We bring the expertise needed to seamlessly integrate with your tech platforms. Strategies designed with your business model in mind. How to register as an investment adviser?

What does Ria firm mean? The Commission is adopting new rule 203A-2(f) under the Advisers Act to exempt from the prohibition on Commission registration certain investment advisers that provide advisory services through the Internet. The fund invests at least of. For more information on anti-fraud provisions, refer to the discussion below under Anti-Fraud Provisions.

To qualify for the expanded definition, the IA must treat the issuer as a private fund under the ICA and applicable rules. Approximately 15investment advisers are so registered. Investment advisors are also. It’s outperformed all of those assets over a recent 20-year period.

We understand that you have unique business needs. Our concierge team is ready to help simplify your experience. Exempt Reporting Advisers (ERAs) are investment advisers that are not required to register as an adviser with the U. Any person that directly or indirectly has the right to vote percent or more of the voting securities, or is entitled to percent or more of the profits, of an investment adviser is presumed to control that investment adviser. All individuals that represent a state registered investment adviser must meet the requirements of NYCRR Title 1 Part 1 §11. If you have taken the Series or both the Series and Series within the last two years, you do not have to do anything.

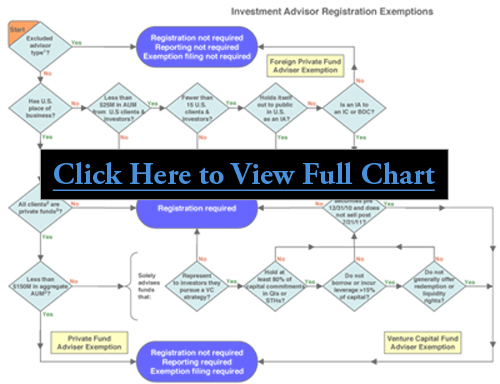

It’s not gol it’s not stocks, it’s not bonds, it’s not homes…. Federally, the two exemptions that advisers can use to claim ERA status are (i) the Private Fund Adviser Exemption or (ii) the Venture Capital Fund Adviser Exemption. Exemption from the compensation prohibition of section 205(a)(1) for investment advisers.

Exemption of investment advisers registered as broker-dealers in connection with the provision of certain investment advisory services. Agency cross transactions for advisory clients. It is unlawful for an investment adviser, federal covered adviser or investment adviser representative, all as defined in this chapter, in connection with giving investment advice or otherwise acting as an investment adviser, federal covered adviser or investment adviser representative to make any untrue statement of fact that a reasonable client or prospective client would deem material or to omit to state a material fact necessary in order to make the statements made, in the light of. District of Columbia as an investment adviser unless the person is licensed or exempt from the licensing requirement. The FAST Act expanded the applicability of two additional exemptions from investment adviser registration for investment advisers to SBICs: (1) The exemption for any adviser solely to one or more “venture capital funds” in Advisers Act section 2(l) (the “venture capital fund adviser exemption”), and (2) the exemption for any adviser solely to “private funds” with less than $1million in assets under management in Advisers Act section 2(m) (the “private fund adviser exemption”).

A person shall not transact business in this state as an investment adviser unless the person is registered under this act as an investment adviser or is exempt from registration as an investment adviser under subsection (2). If an investment advisor has less than $1million of regulatory AUM and is exempt from registration in the state in which its principal office and place of business is locate the investment advisor firm will have to register with the SEC (unless an exemption from SEC registration is available). Who regulates theThe SEC regulates investment advisers who manage $1million or more in client assets, while state securities regulators have jurisdiction over advisers who manage up to $1million. Applications for licensure will be processed in accordance with A. Personal Coaching With One of Our Fidelity Advisors.

Tell us About Your Financial Goals. A person is exempt from the registration requirements of § 13. The states of Texas and Louisiana do not offer a client de minimis exemption from registrations or notice filings for firms and individuals regardless of whether the firm or individuals maintain a place of business in those states. A number of limited exemptions are available from such registration: private fund adviser, foreign adviser, venture capital fund adviser.

However, limited registration with the Securities and Exchange Commission (“SEC”) is required to claim such exemptions. A fourth exemption is for advisers to “Family Offices” is also in force. Like advisers relying on the Private Funds exemption, advisers relying on the venture capital exemption remain subject to modified reporting obligations. A “foreign private adviser” includes an investment adviser that: (i) has no place of business in the U. Foreign Private Adviser.

Advisers to business development companies , when the adviser has at least $million of RAUM, must register with the SEC.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.