Tax Exempt - investopedia. Does being tax exempt save your organization money? What are tax exempt businesses?

Tax-exempt organizations do not have to pay federal income taxes when they buy or sell items. For tax-exempt eligibility, the organization’s purpose must not be to generate profit.

The owners or founders of a tax-exempt organization cannot receive profits from the organization. Though you may be tax exempt from federal income taxes, you might have to pay state and local taxes. To be exempt from state and local taxes, you need an exemption from your state and local governments. See full list on patriotsoftware.

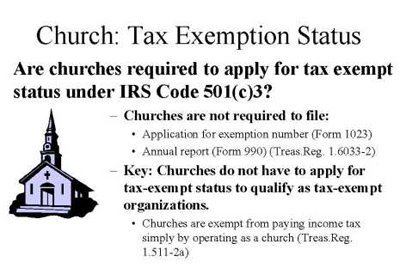

There are a variety of organizations that can be tax exempt. Here are some common tax-exempt organizations: 1. Churches and religious organizations 2. Educational organizations 3.

Social welfare organizations 4. Fraternities, societies, and associations 5. Veterans’ organization with at least of its members serving or have served in the armed forces 6. Trade associations that promote the common interest of its members, such as chambers of commerce 7. Labor organizations that promote the interests of workers, such as work conditions and wages 8. Agricultural and horticultural organizations, including forestry, livestock, and crop institutes 9. For federal tax exemption, your organization must register with the IRS. Though there are other ways to gain exemption, the most common is with section 501(c)(3)of the Internal Revenue Code. Besides tax exemption, 501(c)(3) organizations also receive eligibility for tax deductible charitable gifts, exemption from federal employment taxes, the likelihood of exemption from state and local taxes, and bulk postage rate privileges. To be eligible for 501(c)(3) status, an organization must: 1. Operate for religious, educational, scientific, or other charitable purposes 2. Not give net incometo any private individual, such as an owner or founder 3. Not attempt to influence government legislation or be involved with political campaigns 4. Not practice illegal activities or violate fundamental public policy The process of becoming tax exempt is long and difficult.

You should consult with an attorney as you pursue tax - exempt status. Being tax exempt saves your organization money on taxes.

But if you’re like many small businesses, you probably do not qualify for tax exemption. If you are not tax exempt and contributed charitable donations to a qualified organization, you could claim a tax deduction. The charitable contribution deductionreduces your business’s tax liability. Check that the organization you donated to is qualified before claiming the deduction.

If you claim the deduction for an organization that is not tax exempt, you could get into trouble with the IRS. The IRS will help you know if an organization is tax exempt. Search the organization’s name, city, and state with the IRS’s Search for Charities tool. With this rule, the deduction must be less than of your adjusted gross income.

Usually, you can write off a charitable donation using the limit. Depending on the type of donation and the organization you contributed to, you may be limited to of your adjusted gross income. A sales tax exemption releases a business or organization from having to pay state or local sales tax on at least some of the items that it purchases. In some states, for example, grocery items are exempt from sales tax. It gets tricky because.

Use-based exemptions. Products that are intended to be resold are frequently exempted from sales tax. Buyer-based exemptions. In other words, sales tax exemption certificates are your proof that you can buy an item tax free. It allows your business to buy or rent property or services tax-free when the property or service is resold or re-rented.

Title holding corporations for exempt organizations. Questions Answered Every Seconds. Owe back tax $10K-$200K? See if you Qualify for IRS Fresh Start (Request Online).

The Internal Revenue Code restricts the activities that tax - exempt organizations can carry out. The regulations are set forth in Section 5(a) of the code. Businesses that are granted tax - exempt.

Avoid manual processing of tax refunds Once approve purchasers in your organization can make eligible tax - exempt purchases from Amazon. Customer Support for refunds. Organizations who have filed a Form 990-N (e-Postcard) annual electronic notice. A tax - exempt LLC is a limited liability company that is exempt from paying federal income taxes.

An LLC is a legal business formation owned by at least one owner, called a member. Georgia helps companies lower their cost of doing business by offering the ability to purchase various types of goods and services tax free. These sales tax exemptions are defined in O. Returns filed electronically need to be filed by the 20th of each month following the reporting period regardless of amount due.

Payments are due the 25th of each month. When a filing or payment due date falls on a Saturday, Sunday, or legal holiday, the filing or payment is due the next business day.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.