What is a PAYG payment summary? Can I change the information on a payment summary? How do you complete an amended payment summary? If you want to know more about your payment summary , lodging your tax return or lodging an amendment to your tax return, visit our website at ato.

LUMP SUM PAYMENTS ON TERMINATION OF EMPLOYMENT The amount at lump sum A was paid to you for unused leave payments. At the moment l submit my employees PAYG annual payment summary - individual non-business manually to the ATO by completing ATO forms for each employee. We are a small business but steadily growing in employees.

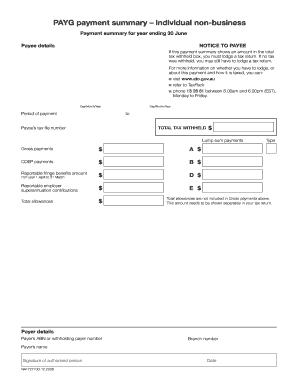

I would like to submit the annual payment summaries online. HOW TO COMPLETE THE PAYG PAYMENT SUMMARY – INDIVIDUAL NON-BUSINESS HOW TO COMPLETE THIS FORM You must: write each letter in a separate box use a black pen use BLOCK LETTERS. You do not have to complete every field.

For example, where an amount has not been paid or withhel leave those boxes blank. Non -taxable components. A recipient may be paid a number of different components that are non -taxable and are not related to tax offsets. You can then generate an electronic file to submit to the Australian Taxation Office (ATO).

Your PAYG instalment for the quarter is $924. Multiply the amount at Step by the instalment rate you chose and recorded at on this activity statement. If no tax was withhel you may still have to lodge a tax return.

If you are preparing an amended PAYG Annual Report electronic file to submit to the ATO , confirm that the Include in E-File checkbox is checked and set the E-File Amendment Indicator field to A-Amended prior to. The Australian Taxation Office (ATO) may pre-fill your payment summary details in the myTax system. We’ll send you an updated payment summary if your payment changes.

You will receive a separate payment summary for any income from this date. Your employer will also report the details from the payment summary to us. No statements of payment are issued. No PAYG payment summary is issued to recipients who receive a payment that is not taxable. If you need to amend an individual non - business payment summary that you have previously submitted to the employee or sent electronically to the ATO , you will follow the same process for initially preparing the summary.

Note: Both Payee (employee) and the ATO require the amended summary. Tick the Include totals summary box. Click on the Reports tab. NON -RESIDENT INDIVIDUAL TAX RATES.

For employee relate the form of the PAYG payment summary - individual non ‑ business is used for payment summary and the PAYG payment summary - employment termination payment is used for ETP. We serve small and medium enterprises. Advance Payroll Services is a payroll bureau that is affordable, flexible, and responsive.

Use a separate declaration for each income year ( July to June). Complete all the relevant sections. Ensure that all details in relation to your payments and the amounts withheld are included.

Go to the Settings tab and click Import button in top-right corner. Select country then click Next button. Check PAYG payment summary — individual non-business then click Import button.

Under SettingsBusiness Details set ABN. This is the payment summary that is provided to employees and to other income recipients such as pensioners. A ‘sample’ version of the form is available.

April to Jul ATO do not provide editable PDF files of the two most common forms used by small business. Very useful if you don’t want to hand write your. Payment Summary for Year Ending June , FBT year. Individual PAYG payment summary schedule. Just came across the following information for you on the ATO website: PAYG payment summary - individual non - business.

You will still need to provide a payment summary for any payments not reported through STP. A separate payment summary has been introduced to report superannuation pensions or income streams.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.