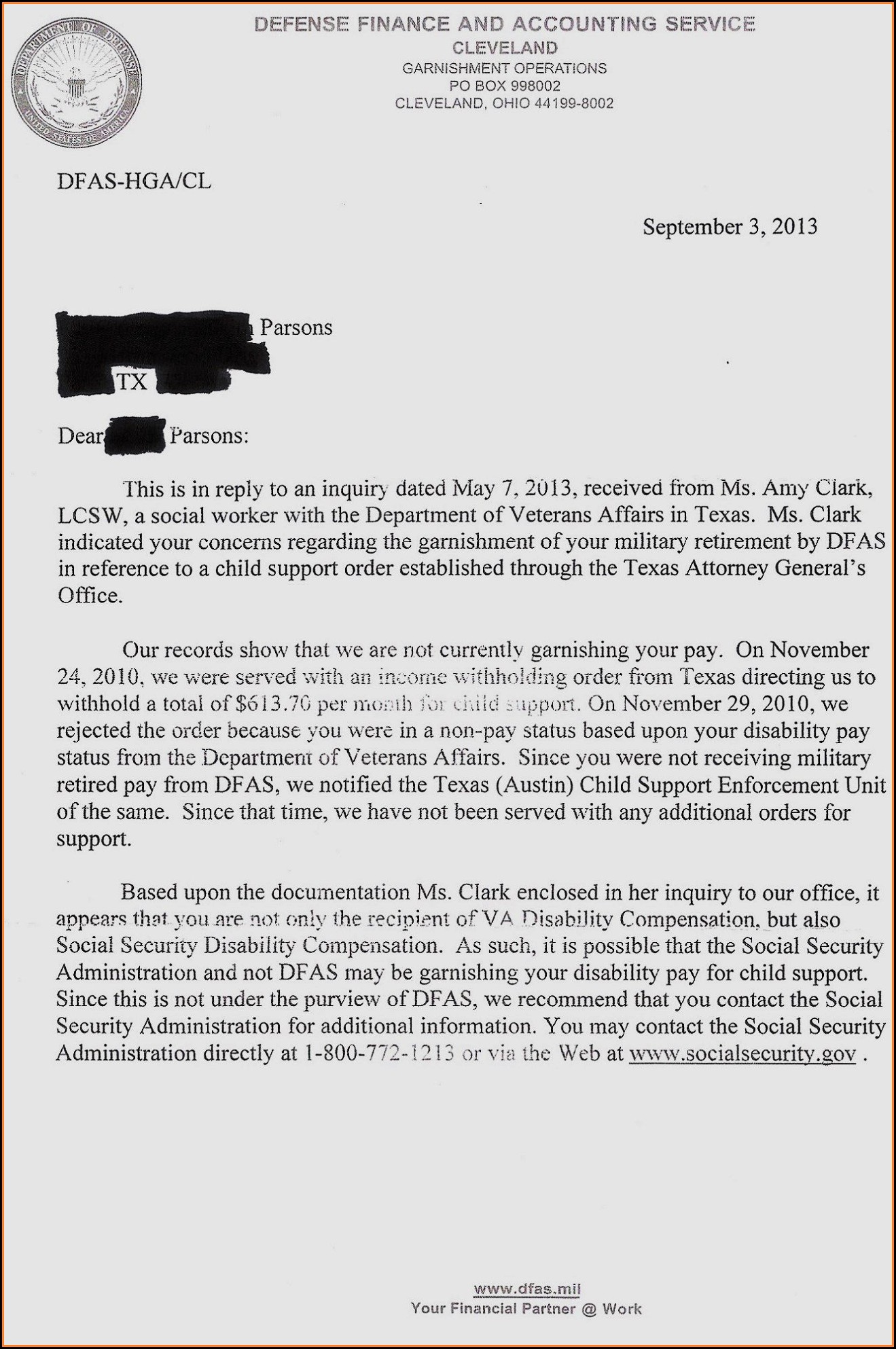

Get your questions answered. Most self-employed individuals will need to pay self-employment tax (comprised of social security and Medicare taxes) if. If you’ve made the determination that the person you’re paying is an independent contractor, the first step is to have the contractor complete Form W-9 (PDF), Request for Taxpayer Identification Number and Certification. This form can be used to request the correct name and Taxpayer Identification Number, or TIN, of the worker. A TIN may be either a Social Security Number (SSN), or an Employer Identification Number (EIN).

