What is remittance advice? How do I print a remittance advice? How to e-mail a payment receipt? In short, remittance advice is a proof of payment document sent by a customer to a business.

Remittance advice often serves as a record of cash initially received. The remittance advice will carry the invoice number for which payment is tendered. Generally, it’s used when a customer wants to let a business know when an invoice has been paid. In a sense, remittance slips are equivalent to cash register receipts.

They’re particularly helpful when it comes to matching up invoices with payments. Some customers might request this, especially if they are a business or are placing a large order. While it isn’t mandatory to send remittance advice slips, it can help vendors match up invoices with payments, which is why many firms continue to implement this practice even after the rise of online payments.

The main reason it is created is to mirror an excellent gesture of goodwill. It is served as a proof of payment. If the payment is done via cheque, then the remittance advice could be sent along with it. Also, some firm include remittance slip with the invoice which the customer can send back to the seller along with the payment. In this age of internet, online payment is becoming increasingly popular which has to a considerable extent reduced the role or importance of remittance advice.

Ready to send a remittance ? Use our handy jargon buster to demystify remittance jargon and simplify the process. If your card uses 3D secure, a window will appear on the screen when you are making an online payment asking you to enter an additional security code before the payment can be put through. However, a remittance letter is not. In its most basic form, a remittance advice is a note or letter that states the invoice number and the amount of the payment. Removable invoice advices.

Some invoices come with removable slips that can be filled out to act as the remittance advice. Therefore, it is considered equivalent to a cash register receipt. They serve as a proof of payment , and thus, are equivalent to a cash register receipt. If payment is made via cheque, remittance advice is commonly sent with the cheque.

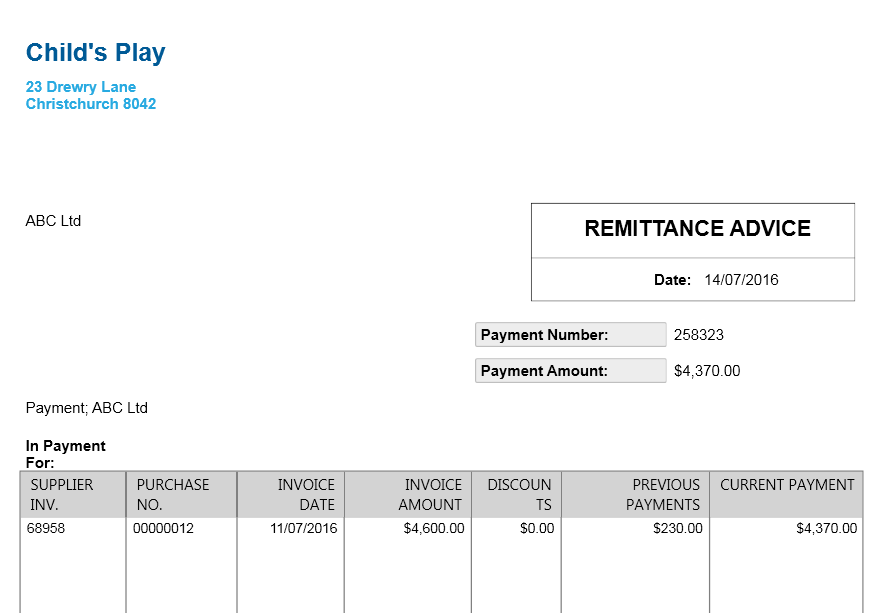

A remittance advice template is used in purchase and claim field. The document verifies how much amount has been paid from actual amount of invoice as there are possibilities of paying some amount of payment from actual amount. The document is of equal importance as the receipt of cash as these are the kind of proof of payment.

The person or company that is making the payment will sometimes include a remittance advice , which is like a receipt of the payment. This term is frequently used in the United Kingdom. If you make payments to suppliers, so they know which invoice you’re paying, you can create a remittance advice.

This is particularly useful if you’re making one payment which covers several payments. The customer sends this letter to inform and help the accounts department of the seller in matching the cash inflows to the invoices. When paying suppliers who regularly have a large number of invoices with the same amount, it is very confusing to not know which invoices have been paid and which ones have not. A payment is the trade of value from one party (such as a person or company) to another for goods, or services, or to fulfill a legal obligation. Payment can take a variety of forms.

Barter, the exchange of one good or service for another, is a form of payment. Definition A document that describes payments that are being made. A denied claim may be reconsidered for payment if errors were made in submitting or processing the original claim.

Electronic funds transfer (EFT) and electronic remittance advice (ERA) send money and remittances between payers, such as Kaiser Permanente, and providers electronically. EFT moves the money, and ERA is the detailed explanation of payment (EOP).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.