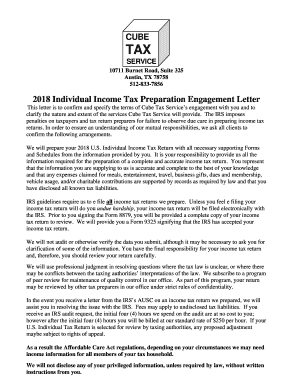

This letter is to confirm our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. Please read this letter carefully, as it is important that you understand and accept the terms under which we have agreed to perform our services. The collaboration section is now simplified and changed. If your tax return is selected for examination or audit, you may request our assistance in responding to such an inquiry. If you ask us to represent you, we will confirm this representation in a separate engagement letter.

Our advice is based upon tax reference materials, facts, assumptions, and representations that are subject to. However, even if a court concludes that the engagement letter is a contract, only certain terms may become the subject of a malpractice suit. Sample Engagement Letter —General This sample engagement letter provides nonauthoritative guidance to assist with compliance with Statement on Standards in Personal Financial Planning Services (SSPFPS) No.

American Institute of CPAs (AICPA). Government Inquiries. This engagement does not include responding to inquiries by any governmental agency or tax authority. What is a tax engagement letter? The tax engagement letter is usually the first written communication a tax practice has with its client each year.

It is also an important piece of evidence if the firm is ever sued. The engagement letter can be either a first line of defense or evidence against the firm. Risk management tip: CPA firms should obtain an engagement letter for all engagements, especially high-risk or nonroutine engagements such as tax planning and representing clients in audits by taxing authorities. Assortment of tax engagement letter template that will perfectly match your needs.

When composing a formal or company letter , discussion style as well as layout is crucial to earning a good impression. Follow Create shortcut. Tax Consulting Engagement Letter. This process places responsibilities on both of us.

