What are the requirements to become an independent contractor? IRS 20-point checklist for independent contractors. Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties. Though these rules are intended only as a guide-the IRS says the importance of each factor depends on the individual circumstances-they should be helpful in determining whether you wield enough control to show an. Checklist For Wage and Hour Compliance 1. Meal and Rest Breaks An employer cannot employ someone for a work period of more than five hours without providing an unpaid , off-duty meal period of at least minutes.

The first meal period must be provided no later than the end of the employee’s fifth hour of work. Employee or independent contractor checklist. Do you need an employee or independent contractor ? Use this accessible checklist template to find out, or to determine whether current workers are properly classified.

See full list on irs. Facts that provide evidence of the degree of control and independence fall into three categories: 1. Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job? Financial: Are the business aspects of the worker’s job controlled by the payer? Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no “magic” or set number of factors that “makes” the worker an employee or an independent cont.

The form may be filed by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status. Be aware that it can take at least six months to get a determination, but a business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8(PDF).

Once a determination is made (whether by the business or by the IRS), the next step is filing the appropriate forms and paying the associated taxes. Forms and associated taxes for independent contractors 2. There are specific employment tax guidelines that must be followed for certain industries. If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker (the relief provisions, discussed below, will not apply).

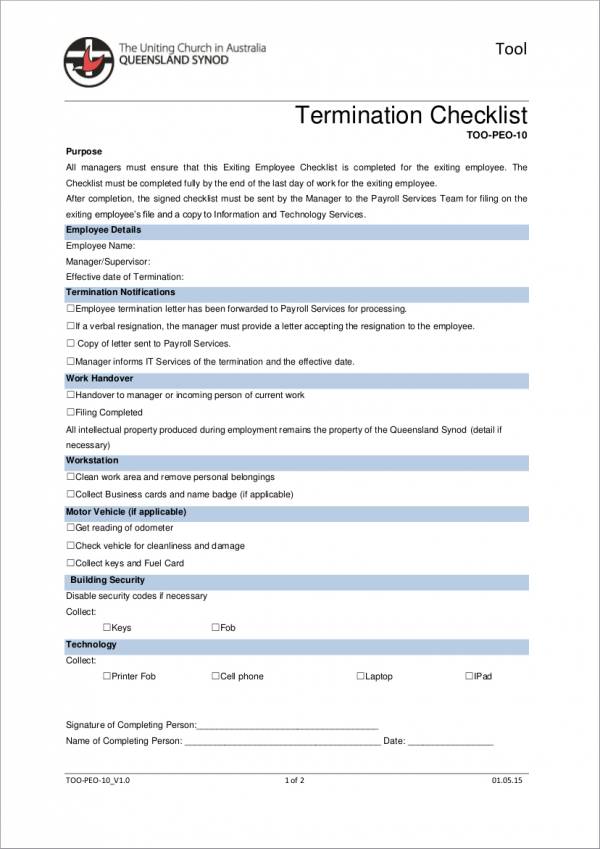

Employment Tax Guidelines: Classifying Certain Van Operators in the Moving Industry(PDF) 2. If you have a reasonable basis for not treating a worker as an employee, you may be relieved from having to pay employment taxes for that worker. To get this relief, you must file all required federal information returns on a basis consistent with your treatment of the worker. Accounts Payable for processing.

Candidate Requisition Form should be completed and forwarded to Human Resources. The payment information will be forwarded to Payroll for processing. By signing below, I (_____) agree that any taxes, interest and penalties assessed by the IRS due to misclassification of this individual as an independent contractor will be paid by the Department authorizing this form. Independent Contractor Vs.

Here is a 10-question test to help determine the classification of a worker as either an employee or independent. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

Register and Subscribe now to work with legal documents online. The gig economy continues to spread across industries, increasing the use of independent contractors for temporary assignments and as part of organizational infrastructures. Use Form SS-for IRS determination of IC status if unclear and the determination cannot be made by the business. Develop a written agreement with an assigned specific scope of work for a specific duration.

This includes freelancers (like artists, planners, or web designers, an outside company (doing cleaning work, for example), a professional such as an attorney or tax preparer — anyone you are paying for services and who is not an employee. The new law addresses the “employment status” of workers when the hiring entity claims the worker is an independent contractor and not an employee.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.