Will my vehicle be exempt from car tax? When does a classic car become tax exempt? Note that Diplomatic Tax Exemption Cards are not valid for exemption from taxes imposed on purchases of motor vehicles.

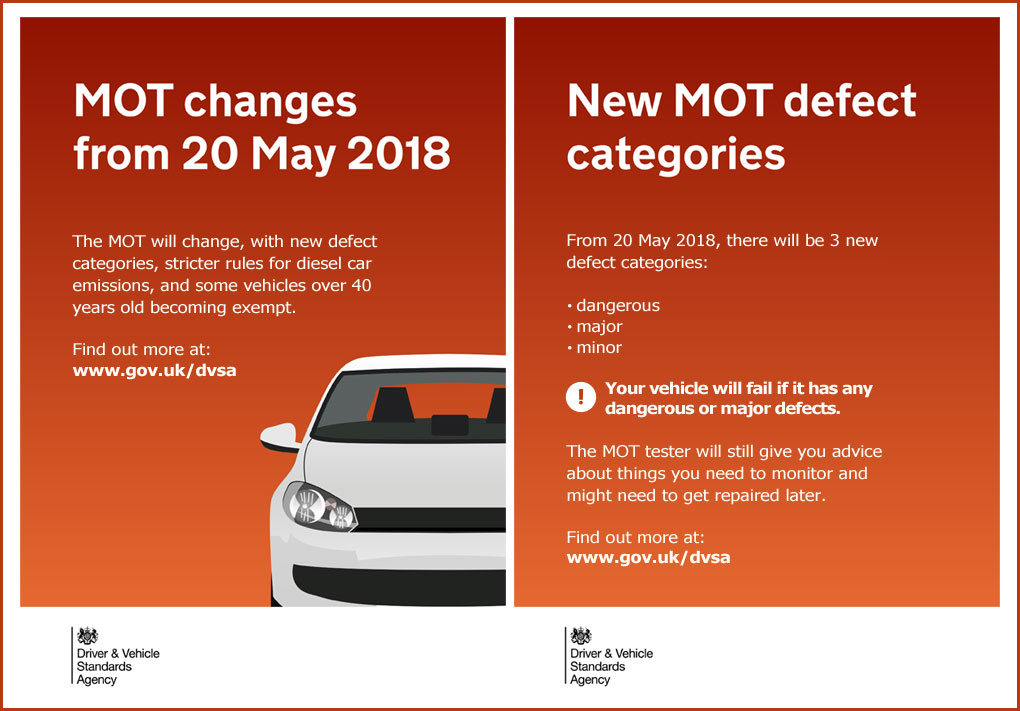

What is vehicle tax exemption? From May 2 when you tax your classic – either online with the Vor reminder letter, or at the Post Office – you can declare the vehicle as MoT exempt once it is beyond the 40th anniversary date of first registration. As of the Department for Transport (DfT) announced that cars years and older will no longer have to undergo their annual roadworthiness check, known to most as an MOT.

Vehicle Excise Duty (VED) is a British excise duty, which has to be paid to acquire a vehicle licence for most types of motor vehicle. If you do not have proof of the price that you paid. As it stands now, your father is still the owner, since you never put into your name. To sell this car, you must have the title transferred into your name. Since dad gave to you, most states will exempt taxes due to it being your father as.

An active-duty member of the United States Armed Forces. Public Health Officer. National Oceanographic and Atmospheric Agency personnel. Coast Guard personnel living in Washington and assigned to duty in the Portlan OR area. To qualify, you must have a copy of your orders showing: 1. See full list on dol.

You got the vehicle at least days before discharge. Along with being exempt from paying tax, vehicles over a certain age are also exempt from requiring a MOT. A person who purchases a motor vehicle in Texas owes motor vehicle sales tax.

The vehicle was purchased. A Texas resident, a person domiciled or doing business in Texas, or a new Texas resident who brings into Texas a motor vehicle that was purchased or leased out of state owes motor vehicle use tax , the new resident tax or the gift tax , as applicable. Standard presumptive value (SPV) is used to calculate sales tax on private-party sales of all types of used motor vehicles purchased in Texas. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. For more information, please see Private-Party Purchases and Standard Presumptive Values.

A private party purchaser must remit the appropriate motor vehicle tax to the county tax assessor-collector as follows: 1. You must tax your vehicle even if you do not have to pay. A 501(c)(3) nonprofit corporation is a charitable organization that the IRS recognizes as tax - exempt. Your vehicle is model years old or older.

You do not drive over 0miles per year. Note: the odometer must be in working condition. This includes purchases from out-of-state sellers, private parties, or California dealers when delivery of the vehicle is taken out of state. Unless an exemption or exclusion applies, you must pay use tax on your vehicle purchase.

Generally, you will pay the use tax when you register your vehicle with the Department of Motor Vehicles (DMV). Purchase Contracts can be used if the tax amount paid to the other state is clearly identified. Finance Contracts are not accepted. Thanking you in advance. It’s super cheap, too.

Who Must Register to Collect Tax ? If you regularly sell or lease motor vehicles to someone else, you must register as a motor vehicle dealer to collect and report Florida sales and use tax. It must be presented by the dealer making the interstate commerce sale to the Clerk of Courts when applying for title to the motor vehicle , off-highway motorcycle or all purpose vehicle. Motor Vehicle , Off-Highway Motorcycle, or All-Purpose Vehicle Non-Resident Exemption Certificate and Affidavit.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.