Register and Subscribe now to work with legal documents online. If you don’t see a download form below, please disable your AD blocker and reload the page. I’ve noticed some ad blockers, including the one I use, block the Javascript that loads the download form. See full list on michaelkummer.

Below is a list of deductions the spreadsheet and formulas take into account – both on a federal and state level (where applicable): 1. Itemized Deductions 2. Number of Children 7. Based on your input (see below), the spreadsheet calculates the following: 1. Adjusted Gross Income (AGI) 2. Please note that the “Gross Income (combined)” field takes, as the name implies, your combined income, including money earned by your spouse, social security benefits, etc. Also, you can claim an additional federal standard deduction if you are at least years old or blind. It may seem intimidating to estimate your taxes before you file your return. But I hope my spreadsheet gives you a solid starting point to figure out if you will get a tax credit or if you will owe money.

It’s certainly not perfect because it doesn’t cover every tax situation out there. Do I have to file income tax return? What are the tax deductions for estates? This deferment applies to all taxpayers, including individuals , trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax. Call Today To Find Out How.

Those properties make it the perfect tool to map your plans for every aspect of your lifetime an also, to follow because of on them. Can claim a efundable cr redit other than the eaned income r credit, American opportunity cedit, or additional child tax cr edit, r such as the net premium tax credit or health coverage tax credit. Take your budget spreadsheet to a whole new level Budget spreadsheets are a great way to keep track of your finances.

You can add up all of your income and expenses in one place and be well prepared to drop your final numbers into your tax prep software. While a basic budget spreadsheet is great, it is a rather manual process to prepare. This site makes available, for free, a spreadsheet that may be used to complete your U. Most individuals will be able to use these spreadsheets for planning their personal income taxes. The tax planner spreadsheets allow you to perform on-the-fly tax planning with minimal effort.

Step 1: Before you start e-Filing, download or print this page as you collect Forms, Receipts, Documents, etc. Listing of individual tax return instructions by year. High call volumes may result in long wait times.

Tax Return Checklist. If you want to try to portion your tasks by enough time of your day, kind of task, or its , turn ahead. Frequently, you can get the tax table with cumulative tax for each tax bracket.

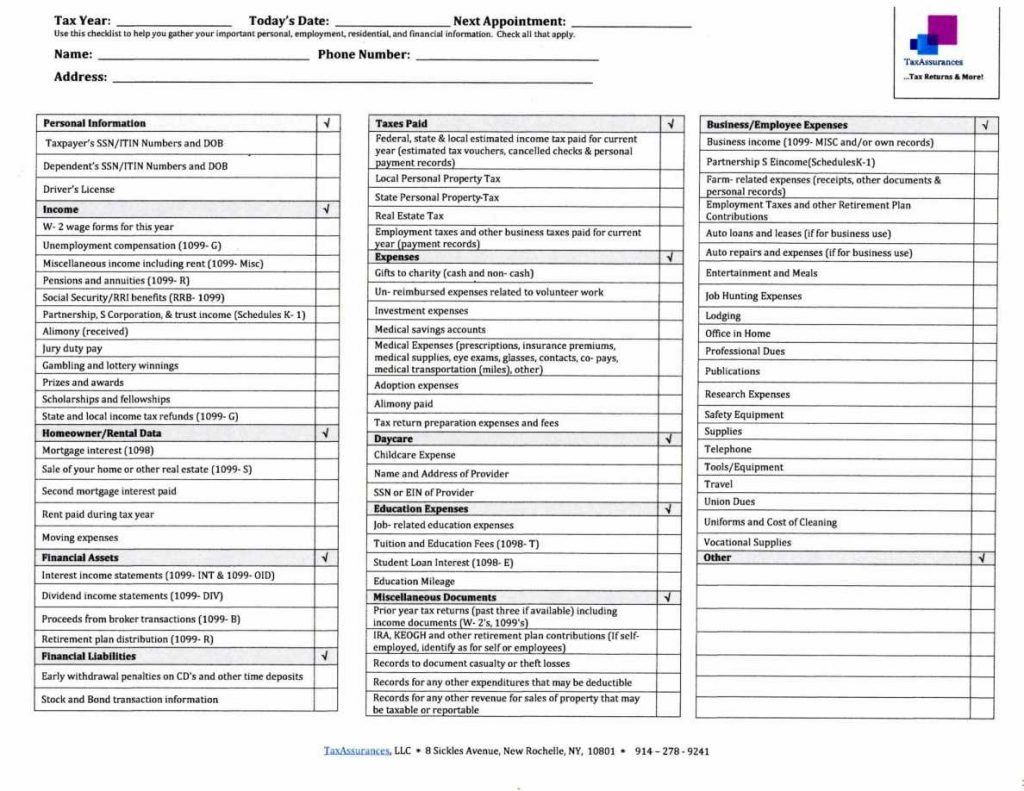

In this condition, you can apply the Vlookup function to calculate the income tax for a certain income in Excel. At the very least, the Federal Only spreadsheet will apply to residents of the United States who earn income in the United States. If you file the spreadsheet , you receive an dividend exclusion. Check the Yes box on Idaho Form 4 line 8b, to opt out of filing the spreadsheet. A tax organizer is a client-facing document to help with the collection and submission of client information necessary to prepare a tax return.

You must make this election annually. The below templates are provided in fillable PDF and in Word (for Word versions, see the zip file). Includes tax due and extension payments.

Self-service options: Available. Online at Where’s My Refund? It takes only a few minutes to fill out your tax return.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.