On the dotted line next to line or line (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ED67(e)”. Include the amount of the adjustment in the total amount reported on line or line 34. Individual Income Tax Return, including recent updates, related forms and instructions on how to file. Changes include a larger font, no shading (shaded sections can be hard to read) and a standard deduction chart.

There are several notable changes to the form proposed for the tax. See full list on apps. If you filed through a tax preparer or CPA, they can provide a printed or electronic copy of your tax return.

Pick the right one and it could make a big difference in your tax bill. Learn more about taxes at Bankrate. You may want to consider using tax software to complete your return. Then ask a tax accountant to review it for accuracy. Brown are filing a joint return.

Next, they find the column for married filing jointly and read down the column. The amount shown where the taxable income line and filing status column meet is $658. The one-page form has four short sections that you need to complete. Ultimately it determines if you owe taxes or if you are getting a refund. The form has instructions, so it is easier than it first appears.

IRS CoronaVirus Relief. Access A Wide Range Of Form s And Templates Easily. Install The App Today. Filing online is quick and easy!

To use this tax form , you must not have a taxable income that exceeds $1000 and you must claim the standard deduction instead of itemizing your deductions. As part of tax reform, politicians promised that taxpayers would now be able to file. It is by far the most flexible of all the annual income tax forms because it allows you to itemize your deductions.

Prepare and file your federal and state income taxes online. Maximum refunds, 1 accuracy guaranteed. One flat-rate price for everyone – just $25. It is the simplest form for individual federal income tax returns filed with the IRS. They are due each year on April of the year after the tax year in question.

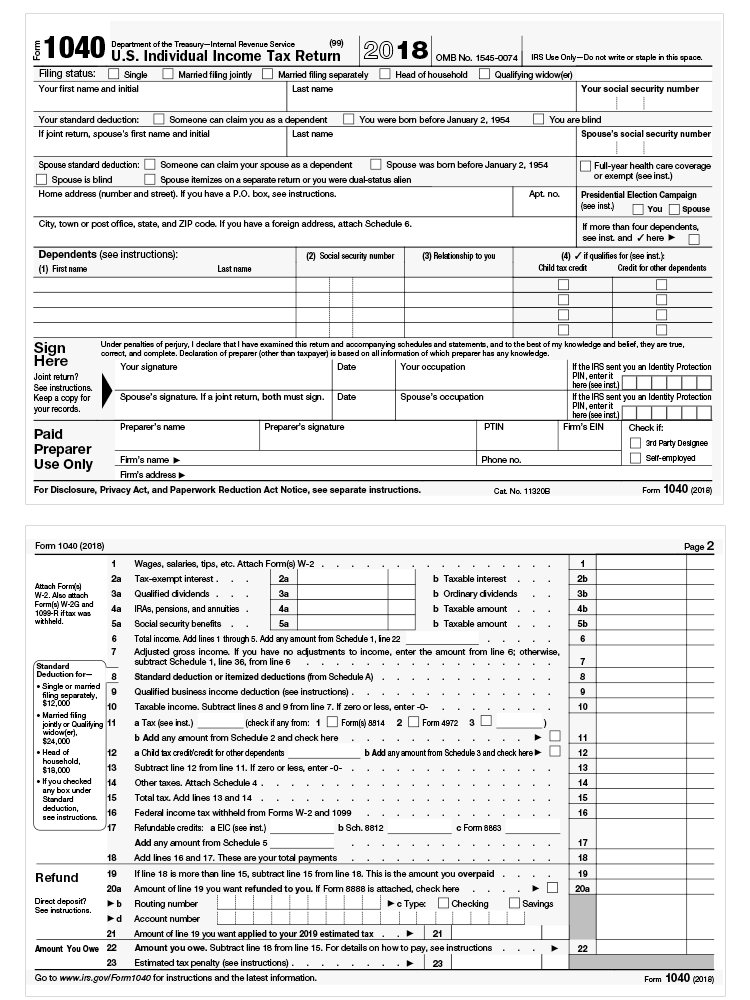

Section B Section A Tax Rate Chart Tax Calculation Worksheet Yourself Spouse Example A Example B 1. The form consists of two major sections: one where income and family information is reporte and one where allowable deductions, credits, and other considerations are applied to tax liability. NOTE:For optimal functionality, save the form to your computer BEFORE completing and utilize Adobe Reader. Department of the Treasury—Internal Revenue Service.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Form s Today. X Trustworthy Source Internal Revenue Service U. Married filing separately Head of household. Qualifying widow(er) Your first name and initial.

Find Form s Related To Tax, Healthcare, Travel And More. On line choose whether taxes were Paid or Accrued and on Line enter the date Paid or Accrued. Numbering and items listed in each part have also changed. Taxpayers can supplement this form with new numbered schedules, if needed. Enter spouse’s name here and SSN below.

Print your SSN, name, mailing address, and city or town here.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.