California ’s wage and hour laws (e.g., minimum wage, overtime, meal periods and rest breaks, etc.), workplace safety laws, and retaliation laws protect employees , but not independent contractors. Under California labor law, whether a worker is an employee or an independent contractor depends on the application of the factors contained in the California common law or employment and statutory provisions of the California Unemployment Insurance Code. Pursuant to California labor law, the basic test for determining whether a worker is an independent contractor versus an employee is whether the principal has the right to direct and control the manner and means by which the work is performed. Pursuant to California labor law , the basic test for determining whether a worker is an independent contractor versus an employee is whether the employer has the right to direct and control the manner and means by which the work is performed. While it is easy to say that independent contractors are simply the opposite of full-time employees , it would serve us well to review in what distinct ways they differ.

Whereas an employee is subject to the full authority and control of their employer , independent contractors work with multiple clients on a per project basis OR with one company for a specified period of time. Before classifying an individual as an independent contractor , familiarize yourself with the many factors the different governmental agencies use to determine independent contractor status. See full list on calchamber.

All businesses and government entities that hire independent contractors must file reports with the state Employment Development Department. The independent contractor reporting program is designed to locate parents who are delinquent in their child support obligations. Businesses operating outside California are subject to this law as well. HRCalifornia members have access to several tools and services that help those who manage human resources to work through independent contractor-related issues, including: 1. How is an independent contractor different from an employee?

What makes you an employee vs. Do you have an independent contractor or an employee? Are You an independent contractor or an employee? Those can include the right to overtime pay, the right to meal breaks, and the right to a minimum wage. In California , there are several legal tests to determine whether a person is an employee or independent contractor.

The tests are similar, but not identical. To add to the confusion, the California test and the federal test to determine whether a worker is an employee or an independent contractor differ in some cases. California Test for Employment To determine if a worker is an independent contractor or an employee , look at the main test and the ten secondary factors. Facts that provide evidence of the degree of control and independence fall into three categories: 1. Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job? Financial: Are the business aspects of the worker’s job controlled by the payer?

Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business? Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor.

There is no “magic” or set number of factors that “makes” the worker an employee or an independent cont. The form may be filed by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status.

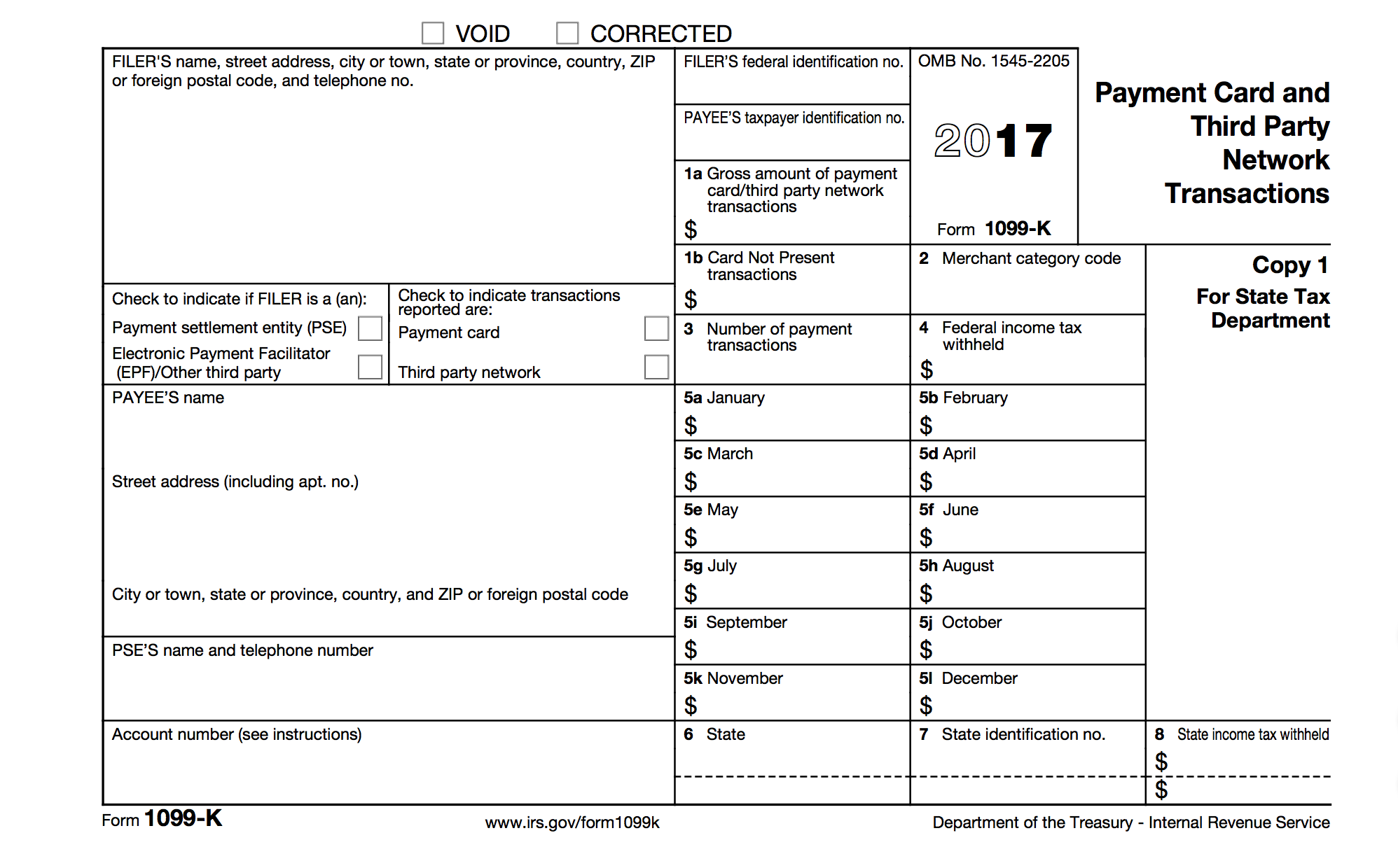

Be aware that it can take at least six months to get a determination, but a business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8(PDF). Once a determination is made (whether by the business or by the IRS), the next step is filing the appropriate forms and paying the associated taxes. Forms and associated taxes for independent contractors 2. There are specific employment tax guidelines that must be followed for certain industries. If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker (the relief provisions, discussed below, will not apply).

Employment Tax Guidelines: Classifying Certain Van Operators in the Moving Industry(PDF) 2. If you have a reasonable basis for not treating a worker as an employee , you may be relieved from having to pay employment taxes for that worker. To get this relief, you must file all required federal information returns on a basis consistent with your treatment of the worker. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! If the employer is unclear whether the worker or the employer has the “right of control”, the employer should review and analyze a list of secondary factors that serve as evidence of the existence or nonexistence of the right of control. Here is a 10-question test to help determine the classification of a worker as either an employee or independent contractor.

If the employer controls and dictates the services performed and how they are done, the worker is an employee. Under the third part of California’s independent-contractor test, an employer must prove that the worker is “customarily engaged” in a business, occupation, or trade that is independent from the company. Independent Contractor Vs. Someone who only works for a single company, ever, usually must be classified as an “employee. For the employee , the company withholds income tax, Social Security, and Medicare from wages paid.

For the independent contractor , the company does not withhold taxes. The California legislature today approved a controversial new law that will reshape the way businesses across the state classify workers. While supporters of the bill have emphasized its impact on independent contractors , the bill also severely impacts legal obligations governing businesses that hire other businesses.

Circuit Court of Appeals recently.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.