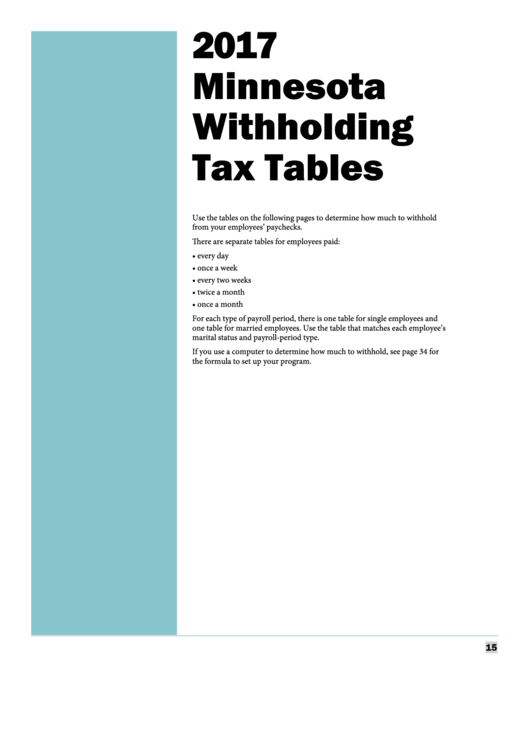

The amount of wages subject to graduated withholding may be reduced by the personal exemption amount. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Other Forms This is a list of forms from GSA and other agencies that are frequently used by GSA employees. State Tax Exempt Forms.

All Government Forms. How to calculate W-exemptions? What is exempt on W-4S? Download the Taxpayer Bill of Rights.

The Kentucky Department of Revenue conducts work under the authority of the Finance and Administration Cabinet. Access IRS Tax Form s. Tax - exempt refers to income or transactions that are free from tax at the federal, state, or local level. Ohio Governor Mike DeWine recently signed two bills - House Bills and 15 that enact several significant Ohio income tax changes for the upcoming tax filing season. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for taxes and fees, processing nearly $37.

Enforce child support law on behalf of about 020children with $1. Browse them all here. Welcome to the Tax and Revenue forms and publications page. Directions for downloading forms. Complete, Edit or Print Tax Form s Instantly.

Taxpayers who used this form in the past must now use Form D-40. In addition to the forms available below, the District of Columbia offers several electronic filing services that make tax -filing fast and secure, while also providing a faster turnaround time for your refund. If your organisation is not a charity, you can self-assess its income tax status. Income tax exempt organisations.

You can find forms relevant to conducting business with the Department of Revenue here. On the left, click on the type of form you need. Tax -specific forms are forms pertaining to specific taxes.

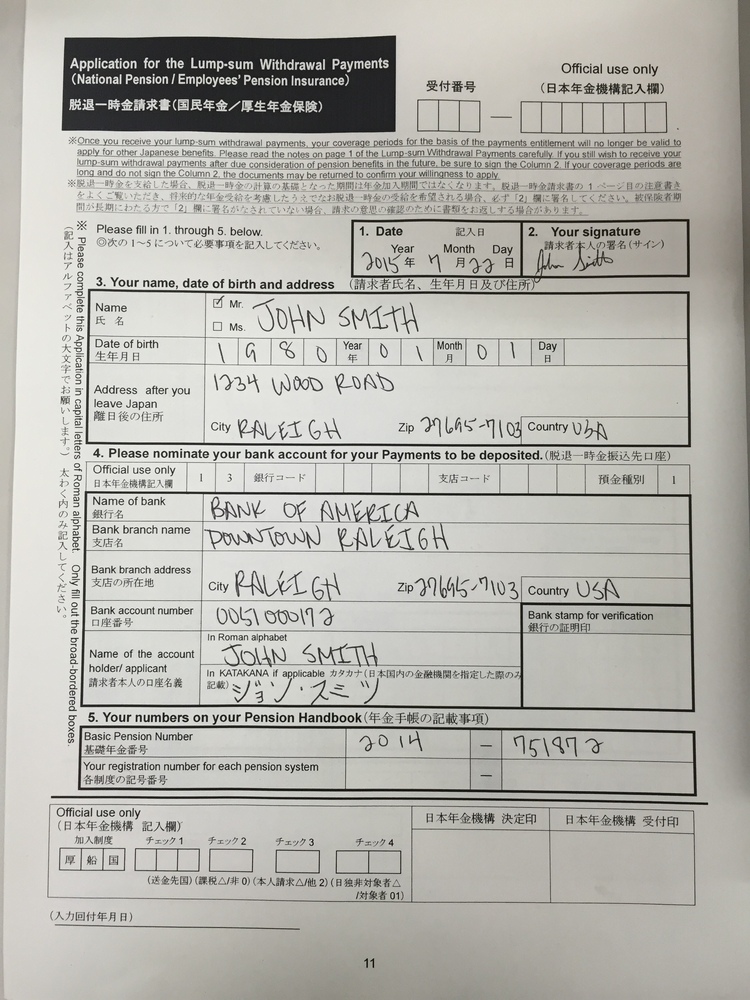

General purpose forms include, but are not limited to, certain registration forms , the power of attorney form , the penalty waiver form and refund forms. INCOME TAX EXEMPTION GUIDELINES. APPLICANTS TO ATTACH THE FOLLOWING COPIES. In most communities, the deadline for submitting exemption applications is March 1. Application deadline. Uncommon Supported IRS Tax Forms.

You Must Send a Copy of Your. Official Discharge Document. We only need a copy of your records the first time you claim the exemption.

Once you receive confirmation we have accepted your discharge paperwork, you claim the exemption on your return annually. Unless your employees work in a state with no state income tax , they must fill out the W-state tax form before starting a new job. Technical College Apportionment Form (PC-401V) Legislators - Wisconsin. You may claim an exemption for yourself.

Beat the IRS at Their Own Game! End Wage Garnishments in Hours. However, DFAS will withhold Connecticut income tax unless you complete Form CT-Weach year and enter E on Line to claim exemption from the tax. Unless you provide a new Form CT-Wto your paymaster each year by February 1 the paymaster will begin to withhold Connecticut income tax for that year. Annual Withholding Tax Form Register and file this tax online via INTIME.

Some states tie the homestead exemption to income level or other criteria. Each area has its own rules and deadlines for applying. Some require you re-apply each year. Seniors and The Disabled. Many states offer property tax exemptions to older homeowners and the disabled.

Military income : Up to $10of military basic pay received during the taxable year may be exempted from Virginia income tax.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.