How does remittance advice work? What is the purpose of remittance advice? It includes the invoice number and payment amount for each invoice paid.

The use of this document can be considered a best practice, since it prevents the recipient of a payment from needing to contact the sender to discuss what was included in the payment. Remittance advice template. In the standard form of remittance advice slip, the left top corner should be allocated to the name and address of the seller , in the middle top head date should be mentione while on the right-hand side, the name and address of the buyer should be clearly mentioned.

This slip can be drafted in a tabular form or in columns. Under the payment details section, you’ll see the payment line. What to include in remittance advice. The main purpose of remittance advice is to help suppliers match invoices with payments.

How to send remittance advice. Because it is not mandatory, there are no legal guidelines for sending remittance advice. If you are looking to design a remittance advice , you should use remittance advice template to prepare it. CO (Contractual Obligation) assigns responsibility to the provider and PR (Patient Responsibility) assigns responsibility to the patient. The template for remittance advice could be of various types such as the remittance advice could be in the form of notes or letters stating the invoice number including the paid amount and it is also like foreign remittance template.

The remittance advice is an optional document but can be used for the purpose of ease to make the comparison between the invoices and payments for the supplier. If the customer is paying by cheque, the remittance advice often accompanies the cheque. Integrated easily with QuickBooks Online and allows us to send remittance info in either PDF or Excel.

Some of our suppliers prefer Excel and others PDF, so that works nicely for us. Indicate the payment date and amount. List all payment details: account numbers, transaction numbers, swift code, etc. Attach to your letter a proof of payment. Ask the recipient to confirm that they received the payment.

A letter of remittance is a documentation accompanying checks or drafts submitted for collection, listing the number of checks (items) being sent and the total dollar amount of the checks. The most common plural of “ remittance advice ” — a note sent by a customer paying a supplier, indicating that payment is on its way — seems to be “ remittance advices”. However, I find that to be inelegant and I often suspect it is just plain made up! On the Find an Existing Value tab, enter search parameters to locate your supplier and click. This is known as the remittance advice.

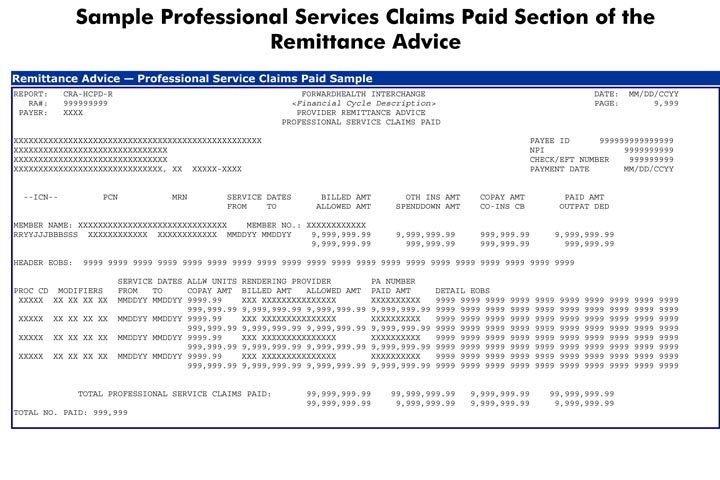

Just about any kind of remittance letter will include three basic pieces of information. The letter will identify the sender, often by including the name and mailing address of the debtor. The remittance advice received by providers is similar to an employee’s salary paystub that describes the amount the employee is being pai the hours worke and an explanation of any adjustments or deductions that are being made to an employee’s salary payment, HHS explains in the interim rule. The person sending the remittance.

Sender’s Bank The bank that the sender will use to fund the remittance transaction. You will see on the left hand side it says Paper RA in blue writing. Click on the blue hyper link of the paid date you would like to view.

It is of great importance, no doubt about it, as it will assist you by providing all the relevant information regarding the payments or transaction. The customer owes to the ISO the net total of the charges and credits (Invoice Total). X12N 8remittance advice electronically. A remittance advice is issued when the total credits exceed the total charges for the given billing period.

However, providers cannot receive a paper copy if this method is chosen. This document contains only the information related to the proprietary remittance advice. Providers also continue to receive the remittance advice on paper if the option to receive an electronic remittance is chosen.

Depending on how the remittance is structure you as the recipient might have a fee to pay in order to access the money, on top of any charges already paid by the person sending the remittance. This charge will be deducted from the amount that was sent before it reaches your bank account. This term is frequently used in the United Kingdom.

Use remittance advice in a sentence “ I was glad to have remittance advice because it meant that payments were being made and everything was gonna be okay.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.