What is clearance and settlement? Depository While traditionally shares were held in a physical certificate format, today it is mandatory to hold them. Clearing Corporation This. The key steps in clearing and settlement of the securities trade Confirmation of trade details. The confirmation of trade occurs between direct market participants and indirect market.

Settlement is the actual exchange of money, or some other value, for the securities. There are types of clearing: bilateral clearing and central clearing. Participants involved in the Process 1. It is important that a strong clearing and settlement system is set in place to maintain the smooth securities trading operations within financial markets. The graphic is interactive, enabling the user to obtain information on the various types of input that are settled through DTC, the processing involved and how the. During settlement, the buyer must make payment for the securities they.

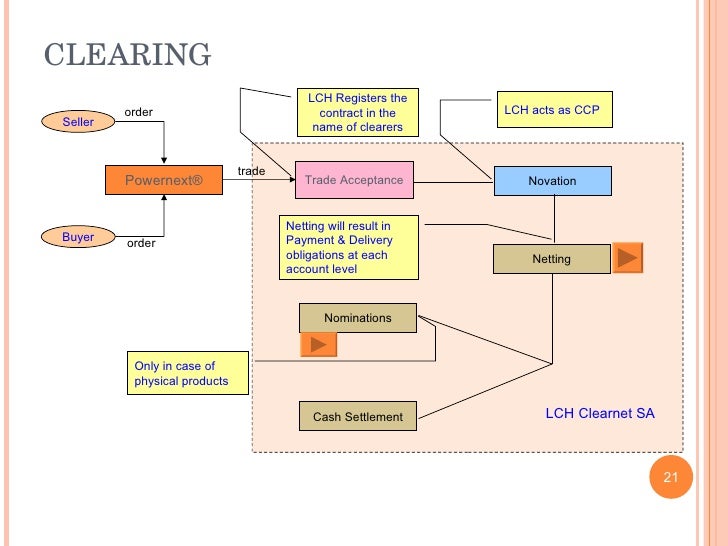

Often with clearing, a specialized organization acts as an intermediary known as a clearinghouse, and assumes the role. Legal agreements can reduce this risk by calling for netting of payments to clearing members from the clearinghouse, or have the loss shared by the settlement banks that were scheduled to receive the funds. Trade settlement is a two-way process which comes in the final stage of the transaction. Once the buyer receives the securities and the seller gets the payment for the same, the trade is said to be settled. While the official deal happens on the transaction date, the settlement date is when the final ownership is transferred.

Banks and brokers, as investors’ intermediaries, are involved in the process of settling trades of securities in book entry form, and in providing access to CSDs. Trading members can trade on a proprietary basis or trade for their clients. All proprietary trades become the member’s obligation for settlement. Where trading members trade on behalf of their clients they could trade for normal clients or for clients who would be settling through.

The buy side will transfer cash for the security via the clearing house, and likewise the sell side will hand over their security. Then everyone’s happy! At the end of each trade day the clearing house will provide reports on settled trades to exchanges and custodians.

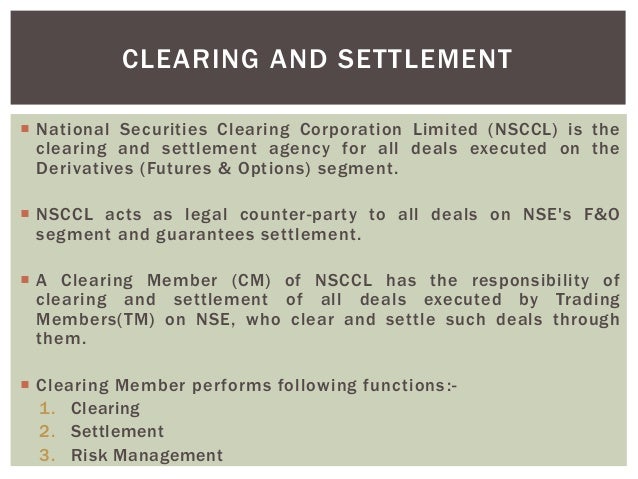

Thinking of getting to a career in Finance? After the trade is executed the clearing process begins. In clearing process , it is identified how much money is owed to the seller and how many shares are owed to the buyer. Apart from identification trade recording, confirmation, determination of the obligation of different parties and risk assessment also take place. The clearing and settlement process integrates three activities – clearing, settlement and risk management.

The trading members’ open positions are in turn determined by aggregating his proprietary and clients’ open positions. As a trader or an investor, you need not actually worry about how the trades are cleared and settled as there are professional intermediaries to carry out this function seamlessly for you. However, the lack of understanding of the clearing and settlement process could leave a voi and would not give a sense of completeness to the learning process.

Members with a funds pay-in obligation are required to have clear funds in their primary clearing account before the stipulated Payin time. Learn about the characteristics of the marketplace, how to process a trade , the role of clearing corporations, and get an overview of settlement , trade processing functions. Primary responsibility of settling these deals rests directly with the members and the Exchange only monitors the settlement.

The clearing process includes computation of brokers’ and Settlement banks’ obligations and advising them on the same. Settlement , a consolidated end-of-day process and the final step of a securities trade , completes the transfer between trading parties of securities ownership and cash. DTC, the central securities depository subsidiary of DTCC, provides settlement services for virtually all broker-to-broker equity and listed corporate and municipal debt securities transactions in the U. The Depository Trust Company (DTC), DTCC’s central securities depository subsidiary, provides settlement services for virtually all equity, corporate and municipal debt trades and Money Market Instruments in the U. DTCC in an efficient and risk controlled process. Equity Trading and Settlement Introduction. The secondary market transactions follow the below sequence.

Stock exchanges ensure a platform for trading, while clearing corporation ensures the funds and securities related issues of the trading members and make sure that the trade is settled through the exchange of obligations. Once a trade has cleare the actual exchange of money for securities takes place. The seller initiates the process by sending the buyer a settlement message through its CMU Member Terminal (CMT Station).

When the message has been confirmed by the buyer, a “matched” transaction is stored in the system. The system checks the availability of securities on the seller’s account and blocks them (on hold).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.