Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! What are some examples of independent contractor jobs? What is an independent contractor contract? Independent Contractor vs.

Engagement of Services. Verbal independent contractor agreement. Partial verbal and written independent contractor agreement. Standard form independent contractor agreement.

Period independent contractor agreement. An auto mechanic who has a station license, a resale license, buys the parts necessary for the repairs, sets his or her own prices, collects from the customer, sets his or her own hours and days of work, and owns or rents the shop from a third party is an example of an independent contractor. Advisers, whether in the legal, financial, health care, or personal services sectors of the economy all may classify as independent contractors.

For example, a tax professional who meets Internal Revenue Service guidelines as self employed would be legally considered an independent contractor. See full list on careertrend. In addition, the majority of people who work as independent contractors technically own small businesses.

For example, the owner of a plumbing business that may employ a dozen or more people and determines how work is performed meets the IRS definition of independent contractor. Correspondingly, the owners of the mom-and-pop catering service can also be dubbed independent contractors. Many individuals who work in the arts and crafts industry fit the definition for independent contractors. Examples include glass cutters, woodworkers, musicians, photographers, graphic designers, sculptors and writers.

The requisite for a position in the arts meeting the definition of an independent contractor is that the creative aspects of the work they perform and how they go about the process is fully under their control. For example, an artist, not on a regular payroll of any company, may be commissioned to paint a mural on a building wall and the artist chooses the methods of how to paint the mural. Thus, the artist would fit the description of an independent contractor. Literally hundreds of occupations fit the description, as long as, in the words of the IRS, the person paying the bill has the right to control or direct only the result of the work and not the means and methods of accomplishing the result.

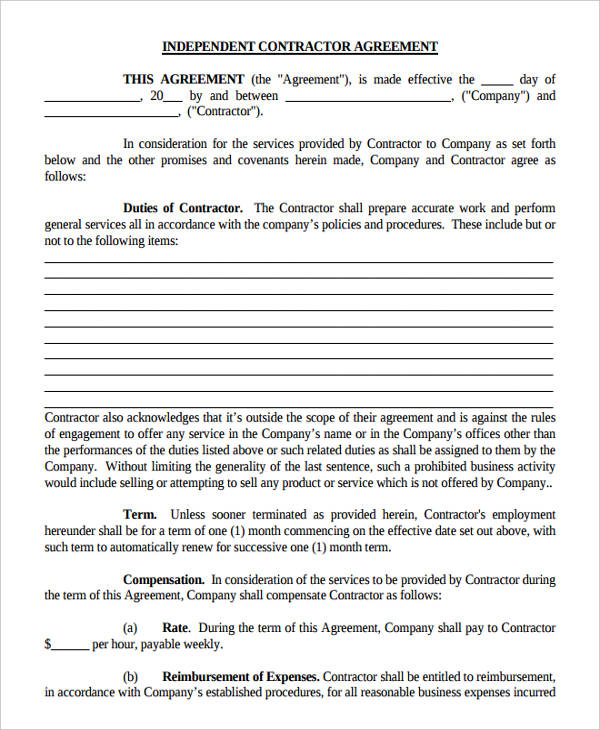

Hair Stylist Agreement 7. Non-Compete (Non-Solicitation) 3. Non-Disclosure (Confidentiality) 6. An independent contractor is classified by the IRS, under CFR 31. Part-time corporate officers. Ultimately, an independent contractor is an individual who h. Once an individual or company has decided that services are neede they will need to determine which independent contractor works best for them. Once a contractor is foun it is time to write an agreement. You can access either version through the buttons attached to the image or the links above.

If desire you can also preview the paperwork via the image di. The hold harmless clause, also known as the ‘indemnification clause’, is written to protect the client from liability while the contractor is performing their services. Therefore, the contractor is solely responsible for themselves and their employees on the job. For Example – Client reveals to a manufacturer they have created the lightest shoe in the world. If the contractor would like to protect themselves to any unforeseen danger th.

The manufacturer cannot turn around and make the shoes themselv. The non-disclosure clause, also known as the ‘confidentiality clause’, states the client will be releasing proprietary information to the contractor. Although, all information that has not been made readily available to the public must be kept confidential or the client may be due serious financial damages. For Example – The client releases information to the contractor their intentions of constructing a 10-story parking garage. The contractor informs the owners of the land and the price o. GA – § 34-8-35(f) 11.

IN – § 22-3-6-1(b)(7) 15. KY – No Statutory Definition 18. MD – No Statutory Definition 21. MA – § 1– 148B 22. Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement.

Facts that provide evidence of the degree of control and independence fall into three categories: 1. Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job? Financial: Are the business aspects of the worker’s job controlled by the payer? Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)?

Will the relationship continue and is the work performed a key aspect of the business? Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor.

There is no “magic” or set number of factors that “makes” the worker an employee or an independent cont. The form may be filed by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status. Be aware that it can take at least six months to get a determination, but a business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8(PDF).

Once a determination is made (whether by the business or by the IRS), the next step is filing the appropriate forms and paying the associated taxes. Forms and associated taxes for independent contractors 2. There are specific employment tax guidelines that must be followed for certain industries. If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker (the relief provisions, discussed below, will not apply). Employment Tax Guidelines: Classifying Certain Van Operators in the Moving Industry(PDF) 2. If you have a reasonable basis for not treating a worker as an employee, you may be relieved from having to pay employment taxes for that worker. To get this relief, you must file all required federal information returns on a basis consistent with your treatment of the worker.

Register and Subscribe now to work with legal documents online. No Installation Needed. Convert PDF to Editable Online.

When hiring independent contractors, keep in mind there are special considerations that cannot be omitted from the contractor agreement, such as any payments that are in lieu of hiring a permanent employee. Examples may include an agreed upon percentage of pay in lieu of benefits and vacation pay, or specific expenses like travel and meals. Contractor acknowledges and agrees that the Services shall be provided as an independent contractor.

A contractor can use the form to register himself in the government roster, to send a proposal to the client or to receive a feedback after the work is completed. Collection of independent contractor offer letter template that will completely match your demands. When creating an official or company letter, presentation design and also layout is essential to earning an excellent impression. The sample independent contractor agreement below details an agreement between the client, ‘Alma C Purvis’, and the independent contractor, ‘Toby D Raker. Toby D Raker agrees to perform a set of services for Alma C Purvis under the conditions specified.

Likewise, customers, clients, or businesses who hire contractors and wish to outline the service arrangement through a written contract. For example, if you face an impending deadline on specific tasks on a major project, it might be wise to utilize a contractor who can focus on the task at hand and be contracted to meet your deadline. This can be preferable to having one or more full-time employees put in extra hours to complete the task.

For more information on your tax obligations if you are self-employed (an independent contractor ), see our Self-Employed Tax Center.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.