The trustees or scheme administrators of a money purchase pension will typically have discretion over the payment of death benefits - unless a binding nomination has been made. The scheme rules will determine the range of possible beneficiaries. Individuals potentially have the choice of a lump sum or a pension (via income drawdown, a lifetime annuity or a scheme pension) whereas nominated charities and trusts can only receive lump sums. See full list on techzone. Dependants and nominated individuals will have the choice of a lump sum or a pension, whereas nominated charities and trusts can only receive lump sums.

This is because, if the deceased: 1. If a non-dependant beneficiary has notbeen nominate the only option will be a lump sum if there is a surviving dependant or someone else who has been nominated. Dependants or beneficiaries who have been nominated will have the choice of whether take a lump sum or a pension, typically via inherited drawdown (if offered by the scheme) or an annuity. If it’s then investe the funds may be subject to income tax and capital gains tax on future investment returns. Inherited drawdown allows pension wealth to remain within the pension wrapper. Income can be taken as and when the beneficiary needs it.

But there will be a lifetime allowance (LTA) tax charge if uncrystallised funds are in excess of the available LTA (and awarded within two years). If paid as a lump sum to the survivor, it will form part of their estate for IHT. This means if the surviving died after age inherited drawdown funds they could have taken tax free will become taxable when paid to their beneficiaries (i.e. successors). Making nominations, therefore giving all beneficiaries the lump sum and pension options can help reduce the amount of tax payable.

By accessing as a lump sum, the whole amount is assessed in a single tax year with only one personal allowance available and the potential of paying tax at a rate higher than they would normally expect to. Using inherited drawdown means tax can be spread across many tax years. The beneficiary has some control over when withdrawals are taken to maximise tax allowances and limit the amount of tax payable.

A bypass trust allows a member to select their own trustees who are more likely to fully understand their situation and carry out their wishes. This additional control may be welcome for those with a more complicated family situation such as where there are children from a previous marriage or relationship. Some pension schemes allow a binding nomination to a bypass trust. Most binding nominations can still be revoked by the scheme member if circumstances change.

Lumps sums paid to a trust are free of income tax if death is before age 75. The tax suffered is available as a credit when the bypass trustees pay money to a beneficiary. However, the pension provider has to deduct tax at if death is after this age. It is treated as income in the hands of beneficiary with a reclaimable tax credit. The credit for the tax already paid is intended to put bypass trusts beneficiaries in a similar position as if they had received inherited drawdown.

There is no prescribed way to make a nomination. Death benefits can only be paid to a charity if the member has nominated one. Most pension providers will have a standard nomination form available for members to complete but many will also accept a letter from the member explaining their wishes regarding the death benefit. Scheme members wanting to give their beneficiaries the option to take income drawdown should name them.

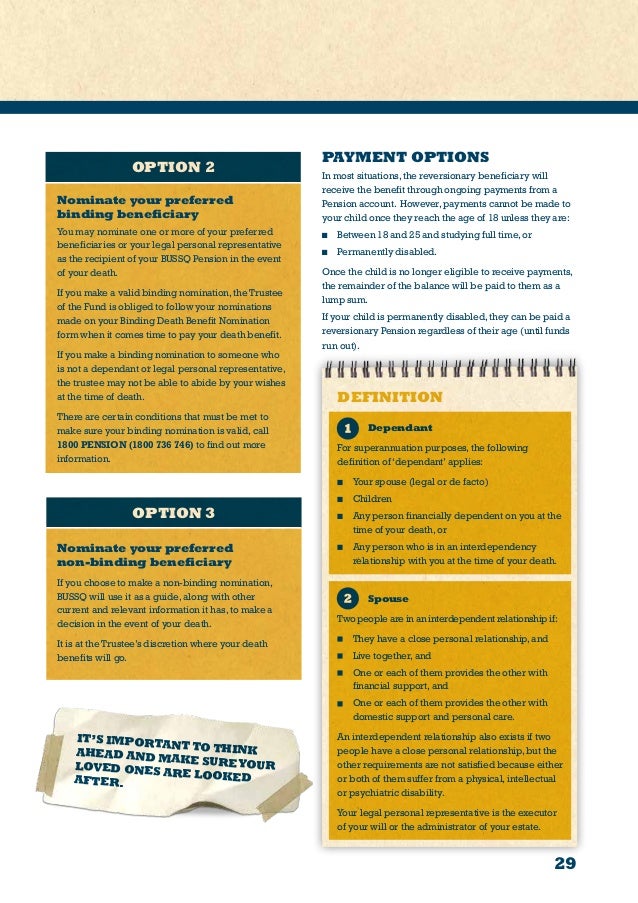

Nominating a class of individuals - for example, grandchildren - may not be sufficient to allow both lump sum and inherited drawdown options. A: A Binding Death Benefit nomination is an instruction to the Trustee of the Superannuation fund by the member on who is to receive their Superannuation benefits when the member dies. The nomination must be to someone who is defined as a Dependant under the Superannuation (Industry Supervision) (SIS) act, or your estate. If the rules of your super fund allow it, you can nominate the beneficiary for your super with your fund.

