or to get started with managing your business and filings online. You may conduct an internet search to ascertain if a vendor holds a valid permit. You may also submit a tax evasion tip for sellers that may not be reporting or remitting tax the the department. We have developed this online service to offer you an easier way to manage your business tax filings. If you are not already registere I encourage you to do so.

See full list on nevadatax. Ensure the stable administration of tax statutes. Cooperate with other agencies and entities to better serve taxpayers.

Promote the fair and equitable treatment of taxpayers. Provide improved and more efficient service. Enhance workforce proficiency through training and communication 7. Improve tax administration through new technology. How much is Nevada sales tax? Does Nevada have a state income tax?

Is Nevada still a tax haven? This is the standard application to designate an employer in an affiliated group as a payroll provider. to get started with managing your marijuana agent card online. It also licenses, regulates and taxes the vehicle, motor carrier and fuel industries.

Home Tax Forms Online Services Commerce Tax Local. A newly adopted regulation requires employers in Nevada to file all quarterly wage and tax reports electronically. Compliance with the regulation is mandatory for all employers in Nevada. Please Login : User: Password: Forgot your. Business in Nevada Starting and operating a business has never been easier in Nevada.

Anyone may report potential fuel tax evasion. Diesel fuel dyed red is intended for off-road use only. Are you authorized to manage this business? Department of Taxation. I declare under penalty of perjury that the information provided is true, correct and complete to the best of my knowledge and belief and acknowledge that pursuant to NRS 239.

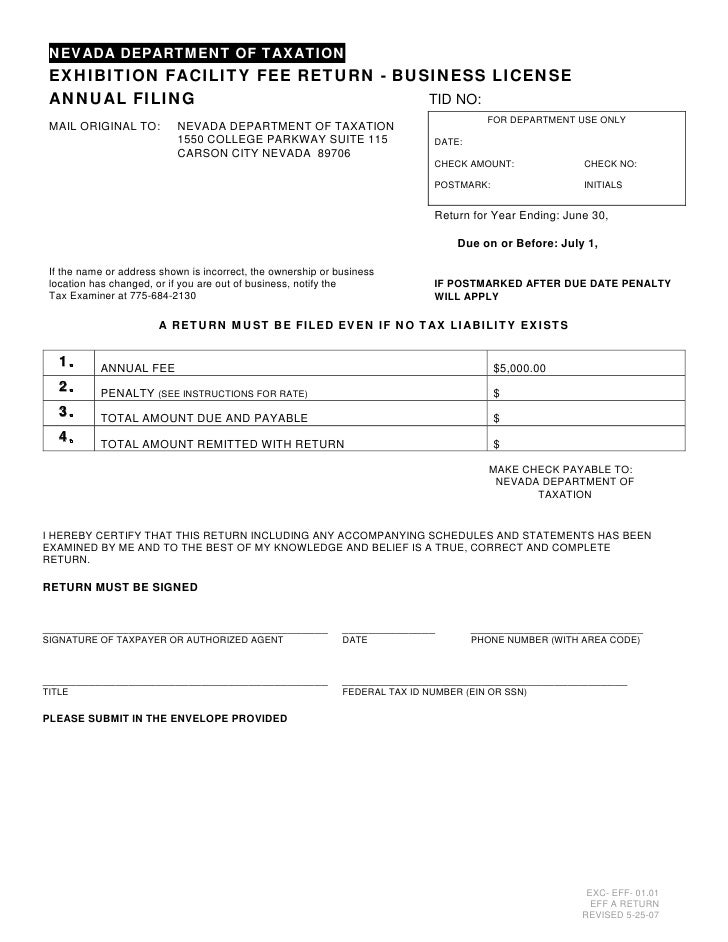

C felony to knowingly offer any false or forged instrument for filing in the Office. What forms do you file for your Nevada taxes? There are no tax return forms, except for sales tax. All Nevada business entities, even sole proprietorships, must pay the annual $5Nevada business license tax.

Estimated tax payments? Use form 40ES if estimated tax will be at least $1for income from non-wage profits of $5or more. Small Business Administration - Nevada State. How do I determine my gross revenue?

Virginia Tax Online Services for Businesses. This website provides a safe, efficient way to file an unemployment insurance claim or file a claim for weekly benefits. The system is available hours a day, seven days a week. Must also contain a number.

WHO ACCEPTS THIS FORM? Some local governments may accept this form. WHAT OTHER INFORMATION MUST I PROVIDE? Official site of the Nevada Secretary of State. Information on elections, businesses, licensing, and securities.

Visit Nevada Explore the world around you. Indulge your inner foodie. Discover historic towns. Jump in with both feet. Or just take it easy.

Nevada is for doers—no matter what type of adventure you’re after.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.