High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. Working as a contractor. As a contractor, you can be an individual (sole trader) or working in your own company, partnership, or trust. Example: Paying a subcontractor.

However, as Simon is not coping with the amount of work, he subcontracts some of the work to Bill (a second-tier subcontractor ). Can you work as a contractor? Can contractor enter a voluntary agreement? Can an ABN be a contractor?

If you wish to, you can issue the payee with a Payee Information Statement , which will show the payee what you have reported to the ATO on the TPAR. Ask questions, share your knowledge and discuss your experiences with us and our Community. Answered: I have subcontractors. Contractor – checklist.

If the contractor is a company, partnership or trust, go to contractor working for you. ATO Community is here to help make tax and super easier. To check if your worker is an employee or contractor, you need to consider the whole working arrangement.

There are a number of factors that need to be considere not just the terms of the employment contract. We show you top so you can stop searching and start finding the you need. A Homeowner Submits A Request Every Seconds. Preview Leads In Your Area Today. Take Charge of Your Business Now.

That Need Help From Pros Like You. One who takes a portion of a contract from the principal contractor or from another subcontractor. When an individual or a company is involved in a large-scale project, a contractor is often hired to see that the work is done. How to Become a Subcontractor. A contractor is a person or a company that seeks to do business by obtaining contracts and carrying them out.

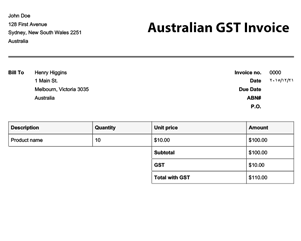

Being a contractor is similar to being a small business owner – you negotiate your deals, work for yourself, have your clientele, and get rewards on your own merits. One of the requirements is that the Tax Invoice has the words including GST or that the Tax Invoice shows the GST amount separately. I was hoping you could assist me. The ATO provides two online tests to help determine if someone is an employee or contractor. As there are some grey areas, you may get a different response in each test.

TIP: Providing you give accurate responses you can rely on the tool’s and will not be penalised if a future review by the ATO shows that you have not met your pay as you go obligations. Make sure you keep a. A subcontractor agreement is between a contractor that hires a subcontractor to assist in the completion of a project or service. The independent contractor will usually hold a contract for services with a client, most commonly in construction, and will choose to hire a subcontractor to finish a part or all of the services.

DCSA will not process an FCL for a one-person company. The ATO conducts preengagement checks for all candidates to be engaged by the ATO. Where a - person fails to satisfy the ATO pre-engagement integrity check or engage in that process, that person will not be engaged or may have their contract terminated. Similarities between Vendor and Subcontractor.

Both are essential in ensuring the smooth running of the supply chain. Differences between Vendor and Subcontractor Selection process. While vendors are hired by the customer or a contractor, a sub-contractor is hired by the client, the general contractor or selected through a tendering process. The Subcontract Act Article (Purpose) The purpose of this Act is, by preventing a delay in payment of subcontract proceeds, etc.

If you perform commercial HVAC repair, as an example, you might attend a construction expo or tool show, as many contractors might attend such an event as. Get reliable information in seconds. Search Informationvine today!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.