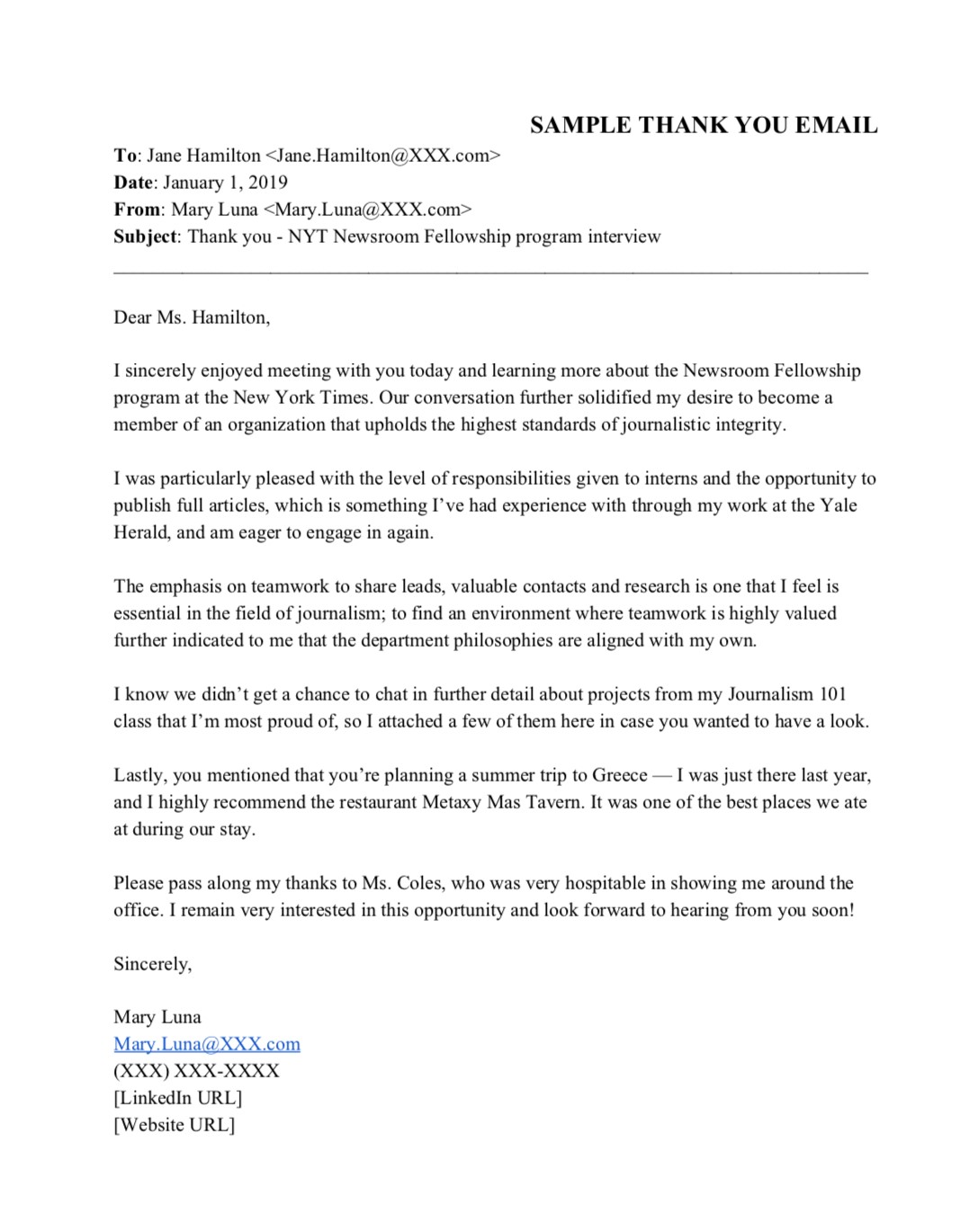

Good ones are a balance between providing enough information and clarity to the tax client about the services you are providing, but not so detailed that the client is scared off by the length of the letter. When writing a formal or organisation letter , presentation design and style is essential to earning a great very first perception. These layouts give excellent instances of the best ways to structure such a letter , as well as consist of example content to serve as an overview of format. By now, most tax practitioners are well aware of the recommendation by professional malpractice defense attorneys and insurers to issue annual engagement letters that define the scope and limitations of engagements, the responsibilities of the accountant and the client, the engagement work product, fee and payment requirements, and other agreed-upon engagement terms. Tax Planning Engagement Letter Rev.

Take a look at our Engagement Letters page. WORK TO BE PERFORMED: My tax service engagement will be designed to perform the following services: 1. Canadian Corporate Tax Engagement Letter Allan Madan, CA. Allan provides valuable tax planning , accounting and income tax preparation services in the. In the event of a tax examination, we can arrange to be available to represent you.

Such representation will be a separate engagement for which an engagement letter will be provided to you. Fees and expenses for defending the returns will be invoiced in accordance with terms we agree on for that engagement. We have no obligation to update estimated tax payments after the engagement is complete. SAMPLE ENGAGEMENT LETTER Dear Client: We appreciate the opportunity of working with you and advising you regarding your income tax.

To ensure a complete understanding between us, we are setting forth the pertinent information about the services that we will perform on your behalf. Your name CFP And Client Name If the scope or terms of the financial planning engagement are subject to change, they should be documented in writing and mutually agreed upon by all parties of the engagement. Save templates, reusable paragraphs, and all of your drafts on the same platform you do the rest of your tax resolution work. Subject: Preparation of Your Partnership Tax Returns.

Dear CLIENT NAME: Dear TAX MATTERS PARTNER: Thank you for selecting YOUR FIRM NAME to assist the NAME OF PARTNERSHIP OR LLC with tax compliance for YEAR. The purpose of this letter is to confirm the terms of our engagement and the services we will provide. Tax planning services Our engagement does include tax planning. The letter details the scope of the agreement, its terms, and costs. Variety of tax preparation engagement letter template that will perfectly match your requirements.

The beginning of the letter includes the services being provided to the client. An accounting engagement letter may include several services such as preparing balance sheets and income tax statements. From lower tax rates to a new deduction for pass-through income, the new tax law may mean more cash in your pocket. An Engagement Letter is a document that defines the conditions in which a professional provides services to its clients. Planning your financial future is an ongoing process that may involve implementation of the plan and ongoing monitoring, review and possible updates to the plan.

At a minimum, the engagement includes a commitment to contact you on an annual basis at your last known mailing address to assess the progress of the plan.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.