What is settlement cycle? How long is the SEC trade settlement period? When are trades settled? The SEC created rules to govern the trading process, which includes outlines for the settlement date. The day the trade is executed is known as the ‘Trade Date’ and is signified as ‘T’.

Ajay buys shares of company ABC on Monday. He buys shares at Rs 0per share. This activity is performed on Monday. Here Monday and the date associated is known as the Trade Date. It is signified by ‘T’.

On the trade date ‘T’, Rs. Ajay’s account and the broker provides him with a Contract Note as proof of the transaction. Ajay will receive shares of company ABC in the DEMAT account by the end of the day.

If in the above example Mr. Ajay had sold his shares instead of buying, then the shares would get blocked in his DEMAT account befo. See full list on tradebrains.

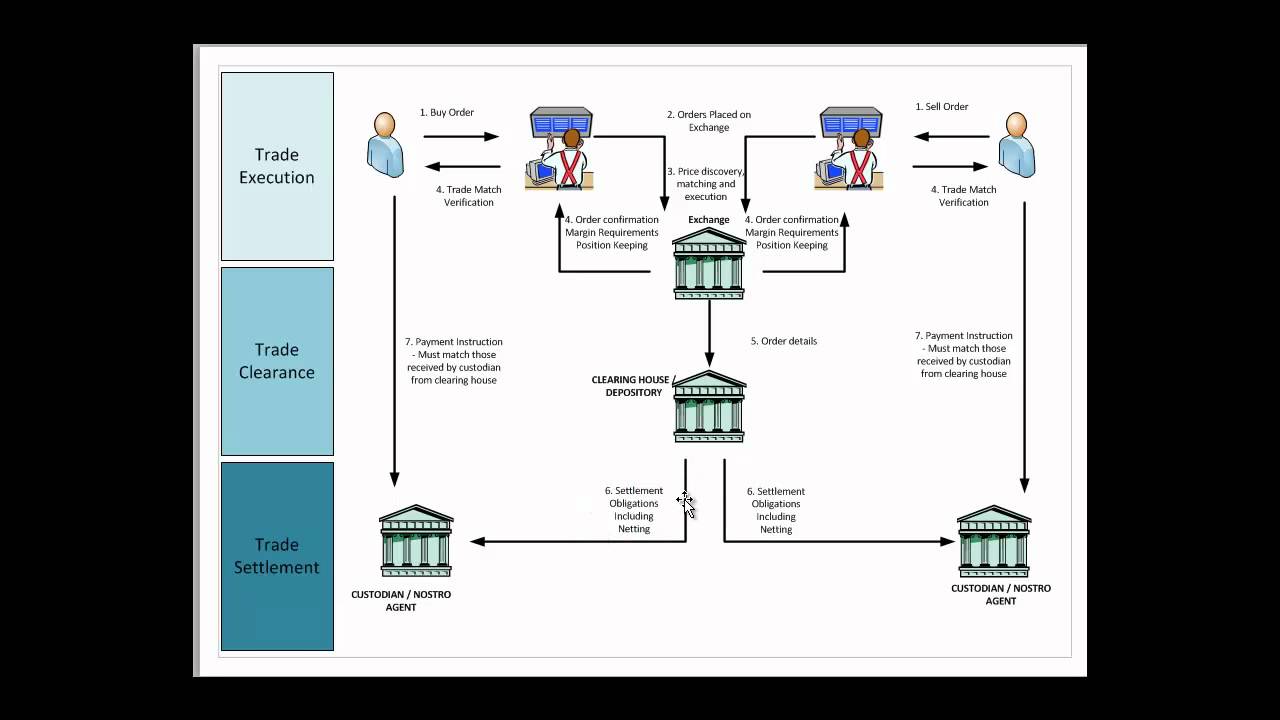

In the trading, clearing, and settlement stages“the Stock exchanges ensure a platform for trading while Clearing Corporation ensures the funds and security-related issues of the trading members and make sure that the trade is settled through the exchange of obligations. The depositories and clearing banks provide the necessary interface between the custodians or clearing members for settlement of securities and funds obligations”. From the above short explanation of activities that take place, we will first look at what are the roles of different parties involved and link them to understand the procedure that takes place to ensure a clearer understanding. Source: AdityaTrading) 1. NSCCL notifies the details of trade to clearing members or custodians who affirm back. Based on the affirmation, it determines obligations.

Download of obligation and pay-in advice of funds or securities are sent by NSCCL to clearing members or custodians. Instructions sent to clearing banks to make funds available by pay-in time. The above explained stock trade settlement process in India might look complicated but they work in perfect synchronization to ensure smooth functioning of the stock market. At those times, the payments were still made with paper checks.

NSCCL directs to credit pool account of custodians or Clearing members and debit its account to depositor. The exchanges closed on Wednesday and took business days to settle trades so that the paperwork could get done. In comparison to the stock market not even functioning throughout the week and five days for the trade cycle , we can thank technological and procedural advances for the ease of functioning we enjoy.

Settlement Cycle Rolling Settlement In a rolling settlement , for all trades executed on trading day. Stock Trade Settlement Process: Key Steps. Let’s us together try and understand the intricacies of stock trade settlement cycle in India. Types of Trade Settlement During trading of financial securities, the time period for.

A faster trade settlement system for Indian stocks is in the offing. These include transactions for stocks, bonds, municipal securities, exchange-traded funds, certain mutual funds, and limited partnerships that trade on an exchange. Smith starts the day with $1of settled cash in his account, and buys $0of XYZ stock. Smith sells his XYZ shares for $50 before fully paying for the security with settled.

Normal segment (N), Trade for trade Surveillance (W), Retail Debt Market (D), Limited Physical market (O), Non cleared TT deals (Z), Auction normal (A) and more. Trade Settlement – This is the process of simultaneous exchange of cash versus securities for a security trade or cash versus cash for a Derivatives trade. Reconciliation – Reconciliation involves matching ledgers against statements to ensure correct accounting of all trade booked.

A pictorial representation of the steps. Some may say trade life cycle is divided into parts pre- trade activities and post trade activities, well, pre- trade activities consists of all those steps that take place before order gets execute post trade activities are all those steps that involve order matching, order conversion to trade and entire clearing and settlement activity. Securities Settlement. Understanding the securities trade lifecycle.

It all starts with your decision to trade. You place an order in a stock exchange via your broker. But behind all this, there are many things happening such as trading, clearing and settlement. The trade is executed at the stock exchange. MBS Notification and Settlement Dates Notification and settlement dates for mortgage-backed securities.

For inquiries regarding MBS notification and settlement dates or CPR claims prices, please contact Chris Killian.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.