This nomination may be non- binding or binding. To answer this question, we need to define what is the Binding Death Benefit Nomination and Reversionary Pension first. A Binding Death Benefit Nomination is the way that the member of a superannuation fund binds the trustee of the superannuation fund to pay his s death benefits according to his advice during his life.

What is a binding death benefit? Can trustees of pension scheme change beneficiaries? There are a number of advantages with binding death benefit nominations.

Advantage 1: Certainty The main benefit of binding nominations is that it provides certainty. If you have provided the trustee of your super with a binding nomination , they must pay your remaining super in accordance with that nomination when you pass away. When a binding nomination has been submitte a super fund trustee is unable to use any discretion as to who receives your super in the event of your death.

Your nomination is binding on the trustee and cannot be altered. Advantage 2: Quicker Payments Because a binding nomination provides the trustee with the highest level of certainty as to who any remaining super balance will be paid to, they can usually make the death benefit payment quicker than if they had to consider all potential beneficiaries. The advantage of a binding nomination is that the trustee does not need to be concerned with whether or not they are making payment to the right person or peop.

With every pro there’s a con. Below is a list of the disadvantages associated with binding nominations. Disadvantage 1: Changes In Circumstances If you make a binding nomination and then have a change in a relationship, your super could end up in the wrong hands. Many people can separate, divorce, or have a falling out with a family member and forget to update super nominations. Changes in personal relationships will often remind people to update their Will, but many forget about their super.

If you have made a binding nomination, the trustee of your super must pay your remaining balance to the beneficiary nominated by you on the form. Unlike a non-bindingnomination, a binding nomination does not provide the super trustee with discretion to change who the payment is made to, even if there has been a clear change in your relationships since the binding nomination form was submitted. There are no specific tax implications associated with binding death benefit nominations. A binding death benefit nomination is simply a document used to direct remaining super savings upon death in a similar way that a Will works for a deceased estate.

Have You Read My Other Posts Yet? A member of a self managed superannuation fund(SMSF) can submit a binding nomination to the trustee of the SMSF. The same advantages and disadvantages, noted above, apply to SMSF binding nominations. It is not compulsory to submit a binding or non-binding nomination to a super fund trustee.

In fact, many superannuation members die with no death benefit nomination. Where no death benefit nomination has been submitted tot he trustee, the trustee (including a SMSF trustee) retains discretion as to how the death benefit will be pai having consideration to the deceased’s dependantsand relationships just prior to death. The process of choosing who the beneficiary(ies) can either involve the scheme administrator using their discretion, or the member directing the choice before their death. If you wish to revoke an existing binding death benefit nomination and not make a further nomination you need only complete Steps and of this form, leaving Step blank. Making a death benefit nomination Pension – Nomination of death benefit beneficiaries (for binding and non- binding only) If you wish to nominate more than four beneficiaries, please copy this page and attach it to your form when you return it to us.

If you are making a binding nomination , please read Who can I nominate from page before. A scheme administrator is duty bound to consider the needs of dependents of the member and may use its discretion to override any non- binding nominations made. Pensions : IHT Charges: death benefits introduction. NB only if the scheme rules allow this). A binding nomination will be more appropriate if a client wants to nominate more.

A valid binding death benefit nomination (lapsing) remains in effect for three years from the date it’s first signe last amended or confirmed (if it lapses, it’ll be treated as a non- binding nomination ). Put simply, a binding death benefit nomination is a legally binding nomination that allows you to advise the trustee who is to receive your superannuation benefit in the event of your death. Any benefit after your death will be paid to the beneficiaries nominate as long as the nomination is valid. In addition to a binding or a non- binding nomination , a reversionary beneficiary nomination can be made when you use your super to start a superannuation pension , such as an account based pension.

It enables you to select the person you would like to continue receiving the pension payments in the event of your death.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.