trust – Include Trustee Names, Trust Name, and Trust Agreement Date below. Transfer on Death (“TOD”) – Note: Only TOD beneficiary may be registered per account.

List the TOD beneficiary name below. These notes have been prepared to assist you when dealing with the shares held by an individual deceased shareholder. The executor must inventory all the property that belongs to the estate including bank accounts, cash, personal property, real estate and securities such as stock certificates. An executor acts as the personal representative for a deceased person ( Estate Trustee in Ontario, Liquidator in Quebec), and is responsible for settling the estate – also referred to as estate administration. Full name(s) of Executor(s) or Administrator(s) 2. Please note: this will take you to one of our external sites.

Manage your portfolio and prepare tax pack. View your registry data. Communication Centre.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.