What is the objective of KYC? Why is KYC Important? It is a mandatory process for identifying and verifying customers the world over. KYC serves an important purpose for providing superior service , preventing liability , and avoiding association with money laundering , and other illegitimate money frauds.

The importance of KYC KYC is a standard business practice globally in the era of regulation within the investment industry. KYC is a part of the CDD (Customer Due Diligence) and EDD(Enhanced Due Diligence) measures required by most financial institutions and relevant service providers to incorporate in their internal risk management mechanism for regulatory compliance requirements. With the emergence of new methodologiesthat uses machine learning and data analytics, KYC has become much easier to use and implement. As to why is it require the predominant reasons remains to be prevention of frau money laundering and terrorist funding.

The idea is knowing who the banks deal with would allow the government and the banks themselves to keep track of potential fraudulent transactions and might eventually lead to prevention of the use of bank resources for such activities. See full list on veri5digital. Though most organisations or registered entities follow KYCin one form or another(private non-banking companies ask for identity documents), not all of them are required by law to do so. Organisations that fall in the category are listed below, 1. Banks and merchant banks 2. Insurance companies 3. Housing and non-banking finance companies 4. Payment system operators 6. Authorized money changers and remitters 7. Chit fund companies 8. Charitable trusts that include temples, churches and non-profit organizations 9. Share transfer agents 13. Trustees, underwriters, portfolio managers and custodians 14.

Investment advisors 15. Depositories and depository participants 16. Foreign institutional investors 17. Credit rating agencies 18. Venture capital funds 19.

Collective schemes including mutual funds 20. The Post office For the rest of us, though not necessary it makes sense to know who we work with. KYC verification process consists of parts 1. Document Verification – Verify the authenticity of the document provided 2. Identity Verification – Verify the identity 3. Address Verification – Verify the address provided in the document Each of these can be either executed separately or together. One of the best options in India would be to use Aadhaar by UIDAI to verify all three, backed by biometric data each Aadhaar is unique and can act both as an identity and address proof. Though government and government organisations can use Aadhaar API’s to verify KYC.

Another way would be to automate this by using services like Yoti or Veri5Digital to drive automated KYC with Aadhaar XMLor any other d. WHY KYC IS SO IMPORTANT? Know your customer (KYC) practices are developed worldwide to prevent theft, financial frau money laundering and terrorist financing. Importance of KYC in banking sector Following are the reasons why KYC is extremely important in banking sector: Some people may not want to show how much money they are earning, even if they are doing it legally, especially when their income attracts high taxes imposed by the government. KYC allows the Financial Institutions to understand the customer better and manage risks prudently. KYC collects and verifies basic details of the customers like: Name and authorized signatures.

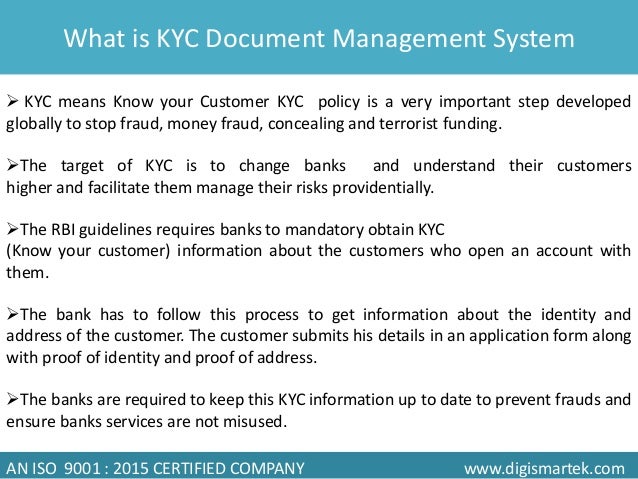

Every Bank has framed a KYC policy by incorporating the directions of RBI such as Customer Acceptance Policy, Customer Identification Procedures, Monitoring of Transactions and Risk management. The objective of KYC guidelines is to prevent banks from being use by criminal elements for money laundering activities. Know Your Customer is the process of verifying the identity of customer. It also enables banks to understand its customers and their financial dealings to serve them better and manage its risks prudently. KYC (Know your Customer) is an important exercise for banks to ensure that their clients are not involve intentionally or unintentionally, in money laundering or terrorism financing.

There is an onus on financial institutions to research the backgrounds of any prospective and even existing clients to avoid severe reputational and financial penalties levied by regulators. KYC is important to prevent identity theft, financial frau money laundering and terrorist financing. Your ID and address proof are asked through KYC. This helps the government bodies a shield or a protection from criminals or fake identities. It helps the businesses know their customers and ensure that they are not getting into business with scammers who may cause them great losses in the future.

It includes verification of registration credentials, location, the UBOs (Ultimate Beneficial Owners) of that business, etc. KYB is a set of practices to verify a business.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.