or to get started with managing your business and filings online. Username must begin with a letter, be 6-letters and. You may conduct an internet search to ascertain if a vendor holds a valid permit. You may also submit a tax evasion tip for sellers that may not be reporting or remitting tax the the department. We have developed this online service to offer you an easier way to manage your business tax filings.

If you are not already registere I encourage you to do so. See full list on nevadatax. Ensure the stable administration of tax statutes.

Cooperate with other agencies and entities to better serve taxpayers. Provide improved and more efficient service. Promote the fair and equitable treatment of taxpayers. Enhance workforce proficiency through training and communication 7. What is the income tax in Las Vegas? Improve tax administration through new technology.

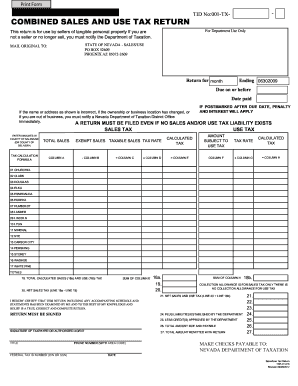

This is the standard monthly or quarterly Sales and Use Tax return used by the majority of taxpayers reporting sales and use tax , for prior time periods. Contact our Call Center for questions regarding general tax inquiries, Sales Tax , Use Tax , Modified Business Tax , or for information on establishing a new business or location. to get started with managing your marijuana agent card online. File and pay business taxes online. Don’t Trust Your Tax Debt With Just Anyone. Partner With Our Senior Team That Works Exclusively With IRS Debt Over $2000.

Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Department of Taxation. Owe back tax $10K-$200K? See if you Qualify for IRS Fresh Start (Request Online).

The office is in the College Parkway Business Center (North) at the northeast corner of East College Parkway and. Home Tax Forms Online Services Commerce Tax Local. Thanks for visiting our site. NEVADA DEPARTMENT OF TAXATION.

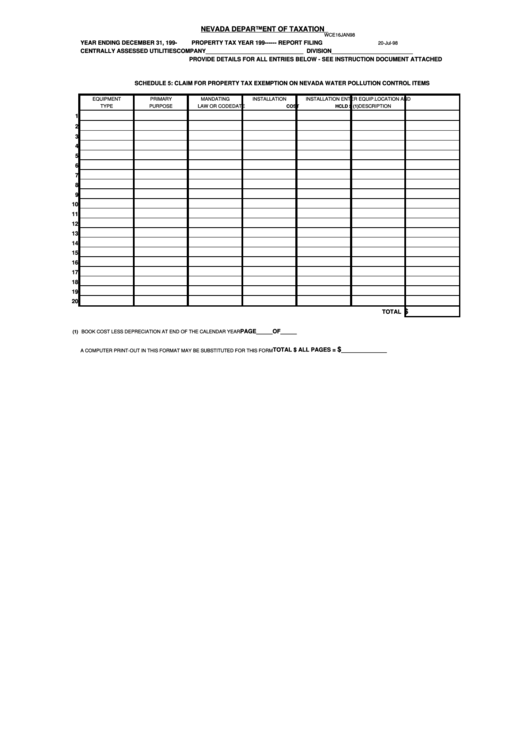

In State Toll Free 1. Nevada Property Tax: Elements and Application. The Las Vegas office is located in the Grant Sawyer Building on the 1st floor. Exempts your nonprofit from paying state corporate taxes. Washington Avenue DEONNE E. We can show you how to claim and get access to it. A few of minutes may change your life.

You can learn more by visiting the sales tax information website at tax. If you sell on Amazon FBA, you may have sales tax nexus in Nevada. There are no tax return forms, except for sales tax.

Estimated tax payments? Use form 40ES if estimated tax will be at least $1for income from non-wage profits of $5or more. It follows federal estimated tax format.

Tax District 1without further adjustment. Are you authorized to manage this business? I declare under penalty of perjury that the information provided is true, correct and complete to the best of my knowledge and belief and acknowledge that pursuant to NRS 239.

C felony to knowingly offer any false or forged instrument for filing in the Office.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.