The W-9 (PDF) should be kept in your files for four years for future re. See full list on irs. FIRE does not provide an electronic fill-in form option.

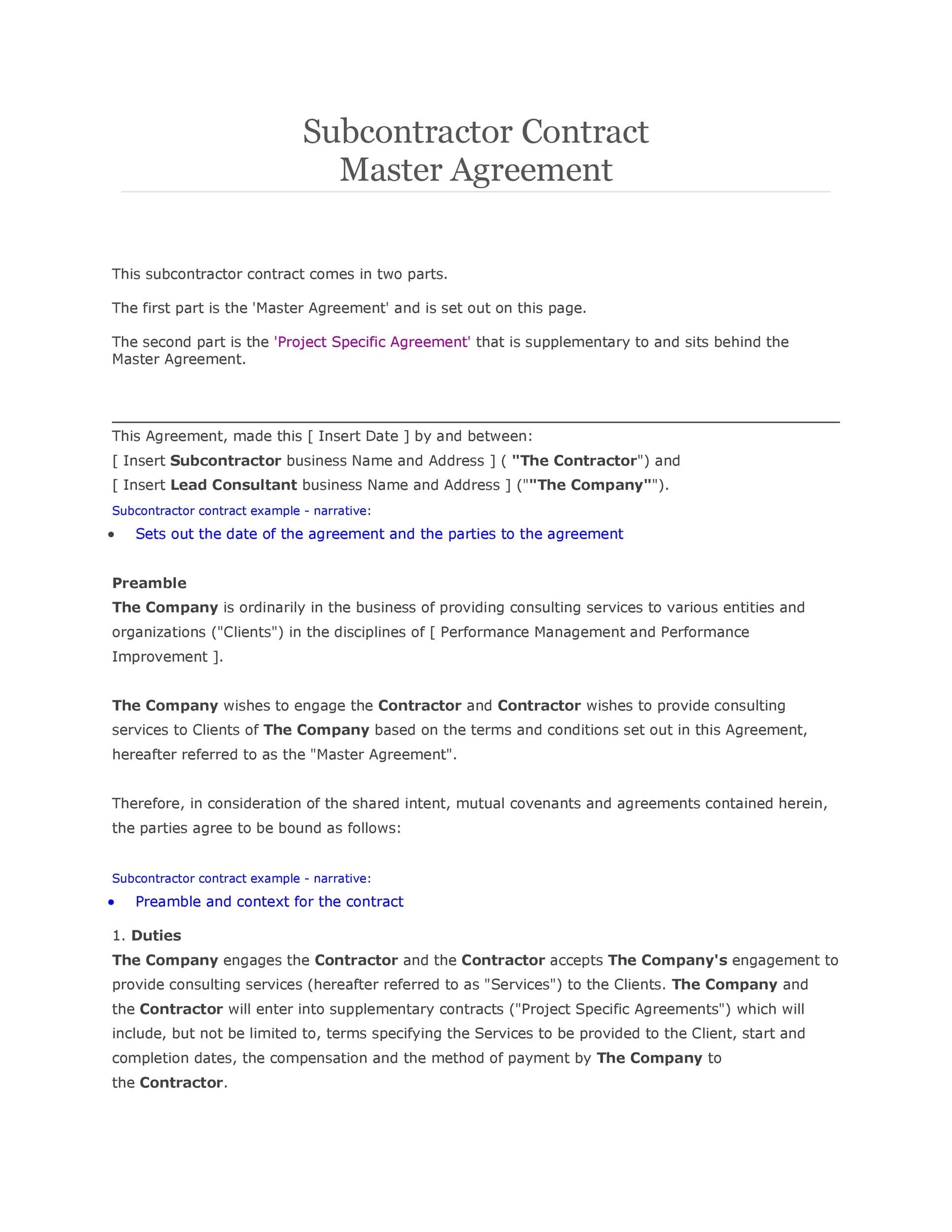

Without a license, you may be liable for accidents during the project. Before you hire a subcontractor , create a written agreement. A standard subcontractor agreement form will help you if the IRS questions the worker’s status. Description, Price and Assurances.

Resolution and Non-Solicitation. Register and Subscribe now to work with legal documents online. Society for Human Resource Management. Internal Revenue Service. Nondisclosure Agreement.

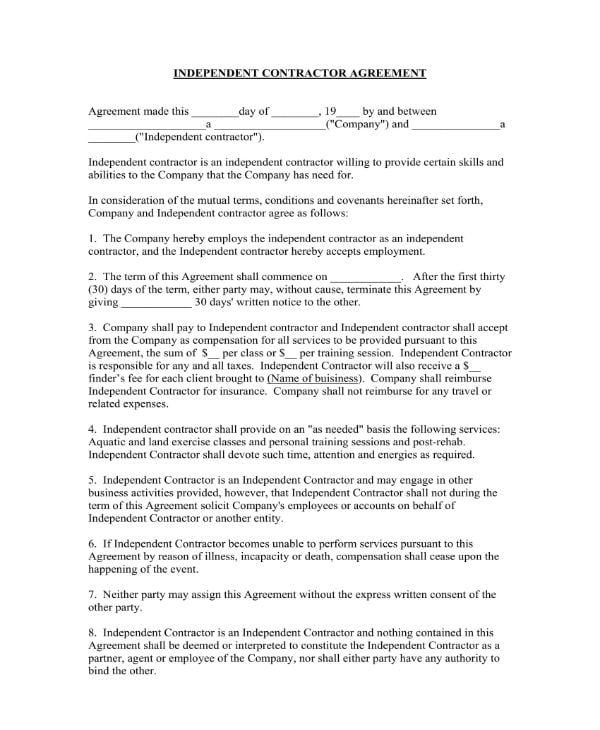

Independent Contractor: Agreement. Download: MS Word (.docx) or Adobe PDF. A subcontractor is not owed or entitled to anything other than the monetary amount by. KensaQ updates its daily to help you find what you are looking for.

Find Subcontractor now. Templates Developed by Lawyers. The Minnesota subcontractor agreement is a legal tool used by contractors when hiring a subcontractor to complete part of a previously negotiated work project. Your Document in Minutes.

The agreement binds the subcontractor to the terms and conditions laid out by the primary contractor. This article describes the general. This review list is provided to inform you about this document in question and assist you in its preparation.

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit. Step-by-Step Process to Ensure You List All Terms of the Contract in Greater Detail. Answer Simple Questions to Make A Subcontractor Agreement On Any Device In Minutes. Step – Subcontractor Signs a Non-Disclosure Agreement Before most subcontractors will even talk about an agreement , they will need to see the plans between the contractor and the client. The subcontractor will commonly need to authorize a non-disclosure agreement stating that any plans they may view will remain confidential.

For W-employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. Startups can streamline the hiring process with an independent contractor by using a standardized agreement. In using an independent contractor agreement template, you ensure that everyone at your startup who is part of the recruitment process uses a consistent and legally defensible document. Hiring an independent contractor or freelancer?

Customize your free agreement in minutes by following our user-friendly questionnaire. Create a Customized Contractor Agreement for Free. A non-compete contract holds your subcontractor from working for your rival prime contractors using any knowledge gained under your employ.

A properly classified independent contractor is allowed to set their own hours, decide from where to work, and are allowed to negotiate payment.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.