How do you take inventory of an estate? What is the Inventory of an estate? Make a list of all insurance policies, noting their cash values and death benefits. List all liabilities, including mortgages, lines of credit, and other debt.

What you can do now: Use our Asset Inventory worksheet for a consolidated view of all the important details about your estate. If something is clearly part of a collection, however, you may be able to list it as such. When you’ve completed the inventory , have a lawyer look it over – the estate would normally pay for this service as well. For cases where the deceased was married and a division of properties need to be conducte the assets and liabilities of the spouse will also be recorded in the estate inventory.

Estate Inventory Workbook Estate Inventory Workbook Introduction One of the key tasks as the executor of an estate is to establish a list of the estate ’s assets and liabilities. To assist with this task, we have created this Estate Inventory Workbook. It provides you with one convenient place to document a list of assets and liabilities.

This inventory is necessary to put a value on the items for the probate inventory and the Form 706. If the decedent has a surviving spouse, the personal and household items may be staying in place after the decedent’s death, except items the decedent specifically bequeaths (leaves by will) to others. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Most but not all states have their own inventory form that estate representatives are expected to use for probate purposes. A current assets list is commonly used when creating a Last Will and Testament or as part of completing an Estate Planning Checklist to identify all assets and holdings that may be unbeknownst to heirs and beneficiaries of the individual.

The probate court will require the executor of an estate to file an inventory of all the decedent’s assets. Preparing this probate inventory should be the executor’s next step after finding the assets and valuing them. Check with your local probate court to verify proper procedures and deadlines for filing the inventory.

If necessary, you can come back and complete any missing information later. There are a few keys to holding a successful estate sale, and they are as follows: 1. Walk through your home and make a list of everything — yes, everything — you plan on including in the sale, as well as any items you won’t be selling. For details about your existing equipment, an Excel inventory template stores everything you nee including stock number, physical condition, and financial status.

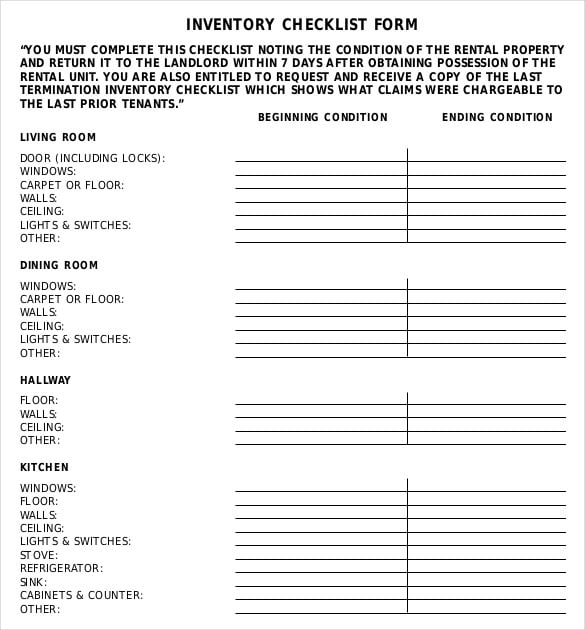

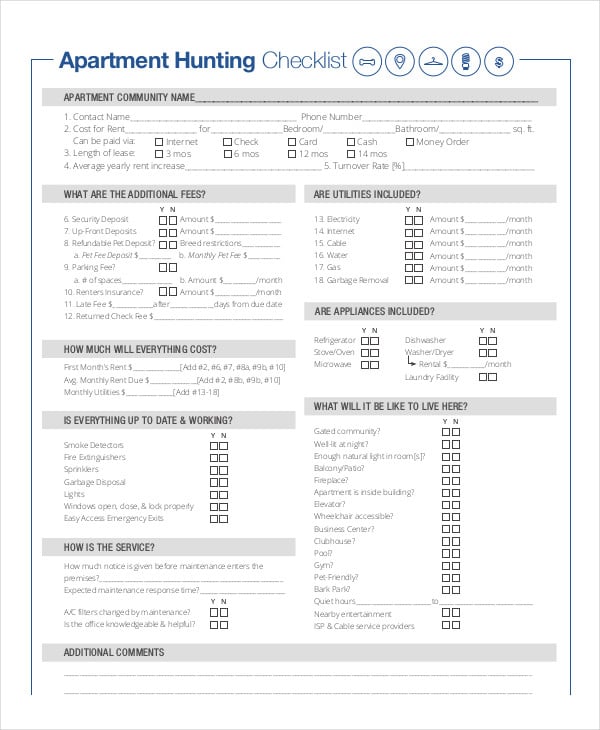

Personal valuables can be listed on an inventory Excel template to keep track of their model or serial numbers, purchase date, and price for estate or insurance purposes. An estate planning checklist is a guide on how to plan an individual’s end of life care and their assets if they should become incapacitated or die. By following the checklist , an individual can get an idea of the estate laws in their State and choose which forms suit their personal financial situation best. Do you need a property inventory checklist to describe the property items that you have?

This check list can easily be used at the beginning and end of the rental contract. If you are in real estate , this can be a great sample of an inventory checking list. Because the home inventory is a complete list of your personal assets, it can be used for loan applications or determining your net worth. Download this Property inventory checklist template now!

A home inventory provides a valuable resource for estate sales and auctions. Information Included in an Inventory Report. Estate inventory is a free template to prepare and conduct an estate inventory for a deceased person. Jun This simple and easy to use inventory sheet sample is the perfect solution to keeping the best track of your business.

An estate inventory shall normally be held within three months after the death. The inventory Fee must be paid before closing the estate or within one year after appointment of the personal representative, whichever is earlier. The list of claims must be attached to the inventory and appraisement.

An example of a claim due or owing to the estate would be if the decedent owned a promissory note and had the right to collect payments on the note from the debtor. Inventory , Appraisement, and List of Claims Statutory Probate Inventory and List of Claims Form II-Inventory , Appraisement, and List of Claims Form II-Order for Inventory , Appraisement, and List of Claims Statutory Probate Inventory Including a Listing of Section 453.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.