Government value always lesser then the actual market value. You would think that “no consideration” means transferring a home for $ 0. It means transferring a home for “value. An existing mortgage is considered consideration because the grantee is assuming the mortgage. Can a no consideration deed be transferred? Can I transfer land without consideration?

What is a property transfer? Can real estate be transferred without consideration? Adding a family member to the deed as a joint owner for no consideration is considered a gift of of the property’s fair market value for tax purposes. Consideration could be the payment of money, the discharge of debt, the performance of services, or anything else of value.

Real estate may be transferred with or without consideration. If the real estate is being sold to a third party, the contract will require the buyer to pay a certain amount as consideration to the seller. The following common conveyances do not actually convey property , or do not include consideration. Giving property for no consideration (aka gift) If the property is transferred without any payment or other consideration to the grantor, and the grantee does not assume any debt or obligation.

Transferring land or property to or from a company When property is transferred to a company, SDLT might be payable on its market value , not the consideration given. For example, if a property has a market value of £600but the company only pays a consideration of £3000 SDLT will still be payable on £60000. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order No w! However, they will not likely owe gift tax due to the unified gift and estate tax exemption, which is currently more than $5. Where an agreement has been entered into between family members to transfer a property , it is important to ensure that the transfer is fair and equitable and that the elderly relative is not at a disadvantage due to issues of capacity, undue influence or fraud. Many title insurance underwriters would request the grantor in the “no consideration deed” to show up at the currently scheduled settlement to either execute a confirmatory dee join in the execution of the deed to the currently proposed insured or, supply present valid identification and confirm their willful and knowing execution of the no consideration deed by an affidavit.

When the grantor receives no money for the property , a Gift Tax is imposed. This tax must be paid at tax return time using IRS Form 709. Individuals are allowed up to $10a year in nontaxable gifts, whereas married couples who share ownership of. If the transfer is a gift and there’s no consideration, SDLT doesn’t normally apply. A gift is different from a transfer as there is no transfer of monetary value.

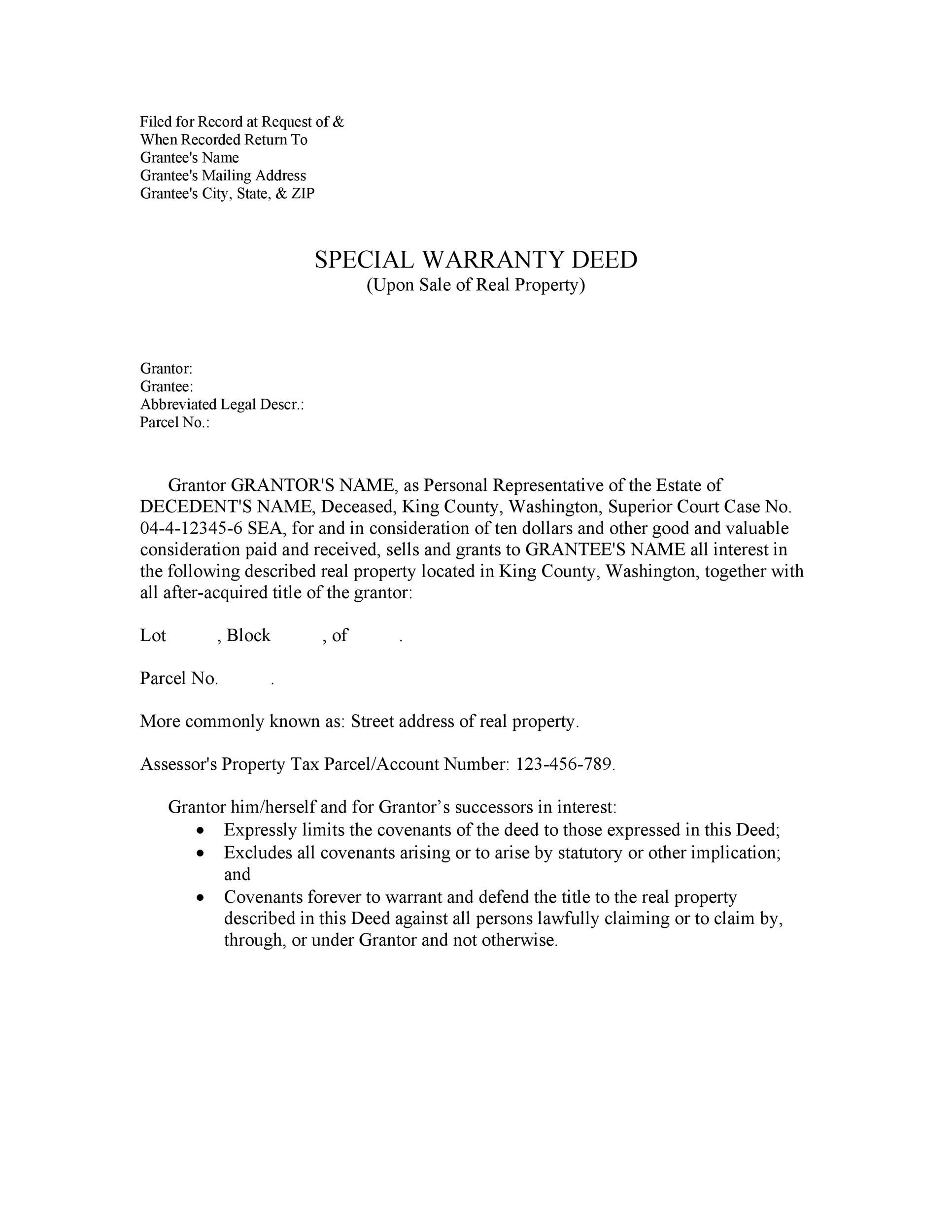

This means the person receiving the property pays no cash for their share, takes on no liability for the mortgage and offers no asset in exchange, so there is no chargeable consideration. The requirements for transferring real property vary from state-to-state. In Washington, real property must be transferred by deed. The tax is based on the consideration listed on the deed.

However, most states consider a number of circumstances as exempt from transfer taxes. Sometimes, if the consideration listed is a very low amount, the tax authority will question the terms of the sale. Types of Consideration. Sales of property involving a quitclaim. Case law suggests that around of the property’s value is reasonable.

If assets are transferred at less than fair market value, there are a couple of outcomes: The transferee can return the property in exchange for their purchase price. However, Wilma also takes on half of the mortgage so, for SDLT purposes, she is deemed to have paid £150for her stake in the property. She will be liable to SDLT on that ‘ consideration ’ in excess of £12000.

There is no spouse exemption. The property is encumbered by a mortgage and there is no other consideration for the property interest transferred. Florida Statutes (F.S.), exempts documents of transfer between spouses of homestead property where the only consideration is a mortgage.

A nominal transaction means that no consideration has passed between the parties to the transaction. In such a situation, the value of the consideration is nil and one or more statements on the Nominal screen in the Teraview system must be selected. As such SDLT could be payable by the Grandaughter as she is purchasing the property subject to the debt.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.