Wherever You Are In The World. Your Taxes Done With Ease. EY Tax Chat, a Digital Tax Filing Service that Connects You to Real Tax Professionals.

TFN application for companies and other organisations. Companies and other organisations can apply for a tax file number (TFN) online at abr. If you: only need a tax file number (TFN), select.

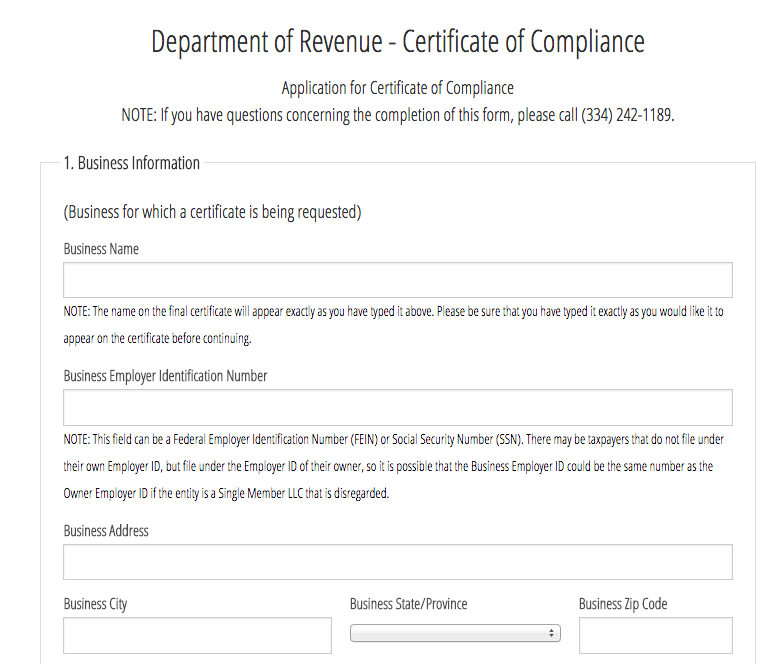

Foreign entities that are not individuals (i.e., foreign corporations, etc.) and that are required to have a federal Employer Identification Number (EIN) in order to claim an exemption from withholding because of a tax treaty (claimed on Form W-8BEN), need to submit Form SS-Application for Employer Identification Number to the Internal. The person applying online must have a valid Taxpayer Identification Number (SSN , ITIN , EIN ). What is a tax file number? Do I need a tax file number for my sole trader? How to apply for a business TFN? Sole traders use their individual TFN.

Partnerships , companies , trusts and other organisations need a business TFN to operate. Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number (TFN) online. Most businesses or organisations can apply for a TFN while completing their ABN application. Within working days after completing an online application. Check your application status.

Please used the given application number to check your application status. Click link to e-Daftar. Apply for a TFN A tax file number ( TFN ) is free and identifies you for tax and superannuation purposes. You keep the same TFN even if you change your name, change jobs , move interstate or go overseas.

Tax file number – application for companies , partnerships, trusts and other organisations. Complete this application if you need a tax file number (TFN) for a company, partnership, trust or other organisation. Do not use this application if you are a trustee or. This allows S corporations to avoid double taxation on the corporate income. S corporations are responsible for tax on certain built-in gains and passive income at the entity level.

Now click on applying tax file number , this will bring you to the main page, make sure you read through all these little links to ensure which tax number will you be applying. Exceptions: Maltese self-employed need not register with the Commissioner for Revenue as the tax registration number is the same as the ID Card number. When the business activity requires the employment of persons, a PE number has to be obtained from the Commissioner for Revenue or alternatively from Business First. However, it takes a while for your tax identification number to be sent to you. This means, it can take a good six weeks of waiting.

Most states also permit “single-member” LLCs, those having only one owner. A few types of businesses generally cannot be LLCs, such as banks and insurance companies. You can click here to apply for your tax ID online. There are special rules for foreign LLCs.

The seller must maintain the sales tax number or exemption number for these customers. Am I eligible for a Tax File Number ? State Sales Tax Rates 1. All Australian residents can apply for a TFN online. Please note: This application applies to Australian residents only.

If you live outside Australia, or are a permanent migrant or temporary visitor, visit the Australian Taxation Office (ATO) website for more information.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.