Applicants can learn more about the requirements, benefits, limitations and expectations of tax-exempt organizations by accessing the online courses at the IRS Small to Mid-Size Tax Exempt Organization Workshop. Federal government websites often end in. Part III Your Specific Activities.

Enter the appropriate 3-character NTEE Code that best describes your activities (See the instructions): 2. To qualify for exemption as a section 501(c)(3) organization, you must be organized and operated exclusively to further one or more of the following purposes. Who can get a tax exempt number? How to apply non profit organization?

Get High Level of In form ation! Turn them into templates for numerous use, include fillable fields to collect recipients? The IRS review period is – weeks.

The filing fee is an additional $275. Are you a corporation? Access IRS Tax Forms.

Where To File Internal Revenue Service P. If you are operated for the benefit of a college or university that is owned or operated by a governmental unit, select Box 2(c). Printer-Friendly PDF. It can be helpful to true micro-charities. Get Instant Quality Info at iZito Now!

Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

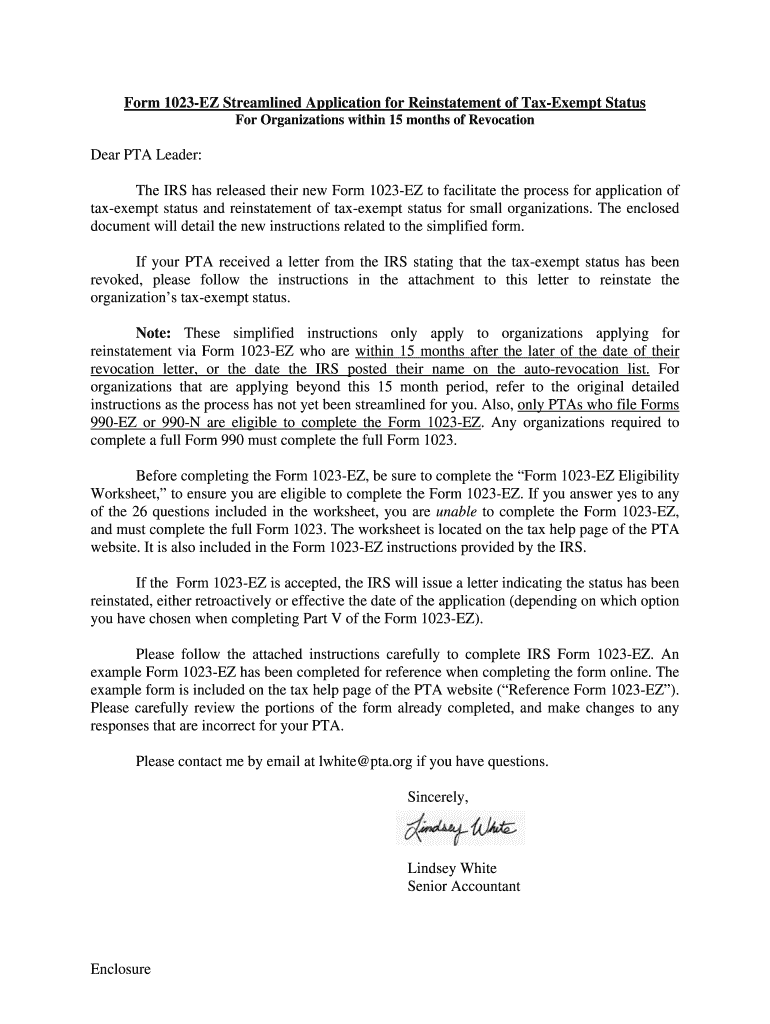

No Installation Needed. You must apply on Form. A new IRS form that is only three pages long will make filing for tax-exempt status much easier.

Please read all content provided to ensure you understand the requirements for tax-exempt status. Small organizations may be eligible to apply for tax exemption using. PDF file to your computer. Do you have an Employer Identification Number (EIN)?

The 501ctax exemption process can be extremely complex and difficult to follow. If done improperly, the processing of your 501cstatus and 501capplication can be delayed for months. It was from reliable on line source and that we love it.

Most parent groups will qualify to use the shorter form. The form is three pages long and online based. Note If exempt status is approved this application will be open for public inspection.

Create your documents via computers and mobiles and forget about any software installing! However, you still may have questions. This process will be addressed in detail at a later point in this document. Non-Profit Organizations.

The questions are easy, an usually very straight forward. Richard: So, you said the next step was applying? Leagle: That’s right. Of course, there are resources to help you on the IRS website.

We’ll be covering this step later in this training - once you decide to apply for tax-exempt status.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.